Net Worth Explained: Your Simple Guide To Financial Clarity

Have you ever felt a bit like you're searching for something important, maybe a bit lost in the digital clutter, or perhaps like some settings are just missing when you really need them? It's a feeling many of us know, whether it’s trying to figure out if that old cleaner program is still good or if there’s a better one out there, or trying to get tables in a document to behave just right. Financial life can feel a bit like that too, you know? It’s often a puzzle, and one piece that really helps bring things into focus is understanding your net worth.

This idea, net worth, might sound a little complex, maybe like something only very rich people need to think about. But actually, it’s a very simple concept that applies to everyone, regardless of how much money you have right now. It’s basically a snapshot, a quick look at your financial health at any given moment. It tells you, in plain terms, what you own versus what you owe. It’s really quite a foundational piece of information for anyone trying to manage their money better.

So, we are going to explore what net worth actually is, why it’s a good idea to know yours, and how you can figure it out for yourself. We’ll also talk about some simple ways to make that number grow over time. This information, you see, can help you feel more in control, less stuck, and more confident about your money picture, which is pretty important, honestly.

Table of Contents

- What is Net Worth, Really?

- Why Knowing Your Net Worth Matters

- How to Calculate Your Net Worth

- Boosting Your Net Worth: Practical Ways to Grow

- Common Questions About Net Worth

What is Net Worth, Really?

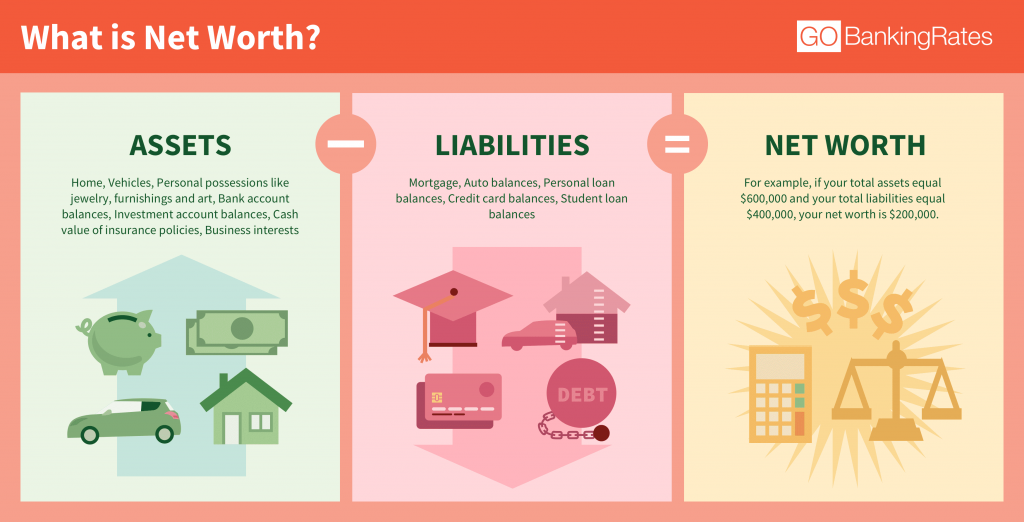

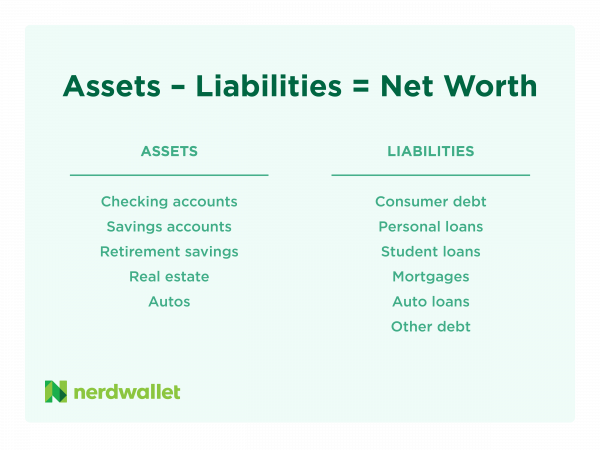

At its very core, net worth is a pretty straightforward calculation. It’s just what you own minus what you owe. Think of it like this: if you were to sell everything you have and pay off all your debts today, the money you’d be left with (or perhaps the money you’d still need to pay) would be your net worth. It’s a very simple equation, really, but it tells you a lot about your financial standing. It’s a bit like taking inventory of your financial life, you know?

