How Much Is H&R Block To File Taxes? A Clear Look At Costs For The Current Tax Season

Figuring out your taxes can feel like a big puzzle, and a lot of people wonder about the costs involved, so it's a very common question. One of the biggest names in tax preparation, H&R Block, often comes to mind when folks think about getting their returns done. You might be asking yourself, "how much is H&R Block to file taxes?" This is a really important question for many households, especially as tax deadlines approach.

Knowing what you might pay helps you budget and plan, which is pretty useful. It also lets you compare options, too, making sure you get good value for your money. People often look for clear answers on pricing before they commit to a service, and that makes a lot of sense, you know?

This article will break down the different ways H&R Block charges for its services, giving you a better idea of what to expect. We will look at online tools, in-person help, and the things that can make your final bill go up or down. You will, arguably, get a much clearer picture of the expenses involved.

Table of Contents

- Understanding H&R Block's Pricing Structure

- Factors That Influence Your H&R Block Price

- How to Find the Best Value at H&R Block

- What to Consider Before You Pay

- Frequently Asked Questions

Understanding H&R Block's Pricing Structure

H&R Block offers a few ways to get your taxes done, and each way has its own price tag. Knowing these different options can help you pick the one that fits your budget and needs, which is pretty helpful. They aim to serve a wide range of people, after all, so there are choices.

It's not just one set price, you see. The cost changes based on how you file and what kind of tax situation you have. This means you have some control over how much you end up paying, which is good to know, naturally.

You can choose to do your taxes yourself using their online software, or you can get help from a tax professional. Both ways have their pros and cons, and of course, different costs, too.

Online Filing Options and Costs

If you like to handle things on your own, H&R Block's online tax software is an option, you know. They have different versions, or tiers, and each one is for a different level of tax complexity. The more complicated your taxes are, the higher the tier, and the higher the price, typically.

For very simple tax returns, like those with just W-2 income, you might find a free option. This is great for many people, especially those just starting out with taxes, you know. But if you have investments or self-employment income, you will need a paid version, that's for sure.

The paid online versions usually have a base fee for federal filing. Then, they often add a separate charge for state tax filing, which is something to keep in mind. These prices can change each tax season, so it's always good to check their website for the most current figures, you know?

For example, a Deluxe online product might be for people with deductions or credits, while a Premium product is more for self-employed individuals. Each step up adds to the cost, as you might expect. This structure means you only pay for what you actually need, in a way.

Sometimes, they offer discounts or promotions early in the tax season, which can save you a little money. It's worth looking for those deals if you are planning to file online, honestly. These can make a difference to your final payment.

In-Person Tax Preparation: What to Expect

For those who prefer a human touch, H&R Block has offices where you can meet with a tax professional. This service usually costs more than using the online software, which is pretty typical for personalized help. You get direct support, after all.

The price for in-person help can vary a lot, depending on how complex your tax situation is, you know. A simple return will cost less than one with many different income sources or lots of deductions. It's not a fixed fee for everyone, which is important to remember.

When you go to an office, the tax preparer will look at your documents and then give you an estimate of the cost. They usually explain what goes into that price, so you have a clear idea, basically. This helps avoid surprises later on.

This service often includes a review by another tax professional, which can give you extra peace of mind. Some people find this added assurance worth the extra cost, you know. It's about getting things done right, after all.

You might also pay for additional services, like audit assistance or help with past-due returns. These are extra features that add to the overall price, so be aware of them. It is something to consider if you need that kind of help.

Software vs. Expert Help: A Cost Comparison

Deciding between using software yourself and getting help from an expert comes down to a few things, including cost. The online software is almost always the cheaper option, especially for straightforward tax returns, that's for sure. It's designed for efficiency and self-service.

If your taxes are pretty simple, and you feel comfortable entering your own information, the online software can save you a good amount of money. It's a very cost-effective way to file, many people find. You just follow the prompts, and it guides you along.

However, if your tax situation is complicated, or you just prefer someone else handle it, paying for an expert might be a better choice. The higher cost often comes with the benefit of professional advice and help, you know. They can spot things you might miss.

An expert can also help you find deductions or credits you might not have known about, which could, in a way, offset the fee you pay them. This is a big reason why some people choose the in-person route, actually. It can be worth the investment.

