In the world of modern financial services, banking with MoneyLion has emerged as a game-changer for many individuals seeking a convenient, all-in-one platform to manage their finances. As financial technology continues to evolve, more people are turning to digital solutions that offer more than just traditional banking services. MoneyLion, with its innovative approach, combines banking, investing, and credit-building tools into one app, making it a popular choice for those looking to streamline their financial management. But is it really worth it? This article will delve into everything you need to know about MoneyLion's banking services, offering an in-depth review to help you make an informed decision.

Whether you're a young professional or someone looking to improve your financial health, MoneyLion offers a variety of features designed to cater to your needs. From cashback rewards and no-fee checking accounts to investment opportunities and credit score monitoring, MoneyLion has something for everyone. However, like any financial service, it's important to weigh the pros and cons before committing.

As we navigate through this comprehensive review, we will explore the benefits, drawbacks, and unique features of MoneyLion's banking services. By the end of this article, you'll have a clear understanding of whether MoneyLion is the right financial partner for you. Let's dive in!

Read also:Accident Insurance Aflac

Table of Contents

- Introduction to MoneyLion Banking

- Key Features of Banking with MoneyLion

- Benefits of Using MoneyLion for Banking

- Drawbacks of MoneyLion Banking Services

- Costs Associated with MoneyLion Banking

- Comparison with Traditional Banks

- User Experience and Reviews

- Security Measures in MoneyLion

- Eligibility Requirements

- Final Thoughts and Recommendations

Introduction to MoneyLion Banking

MoneyLion is more than just a banking platform; it's a holistic financial ecosystem designed to empower users with tools to manage their money effectively. Launched in 2013, MoneyLion has quickly gained traction among millennials and Gen Z users who demand seamless integration of banking, investing, and credit-building services. The platform's flagship product, the MoneyLion Roar Checking Account, offers users a no-fee checking account with additional perks like cashback rewards and instant paycheck deposits.

What sets MoneyLion apart is its focus on financial wellness. By combining personalized insights, budgeting tools, and access to low-interest loans, MoneyLion aims to help users achieve long-term financial stability. Whether you're looking to save money, invest for the future, or build credit, MoneyLion offers a suite of features tailored to meet your needs.

Why Choose MoneyLion Banking?

The appeal of MoneyLion lies in its simplicity and accessibility. Unlike traditional banks, which often come with hidden fees and complex processes, MoneyLion prioritizes transparency and user convenience. Here are a few reasons why users choose MoneyLion for their banking needs:

