Converting 80 billion won to USD is a common financial inquiry, especially for businesses and individuals involved in international transactions. The South Korean won (KRW) and the United States dollar (USD) are two of the most traded currencies globally, making understanding their exchange rates crucial. Whether you're planning a business investment, traveling abroad, or simply curious about currency values, this article will provide all the necessary information.

In today's globalized economy, currency conversion plays a vital role in financial decision-making. For those dealing with large sums like 80 billion won, having accurate and up-to-date exchange rate information is essential. This article aims to simplify the complexities of currency conversion while offering valuable insights into the factors affecting exchange rates.

By the end of this article, you'll have a clear understanding of how to convert 80 billion won to USD, the factors influencing exchange rates, and how to make informed financial decisions. Let's dive into the details.

Read also:Carol Boone

Table of Contents

- The Conversion Process: 80 Billion Won to USD

- Factors Affecting Exchange Rates

- Historical Data of KRW to USD

- Using Conversion Tools for Accuracy

- Insights for Investors and Businesses

- A Traveler's Guide to Currency Exchange

- The Economic Impact of Currency Fluctuations

- Understanding the Global Financial System

- Common Mistakes to Avoid in Currency Conversion

- Conclusion and Final Thoughts

The Conversion Process: 80 Billion Won to USD

Understanding the Basics of Currency Conversion

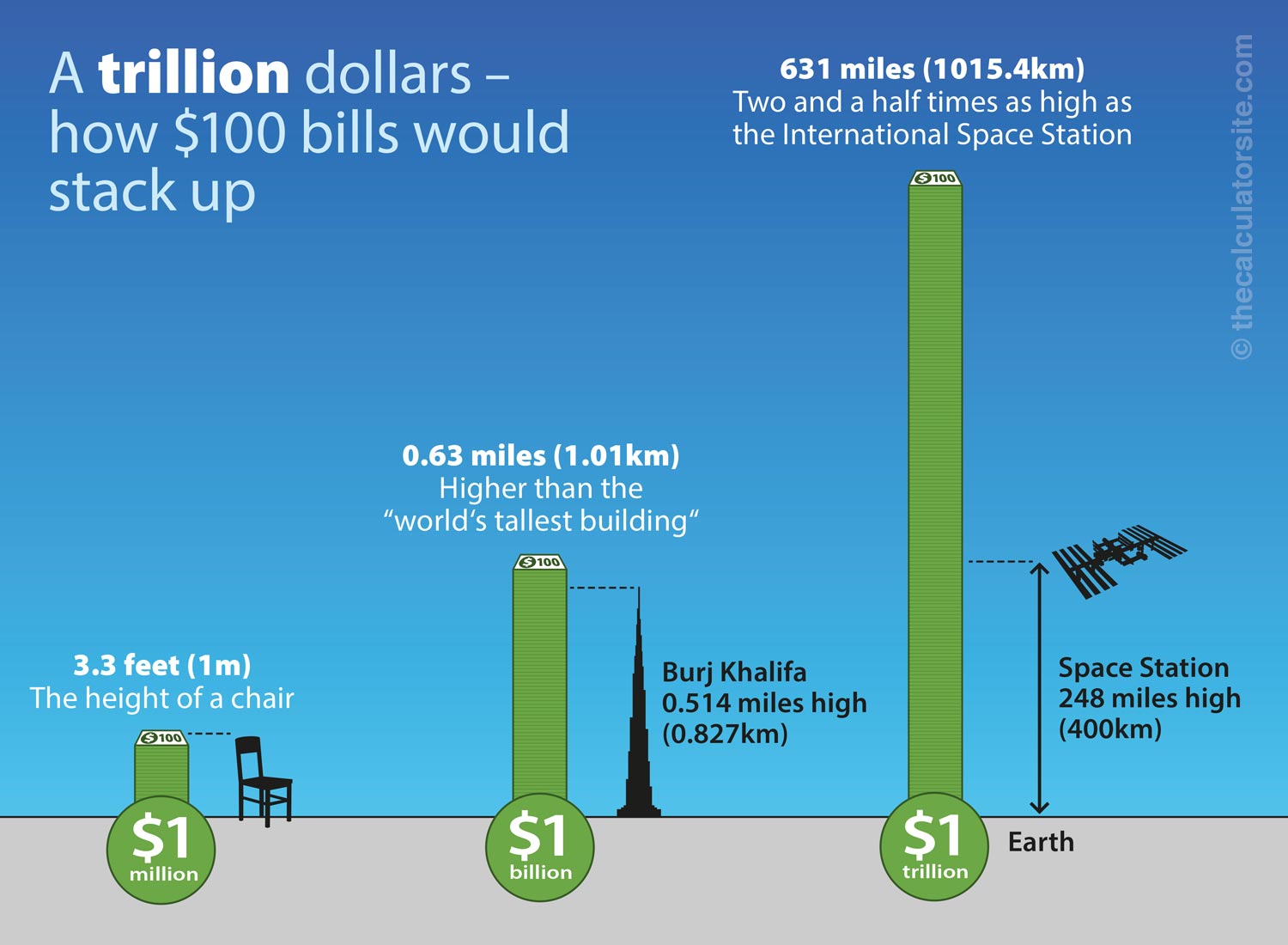

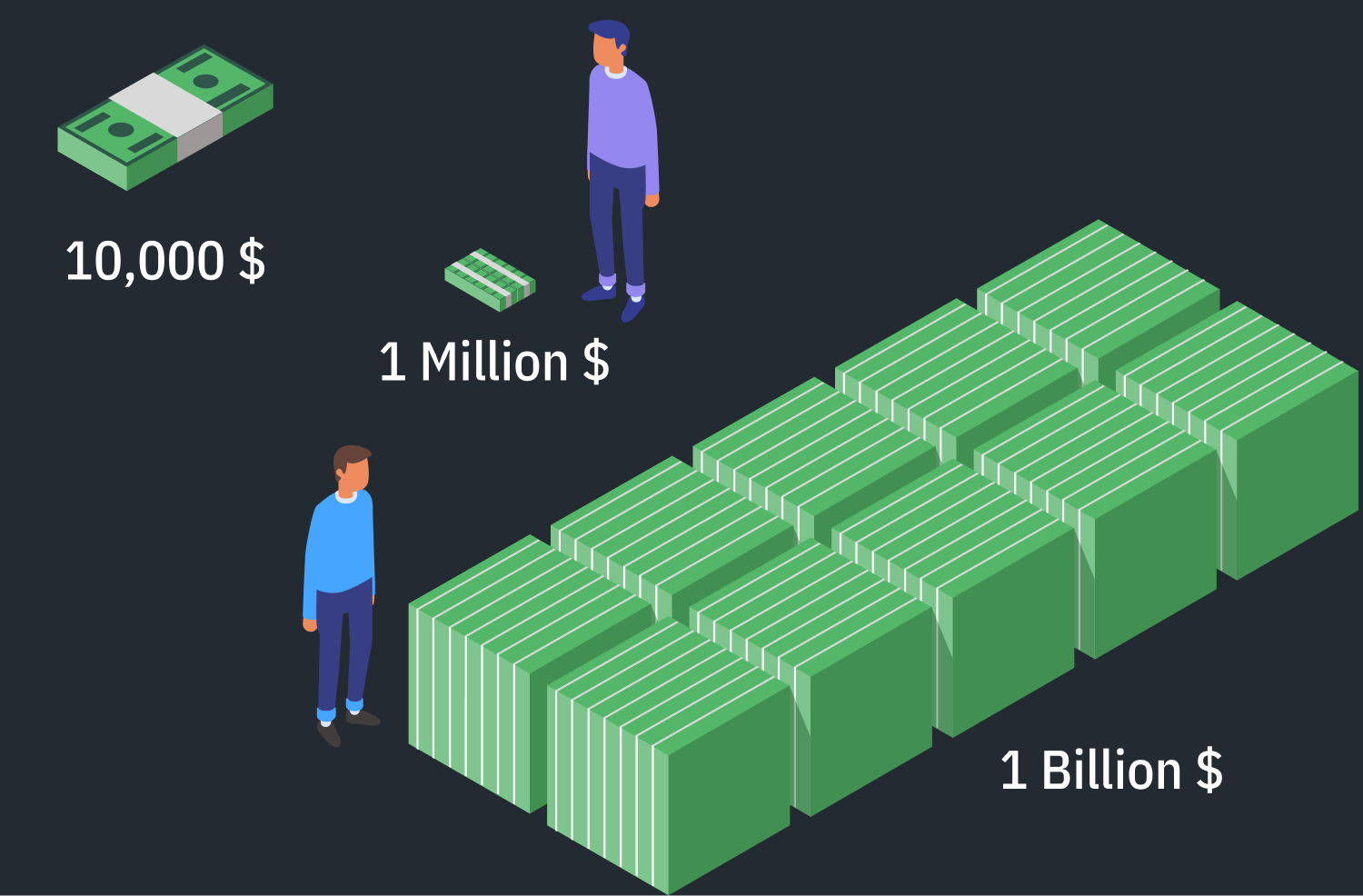

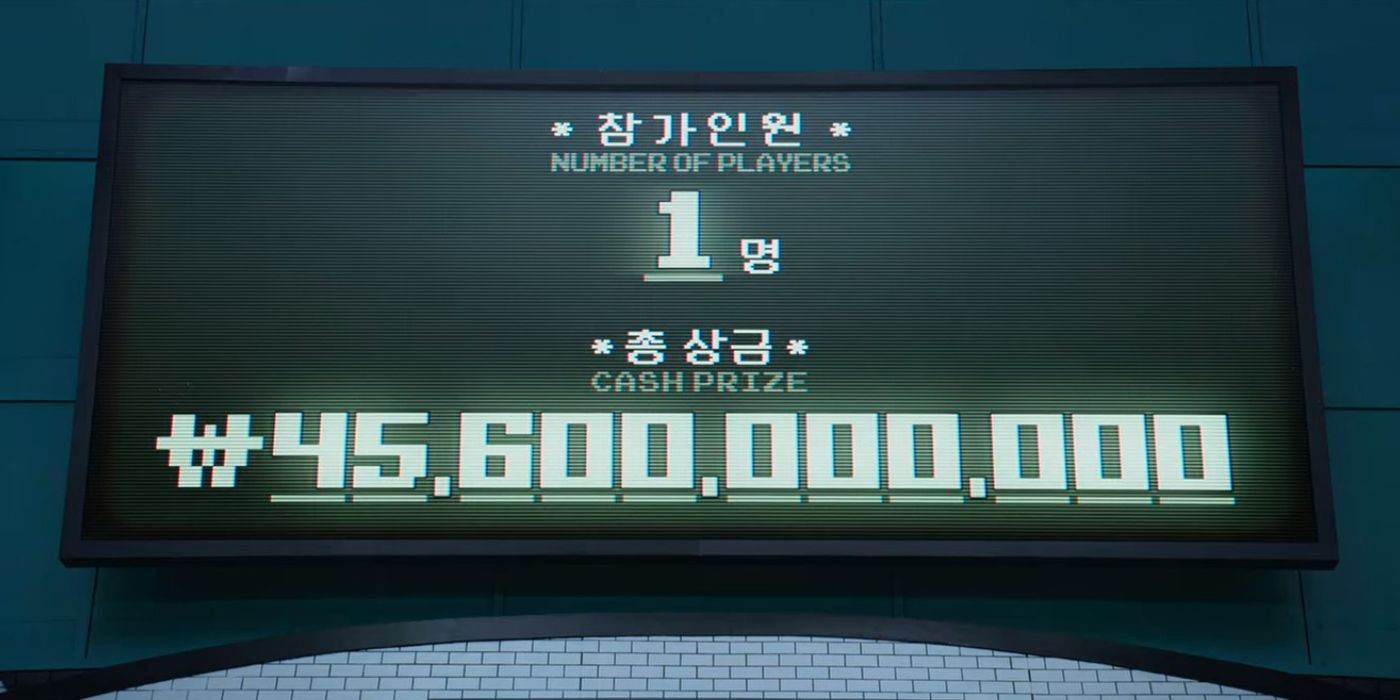

Converting 80 billion won to USD involves understanding the current exchange rate between the South Korean won (KRW) and the United States dollar (USD). As of the latest data, the exchange rate fluctuates daily due to various economic factors. To calculate the conversion, multiply the amount in KRW by the current exchange rate.

For example, if the exchange rate is 1 KRW = 0.0008 USD, the calculation would be:

- 80,000,000,000 KRW × 0.0008 USD = 64,000,000 USD

It's important to note that exchange rates can vary slightly depending on the financial institution or platform used for the conversion.