This number can be positive, which means you own more than you owe, or it can be negative, meaning your debts are currently higher than your assets. Both are normal at different stages of life, so there’s no need to feel bad if your number isn’t where you want it to be right now. The important thing is just knowing what it is, and then you can figure out where to go from there, honestly.

Assets: What You Own

Assets are basically anything you possess that has some kind of monetary value. These are the things that add to your side of the ledger. They can be things you can easily turn into cash, or things that are a bit harder to sell quickly. So, it includes a wide range of items, typically.

Liquid assets, for example, are things like the money in your checking and savings accounts. These are very easy to access and use. Cash itself is also a liquid asset, of course. These are usually the first things people think of when they think about what they own, and they are pretty important for daily life, you know.

Then there are investments. This could be money in a retirement account, like a 401(k) or an IRA. It might also be stocks, bonds, or mutual funds you own outside of retirement accounts. These are usually meant for longer-term growth, so they are not always instantly accessible, but they certainly count as something you own, and they are pretty valuable.

Real estate is another big one for many people. This includes the value of your home, if you own one, or any other properties you might have. Even if you have a mortgage on your home, the value of the property itself counts as an asset. You just factor in the mortgage on the other side of the equation, which is pretty straightforward.

Other assets can include things like your car, valuable jewelry, or even significant collectibles. While these might not be as easy to sell as cash, they still have value. Some people also include the cash value of life insurance policies. So, you see, it’s a fairly broad category of things you have that are worth something, generally speaking.

Liabilities: What You Owe

Liabilities are the opposite of assets; they are all the debts and financial obligations you have. These are the things that subtract from your side of the ledger. Knowing these is just as important as knowing your assets, because they represent money that you will need to pay out, you know.

Common liabilities include things like credit card debt. This is often one of the first things people think of when they consider what they owe. High-interest credit card balances can really eat away at your financial health, so they are pretty significant.

Student loans are another very common liability for many people, especially younger folks. These can be quite large amounts that take many years to pay off. Knowing your total student loan balance is a key part of figuring out your overall financial picture, honestly.

Mortgages, as we mentioned earlier, are also a big liability. Even if your home is a valuable asset, the loan you took out to buy it is a debt. The outstanding balance on your mortgage is what you still owe to the bank. This is typically the largest debt for many homeowners, so it’s a very big piece of the puzzle.

Car loans are another type of debt. If you financed your vehicle, the remaining balance on that loan is a liability. Personal loans, medical bills, and even things like payday loans also fall into this category. Basically, anything that you are obligated to pay back to someone else is a liability, and it’s good to have a clear picture of all of them, so you can plan, you know.

Why Knowing Your Net Worth Matters

You might wonder why it’s such a big deal to calculate this number. After all, you probably have a general idea of your money situation, right? But actually, having a clear, concrete number for your net worth can be incredibly helpful for a few important reasons. It’s a bit like getting a detailed report on your computer’s health, rather than just guessing if it’s running okay, which is pretty useful.

A Financial Snapshot

Your net worth gives you a clear, single number that summarizes your entire financial situation at a specific point in time. It’s like taking a photograph of your finances. This snapshot helps you see the big picture, rather than just focusing on individual accounts or debts. It can be quite eye-opening, honestly, to see it all laid out.

Without this overall view, it’s easy to feel a bit stuck or overwhelmed by individual financial tasks, like trying to manage a bunch of different accounts or figuring out how to get those table settings right in Word. Your net worth simplifies things, giving you one number to focus on. It helps you see if you’re generally moving forward or if things are slipping a bit, which is pretty important for making decisions.

Tracking Progress

Once you know your net worth, you can track it over time. This is where it becomes a really powerful tool. By calculating it regularly – maybe once a month, once a quarter, or once a year – you can see if your financial actions are actually making a difference. Is your number going up? Is it going down? This kind of tracking is very motivating, you know.

If you’re trying to pay off debt or save more money, seeing your net worth increase is a fantastic way to know you’re on the right path. It provides concrete evidence of your efforts. Similarly, if it’s decreasing, it can be a signal to adjust your habits. It’s like seeing your health metrics improve; it encourages you to keep going, which is pretty cool.

Making Smart Choices

Knowing your net worth empowers you to make more informed financial decisions. When you understand your full financial picture, you can better assess risks and opportunities. For example, if you’re considering taking on a new loan or making a large purchase, you can see how it might impact your overall financial health. It’s really about having all the information, you see.