- No monthly maintenance fees

- Instant access to paycheck deposits

- Integration with investment and credit-building tools

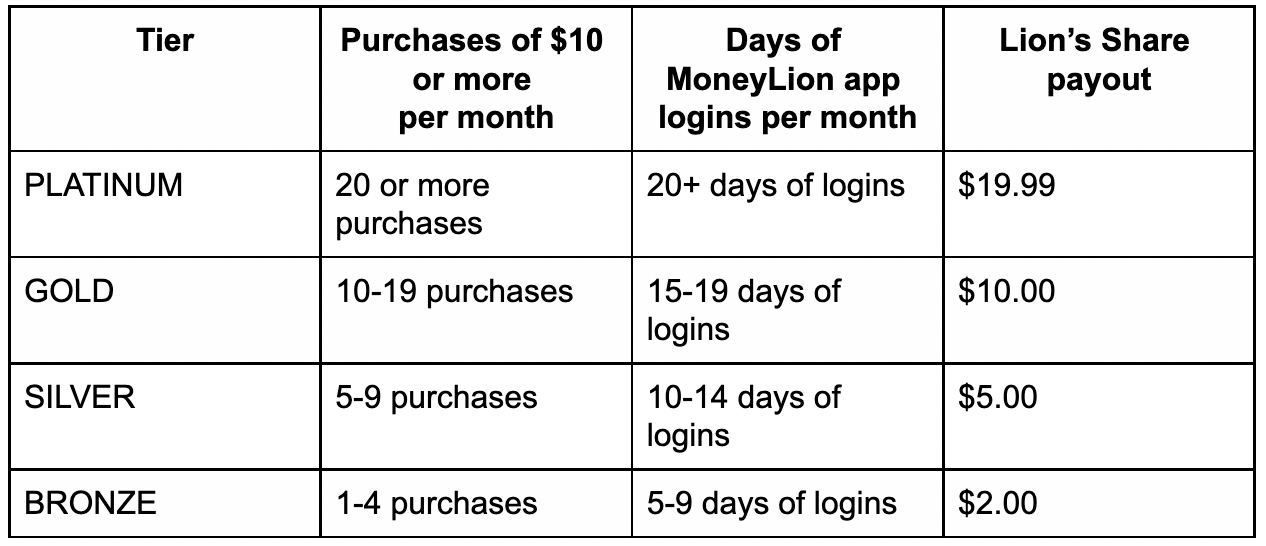

- Competitive cashback rewards

Key Features of Banking with MoneyLion

MoneyLion's banking services go beyond the basics of a traditional checking account. Here's a closer look at some of its standout features:

1. Roar Checking Account

The Roar Checking Account is MoneyLion's primary banking offering. It allows users to deposit checks, make payments, and manage their finances without any monthly fees. Additionally, users can earn cashback rewards on qualifying purchases and enjoy instant paycheck deposits.

2. Investment Opportunities

MoneyLion offers investment options through its app, allowing users to grow their wealth with low-cost ETFs and fractional shares. This feature is particularly appealing to beginners who want to dip their toes into the world of investing.

Read also:Yo Movies Re

3. Credit Builder Plus

For those looking to improve their credit score, MoneyLion's Credit Builder Plus program provides access to a low-interest loan and personalized credit advice. This feature is ideal for individuals with limited credit history or those seeking to rebuild their credit.

Benefits of Using MoneyLion for Banking

There are numerous advantages to choosing MoneyLion as your primary banking platform. Below are some of the key benefits:

1. No Hidden Fees

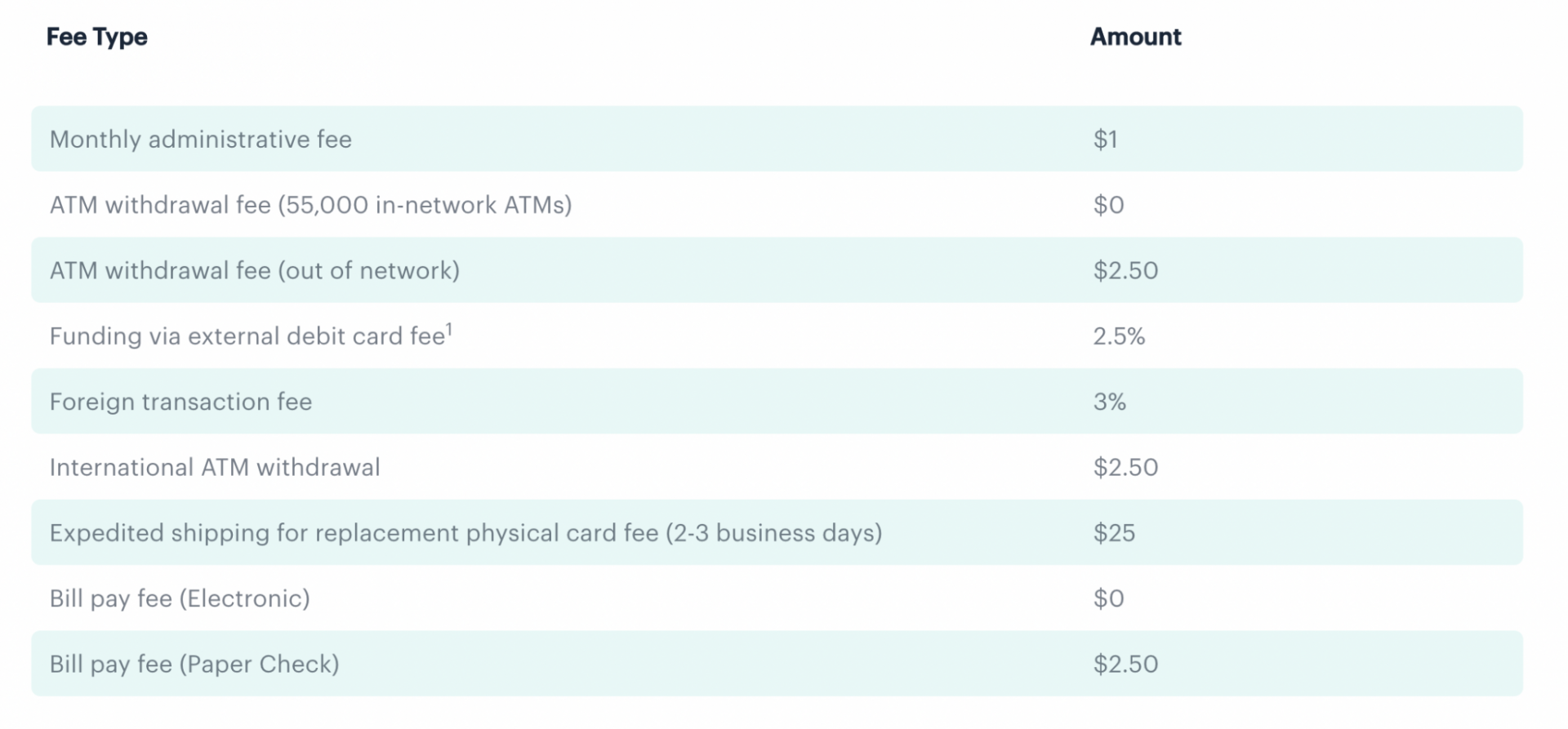

MoneyLion stands out for its commitment to transparency. Unlike many traditional banks, MoneyLion does not charge monthly maintenance fees, overdraft fees, or ATM fees within its network.

2. Financial Education Resources

MoneyLion offers a wealth of educational content to help users improve their financial literacy. From budgeting tips to investment strategies, the platform provides users with the knowledge they need to make informed financial decisions.

3. Mobile-Friendly Interface

With its sleek and intuitive app, MoneyLion makes managing your finances easier than ever. Users can check their balance, transfer funds, and track their spending all from the convenience of their smartphone.

Drawbacks of MoneyLion Banking Services

While MoneyLion offers many advantages, it's not without its limitations. Here are a few potential drawbacks to consider:

1. Limited ATM Network

Although MoneyLion does not charge ATM fees within its network, the network itself is relatively small compared to major banks. This could be inconvenient for users who frequently withdraw cash.

2. Lack of Physical Branches

As a purely digital platform, MoneyLion does not have physical branches. While this is not an issue for many users, some may prefer the convenience of visiting a local branch for in-person assistance.