Think about how much time you have, too. Using software yourself takes some time and effort, while an expert does most of the work for you. Your time has value, after all, so that's something to consider, too.

Factors That Influence Your H&R Block Price

The final amount you pay H&R Block is not just about choosing online or in-person service. Several other things can make the price go up or down, which is pretty important to know. These factors are often specific to your own financial life, you see.

Understanding these elements can help you estimate your cost more accurately before you even start. It also helps you avoid surprises when you get your bill, which is always good. You want to be prepared, after all.

From the kind of income you have to the state you live in, many things play a role. We will look at some of the most common ones now, so you can get a better idea, you know.

Your Tax Situation's Complexity

The simpler your taxes, the less you will likely pay, which is pretty straightforward. If you just have one job and take the standard deduction, your cost will be on the lower end, that's for sure. This is the case for many people, especially younger filers.

But if you own a business, have rental properties, or deal with investments like stocks and bonds, your taxes become more complex. This means more forms, more calculations, and more time for the preparer or software to handle. More work usually means a higher price, naturally.

Things like itemized deductions, multiple W-2s, or needing to report cryptocurrency transactions also add to the complexity. Each of these can push you into a higher-priced tier for online software or increase the fee for an in-person preparer. It's just how it works, you know.

If you have dependents, or if you are claiming certain tax credits, that can also affect the price. These things require more specific data entry and sometimes more careful review, which adds to the effort involved, you see. So, the more detailed your financial life, the more you might pay.

It is almost like a menu, where each extra item you add increases the total. So, a very detailed financial picture will typically cost more to process, basically.

State Tax Filing Fees

Many states also require you to file a state income tax return, and H&R Block often charges a separate fee for this. This is an additional cost on top of your federal filing fee, which is important to remember. It can add up, too.

The cost for state filing can vary by state, and it can also depend on whether you are using online software or an in-person preparer. Sometimes, the online software might include one state for free with a paid federal product, but not always, so check carefully, you know.

If you lived in multiple states during the tax year, or if you earned income in more than one state, you might need to file multiple state returns. Each additional state return will likely come with its own separate charge, which can increase your overall cost significantly, you see.

Some states do not have income tax, so residents there would not have this extra fee. But for most people, state tax filing is a necessary step and an extra expense to factor in. It is just part of the process for many taxpayers, naturally.

Always look at the total price that includes both federal and state filing before you commit. This gives you the full picture of what you will pay, which is pretty helpful, anyway.

Add-On Services and Guarantees

H&R Block offers various extra services that can add to your total bill. These are optional, but they might be useful depending on your needs, you know. They can provide extra peace of mind for some people.

One common add-on is audit support or audit representation. This means if the IRS questions your return, H&R Block will help you respond or even represent you. This service usually comes with an extra fee, but it can be very valuable if you face an audit, honestly.

Another extra might be a refund transfer option, where your tax preparation fees are taken directly from your tax refund. This can be convenient if you do not want to pay upfront, but there is usually a fee for this service, you see. It's a way to defer payment, but it costs a little extra.

They also offer various guarantees, like a maximum refund guarantee or an accuracy guarantee. While these are often included with their services, some enhanced guarantees might come with an additional charge. It is something to look into if you want extra protection, you know.

Before you finalize your payment, review all the charges to make sure you understand what you are paying for. You want to avoid any surprises, after all, so checking the details is a good idea, you know.

How to Find the Best Value at H&R Block

Getting your taxes done does not have to break the bank, and there are ways to find good value with H&R Block. It is about being smart and looking for opportunities to save money, which is something many people want to do, naturally.

A little bit of research and timing can go a long way in reducing your costs. You want to make sure you are not paying for services you do not need, too. This helps keep your expenses down, after all.

We will look at some tips for getting the most out of H&R Block without overspending. These ideas can help you make a good decision, you know.

Looking for Discounts and Promotions

H&R Block often runs special deals, especially early in the tax season. These can include discounts on their online software or even special pricing for in-person services, you know. Keeping an eye out for these can save you some money.

Check their website regularly, or sign up for their email list to get notified about current promotions. Sometimes, they have specific offers for new customers, or for people who file early, which is pretty common. It pays to be aware of these opportunities, you see.