It also helps you set realistic financial goals. If your net worth is currently negative, your first goal might be to get it to zero. If it’s positive, you might aim to increase it by a certain percentage each year. This clarity helps you prioritize where to put your money and energy. It’s pretty much a roadmap for your financial journey, honestly.

This understanding can also help you avoid feeling like you’re constantly searching for answers, like trying to find old emails from years ago with just the inbox label. It gives you a clear point of reference for all your financial questions. It’s a good way to stay organized and avoid feeling stuck, you know.

How to Calculate Your Net Worth

Calculating your net worth is surprisingly simple. You don't need any special software or complicated formulas. All you really need is a list of your assets and a list of your liabilities. Then, it's just a bit of basic math. It’s a process that anyone can do, and it typically doesn’t take very long once you have your numbers ready, which is pretty convenient.

Step-by-Step Guide

First, gather all your asset information. This means looking at your bank statements for checking and savings accounts. Check your investment statements for retirement accounts, brokerage accounts, and any other investments you have. If you own a home, you’ll want to get an estimate of its current market value, perhaps from a real estate website or a recent appraisal. Don't forget any other significant valuables, like a car or expensive jewelry. Just make a list of each item and its estimated value. This step can take a little time, but it’s definitely worth it, you know.

Next, sum up all those asset values. Add them all together to get your total assets. This number represents everything you own that has monetary value. It’s a big number for most people, and it’s pretty satisfying to see all your hard work represented in one place, honestly.

Then, it’s time to list your liabilities. Go through your credit card statements and note down the outstanding balances. Look up your student loan balances, your mortgage balance, and any car loan balances. Don’t forget any personal loans, medical bills, or other debts you might have. Just like with assets, write down each liability and the amount you owe. This part can feel a bit less fun, but it’s very important to be thorough, you see.

After that, add up all your liabilities to get your total liabilities. This number represents everything you owe. It’s the flip side of your assets, and it’s just as crucial for getting a complete picture. This is where you might feel a bit of a pinch, but it’s just part of the process, really.

Finally, subtract your total liabilities from your total assets. The result is your net worth. So, the formula is: Total Assets – Total Liabilities = Net Worth. That’s it! It’s really quite simple, yet it gives you such a powerful piece of information. This number, whether positive or negative, is your financial snapshot right now, and it’s a very useful thing to know, generally speaking.

A Simple Example

Let's imagine someone named Alex. Alex wants to figure out their net worth. So, Alex starts by listing all their assets. Alex has $5,000 in a savings account, $1,000 in a checking account, and $20,000 in a retirement fund. Alex also owns a car worth $15,000 and has a house valued at $200,000. So, Alex's total assets are $5,000 + $1,000 + $20,000 + $15,000 + $200,000, which equals $241,000. That’s a pretty good start, you know.

Next, Alex lists their liabilities. Alex has $3,000 in credit card debt, a student loan balance of $10,000, and a mortgage balance of $150,000. So, Alex's total liabilities are $3,000 + $10,000 + $150,000, which equals $163,000. These are the things Alex still needs to pay back, you see.

To find the net worth, Alex subtracts the total liabilities from the total assets: $241,000 (Assets) - $163,000 (Liabilities) = $78,000. So, Alex's net worth is $78,000. This is a positive number, which means Alex owns more than they owe. It’s a pretty solid position, honestly, and it gives Alex a clear picture of their financial standing right now.

This calculation, you know, is just a starting point. It’s not about judging Alex’s financial situation, but rather about providing clarity. Alex can now use this number to track progress and make future financial plans. It’s a very practical tool for anyone, really, who wants to take charge of their money, which is a very smart thing to do.

Boosting Your Net Worth: Practical Ways to Grow

Once you know your net worth, the natural next step for many people is to think about how to make that number grow. It’s a bit like trying to optimize your computer performance or finding a better cleaner program; you want things to work more efficiently and improve over time. Growing your net worth isn't about getting rich overnight, but rather about consistent, smart financial habits. It’s a marathon, not a sprint, you know, and it typically takes some patience.

Increase Your Assets

One very clear way to boost your net worth is to simply acquire more valuable things, or make your current valuable things grow in value. This often means focusing on saving and investing. The more money you put into savings accounts, investment portfolios, or even paying down the principal on your home, the more your assets grow. It’s a pretty direct path, honestly.