Costs Associated with MoneyLion Banking

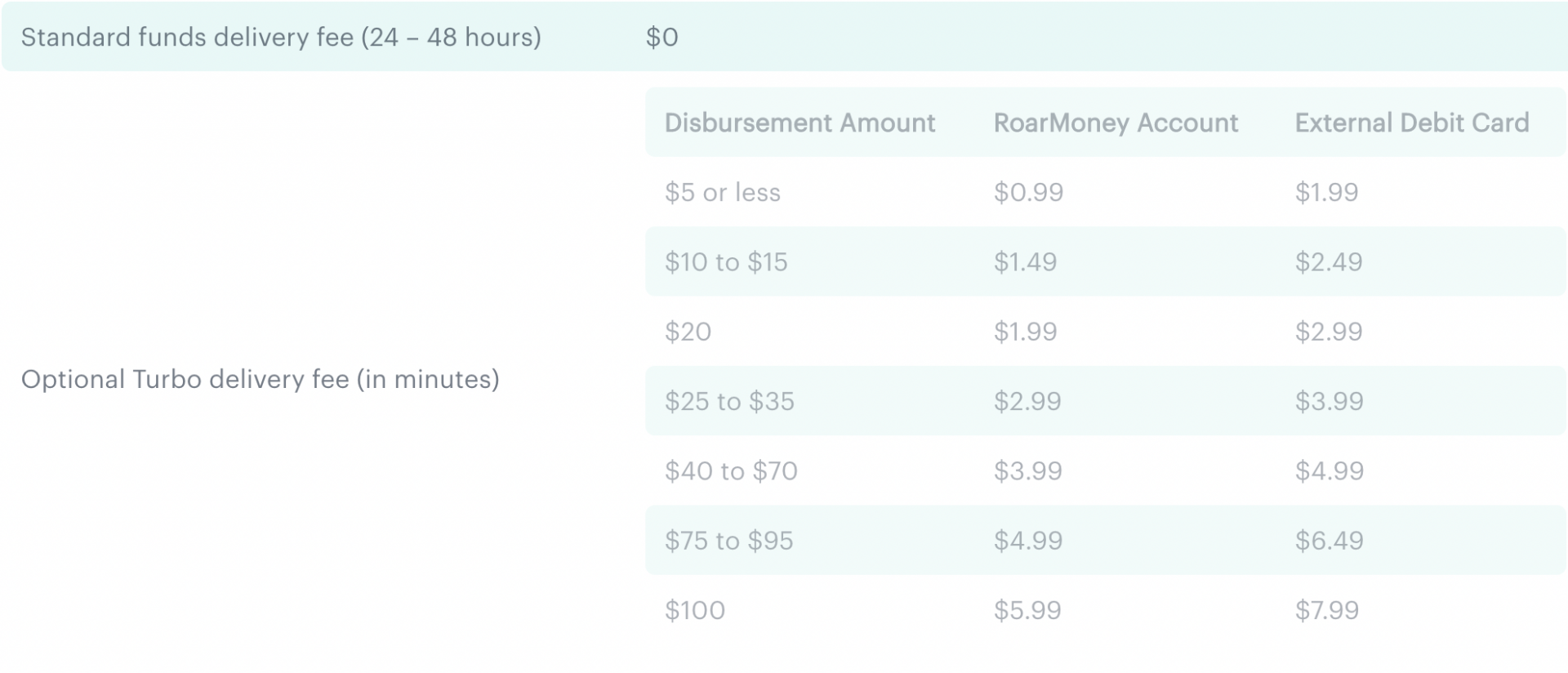

MoneyLion's banking services are generally free to use, but there are some costs associated with certain features. For example, the Credit Builder Plus program comes with a monthly subscription fee. Additionally, users may incur out-of-network ATM fees if they choose to withdraw cash from non-partner ATMs.

How Much Does MoneyLion Cost?

Here's a breakdown of the costs you can expect:

- Roar Checking Account: Free

- Credit Builder Plus: $29.99 per month

- Out-of-Network ATM Fees: Varies by location

Comparison with Traditional Banks

When comparing MoneyLion to traditional banks, it's important to consider both the advantages and disadvantages of each option. Traditional banks often offer a wider range of services, including mortgages and business loans, but they may also come with higher fees and less flexibility. MoneyLion, on the other hand, excels in providing a streamlined, user-friendly experience for everyday banking needs.

Which Is Better for You?

The best choice depends on your specific financial needs. If you're looking for a simple, no-frills banking solution with added financial wellness tools, MoneyLion may be the right choice. However, if you require more comprehensive banking services, a traditional bank might be a better fit.

User Experience and Reviews

MoneyLion has garnered a mixed reputation among users. Many praise its ease of use and innovative features, while others express concerns about its limited ATM network and lack of physical branches. Overall, user reviews highlight the platform's strengths in financial education and transparency.

What Users Love About MoneyLion

- No monthly fees

- Instant paycheck deposits

- Personalized financial advice

What Users Dislike About MoneyLion

- Small ATM network

- No physical branches

- Subscription fees for premium features

Security Measures in MoneyLion

Security is a top priority for MoneyLion. The platform employs industry-standard encryption protocols to protect user data and offers features like two-factor authentication and fraud monitoring. Additionally, MoneyLion's Roar Checking Account is FDIC-insured up to $250,000, providing users with peace of mind.

Eligibility Requirements

To use MoneyLion's banking services, users must meet certain eligibility requirements. These include being at least 18 years old, having a valid Social Security number, and providing proof of identity. While these requirements are standard for most financial institutions, it's important to ensure you meet all criteria before signing up.

Final Thoughts and Recommendations

Banking with MoneyLion offers a unique and innovative approach to managing your finances. With its no-fee checking account, investment opportunities, and credit-building tools, MoneyLion provides users with a comprehensive platform to achieve their financial goals. However, it's essential to weigh the pros and cons before committing to any financial service.

If you're considering MoneyLion for your banking needs, we recommend starting with the Roar Checking Account to experience the platform's core features. From there, you can explore additional services like investment options and credit-building programs to further enhance your financial wellness.

We invite you to share your thoughts and experiences with MoneyLion in the comments below. Additionally, feel free to explore other articles on our site for more insights into personal finance and digital banking solutions.