Factors Affecting Exchange Rates

Economic Indicators and Their Influence

Several factors influence the exchange rate between the KRW and USD. These include:

- Inflation Rates: Differences in inflation between South Korea and the United States can affect currency values.

- Interest Rates: Central banks' decisions on interest rates impact currency strength. Higher interest rates typically strengthen a currency.

- Political Stability: Political events, such as elections or geopolitical tensions, can lead to currency fluctuations.

- Economic Performance: Strong economic growth and robust exports can strengthen a currency.

Understanding these factors helps in predicting currency movements and making informed financial decisions.

Historical Data of KRW to USD

Tracking Exchange Rate Trends Over Time

Historical data provides valuable insights into currency trends. Over the past decade, the KRW to USD exchange rate has experienced significant fluctuations. For instance:

Read also:Ufc Illegal Streaming

- In 2010, the exchange rate was approximately 1 KRW = 0.00085 USD.

- In 2015, it dropped to around 1 KRW = 0.00088 USD.

- By 2020, the rate stabilized at 1 KRW = 0.00083 USD.

These trends highlight the importance of monitoring exchange rates for long-term financial planning.

Using Conversion Tools for Accuracy

Reliable Platforms for Currency Conversion

For accurate and up-to-date currency conversion, several reliable platforms are available:

- XE.com: Offers real-time exchange rates and a user-friendly interface.

- OANDA: Provides detailed currency data and conversion tools.

- Bloomberg: A trusted source for financial news and currency information.

Using these tools ensures precise calculations when converting 80 billion won to USD.

Insights for Investors and Businesses

Maximizing Returns Through Currency Management

For investors and businesses, managing currency risks is crucial. Strategies such as hedging and diversification can protect against exchange rate fluctuations. Consider the following tips:

- Hedging: Use financial instruments like futures and options to lock in exchange rates.

- Diversification: Invest in multiple currencies to spread risk.

- Stay Informed: Keep up with economic news and trends affecting currency values.

Implementing these strategies can enhance financial stability and profitability.

A Traveler's Guide to Currency Exchange

Tips for Converting Currency When Traveling

For travelers, exchanging currency involves practical considerations:

- Compare Exchange Rates: Use online tools to find the best rates.

- Avoid Tourist Areas: Exchange currency at banks or authorized exchange offices rather than tourist spots.

- Consider Fees: Be aware of hidden fees when using ATMs or credit cards abroad.

These tips ensure a smooth and cost-effective currency exchange experience.

The Economic Impact of Currency Fluctuations

How Exchange Rates Affect Global Trade

Currency fluctuations have a significant impact on global trade. For example:

- Exporters benefit from a weaker domestic currency as their products become cheaper abroad.

- Importers face higher costs when the domestic currency weakens, leading to potential price increases for consumers.

- Investors may shift capital to stronger currencies, affecting financial markets.

Understanding these dynamics is essential for businesses operating in international markets.

Understanding the Global Financial System

The Role of Central Banks and International Organizations

Central banks and international organizations play a crucial role in maintaining currency stability. The Federal Reserve in the United States and the Bank of Korea work together to manage monetary policies that affect exchange rates. Additionally, institutions like the International Monetary Fund (IMF) provide support and guidance to ensure global financial stability.

Staying informed about these organizations' actions helps in predicting currency movements and making informed decisions.

Common Mistakes to Avoid in Currency Conversion

Practical Advice for Accurate Transactions

When converting 80 billion won to USD, avoid common pitfalls:

- Ignoring Exchange Rate Fluctuations: Monitor rates regularly to ensure the best conversion time.

- Overlooking Fees: Be aware of transaction fees that can eat into profits.

- Using Unreliable Platforms: Stick to trusted sources for accurate and secure transactions.

By avoiding these mistakes, you can ensure smooth and profitable currency conversions.

Conclusion and Final Thoughts

Converting 80 billion won to USD involves understanding exchange rates, economic factors, and practical considerations. This article has provided comprehensive insights into the process, factors affecting exchange rates, and strategies for managing currency risks. Whether you're an investor, business owner, or traveler, this information will help you make informed financial decisions.

We invite you to share your thoughts and experiences in the comments section below. Additionally, explore other articles on our site for more valuable financial insights. Thank you for reading!