Saving more money regularly is a big one. Try to set aside a portion of every paycheck, even if it’s just a small amount to start. Over time, these consistent savings add up significantly. You could set up an automatic transfer from your checking to your savings account so you don't even have to think about it. It’s a very effective way to build up your cash reserves, you know.

Investing is another powerful tool for increasing assets. Money invested in things like stocks, bonds, or mutual funds has the potential to grow over time, thanks to compound interest. This means your money earns money, and then that money earns more money, and so on. The earlier you start investing, the more time your money has to grow, which is pretty exciting. Even small, regular contributions can make a huge difference in the long run, seriously.

Consider contributing more to your retirement accounts, especially if your employer offers a matching contribution. That’s essentially free money, and it goes straight into your asset column. It’s a very smart move for your future, you see. Also, if you own real estate, paying down your mortgage principal increases your equity, which is the part of your home you truly own, so that also builds your assets, which is quite good.

Decrease Your Liabilities

The other side of the net worth equation is your liabilities, or what you owe. By reducing your debts, you directly increase your net worth, even if your assets don’t change at all. This is often the quickest way for many people to see their net worth improve, especially if they have high-interest debts. It’s a bit like decluttering your financial life, you know.

Focus on paying down high-interest debts first, like credit card balances. The interest rates on these can be incredibly high, meaning a large portion of your payment just goes to interest, not the actual amount you borrowed. Getting rid of these debts frees up more of your money to go towards other goals, which is very helpful. It’s a pretty good feeling to get those cleared, honestly.

You might consider strategies like the debt snowball or debt avalanche methods. The debt snowball involves paying off your smallest debts first to build momentum, while the debt avalanche focuses on paying off the debts with the highest interest rates first to save money. Both are effective ways to systematically reduce what you owe, and they can really help you get unstuck, you see.

Refinancing loans with high interest rates, if possible, can also help. For example, if you have student loans with a very high interest rate, you might be able to refinance them to a lower rate, which could save you a lot of money over the life of the loan. This reduces your overall financial burden, making it easier to pay things off and improve your net worth, which is pretty smart, generally speaking.

Smart Habits for Growth

Beyond just increasing assets and decreasing liabilities, cultivating good financial habits is really what helps your net worth grow consistently over time. These are the daily and weekly actions that, when done regularly, lead to big results. It’s about building a solid foundation, you know, just like maintaining your computer so it runs smoothly.

Creating and sticking to a budget is a very important habit. A budget helps you see exactly where your money is going each month, allowing you to identify areas where you can save more or cut back on unnecessary spending. It gives you control and helps prevent that feeling of money just disappearing, like when your OneNote data is suddenly gone. This clarity is pretty powerful, honestly.

Regularly reviewing your financial accounts is another good habit. Check your bank statements, credit card statements, and investment accounts regularly. This helps you catch any errors, track your spending, and stay aware of your balances. It’s like doing a regular check-up on your financial health, and it’s very important for keeping things on track, you see.

Setting clear, specific financial goals is also crucial. Do you want to save for a down payment on a house? Pay off a certain amount of debt by a specific date? Having clear goals gives you something to work towards and keeps you motivated. It’s hard to hit a target if you don’t know what you’re aiming for, so having those goals is pretty essential, really.

Educating yourself about personal finance is a continuous process. There’s always more to learn about investing, saving, and managing money. Reading articles, listening to podcasts, or even taking a basic finance course can provide valuable insights. The more you know, the better decisions you can make. It’s a bit like learning new features in Microsoft 365; the more you understand, the more effective you become, which is very true.

Consider looking for ways to increase your income. This could be through a raise at your current job, starting a side hustle, or developing new skills that lead to higher-paying opportunities. More income means more money available to save, invest, and pay down debt, which directly boosts your net worth. It’s a very direct way to speed up your progress, you know. For more ideas on managing your money, you could check out resources like Investopedia's Personal Finance section.

Common Questions About Net Worth

When people start thinking about net worth, a few questions tend to come up pretty often. It’s natural to wonder about what’s considered "good" or how it relates to different life stages. These are pretty common thoughts, honestly, and it’s good to address them directly, you see.

Is a high net worth good?

Determine Your Net Worth in 3 Easy Steps! - New Century Investments

Net Worth Defined: What Is My Net Worth? - NerdWallet

:max_bytes(150000):strip_icc()/net-worth-4192297-1-6e76a5b895f04fa5b6c10b75ed3d576f.jpg)

Net worth concept illustration