Student discounts or offers for military personnel are also sometimes available. If you fall into one of these groups, it is always worth asking if there is a special rate for you. A quick question can save you a bit, after all.

Coupon codes might also be found on various coupon websites, though you should always verify their validity directly on the H&R Block site. A little searching can sometimes yield a nice surprise, honestly. Every little bit helps, right?

These promotions are not always around, so if you see a good one, it might be wise to act on it. It is almost like catching a sale at your favorite store, you know.

Free Filing Options: Are You Eligible?

For many people, especially those with very simple tax situations, H&R Block offers a free online filing option. This is a great way to get your taxes done without spending any money, which is something everyone wants, you know.

Typically, this free version is for people who only have W-2 income, take the standard deduction, and do not have any complex tax situations. If your taxes fit this description, you should definitely check if you qualify, you see.

They also participate in the IRS Free File program, which allows eligible taxpayers to file their federal and sometimes state taxes for free. This program has income limits, so check the IRS website for the current year's guidelines, which is very important.

Do not assume you have to pay if your taxes seem simple. Always check the free options first, because you might be pleasantly surprised. It could save you a significant amount, honestly, which is pretty good.

Even if you end up needing a paid version, knowing the free options helps you understand why you are paying. It gives you a baseline for comparison, you know.

Comparing H&R Block to Other Services

Before you decide on H&R Block, it is a really good idea to compare their prices and services with other tax preparation companies. This helps you ensure you are getting the best deal for your specific needs, which is a smart move, basically.

Companies like TurboTax, TaxAct, and FreeTaxUSA also offer online software and sometimes in-person help. Their pricing structures can be similar, but there might be differences in what is included in each tier, you know. A small difference can mean a lot.

Look at what each service offers for your type of tax return. Does one include state filing for free where another charges? Does one offer better customer support for a similar price? These details matter, you see.

Some people even use a simple tax calculator from one service to get an estimate, then compare it to another. This way, you can get a rough idea of what your total cost might be across different providers. It is a good way to shop around, you know.

Remember that the cheapest option is not always the best if it does not meet your needs or provide enough support. It is about finding the right balance between cost and value, after all. Learn more about tax filing strategies on our site.

What to Consider Before You Pay

Before you hand over your money to H&R Block, or any tax service, there are a few final thoughts to keep in mind. Making an informed choice can save you stress and money in the long run, which is pretty important, you know.

It is not just about the price tag, but also about what you are getting for that price. Thinking about these points can help you feel more confident in your decision, you see. You want to be sure you are making the right move.

From the level of support you need to how ready your documents are, these things can influence your experience. Let us look at them now, basically.

The Value of Peace of Mind

Sometimes, paying a little more for a service like H&R Block gives you peace of mind, and that can be very valuable. Knowing your taxes are done correctly and that you have support if questions arise can be worth the extra cost for some people, you know.

If you are worried about making mistakes, or if your tax situation is new and confusing, the assurance of professional help can be a big relief. This is especially true if you are dealing with things like self-employment taxes for the first time, you see. It can feel like a lot to handle alone.

The guarantees H&R Block offers, like audit support, can also contribute to this peace of mind. While they might cost extra, they provide a safety net that some people find essential. It is like having insurance for your tax return, in a way.

Consider how much your time is worth, too. If spending hours trying to figure out tax software yourself causes you stress, paying someone else to do it might be a smart choice. Your mental well-being has value, after all, so that's something to think about, too.

So, while cost is important, also weigh the comfort and confidence that comes with professional help. It is not always about the lowest price, you know.

Support and Assistance Levels

The level of support you get varies significantly between H&R Block's online products and their in-person services. Think about how much help you think you will need, which is a good first step. This impacts your choice, you see.

Their basic online software might offer limited customer support, perhaps just through FAQs or a chat bot. If you are comfortable working through things yourself, this might be fine. But if you hit a snag, you might be on your own, you know.

Higher-tier online products often include access to tax experts for questions, either by chat or phone. This can be a really helpful feature if you get stuck on a specific tax form or rule. It is like having a lifeline when you need it, naturally.

With in-person service, you get direct, one-on-one help from a tax professional. They can answer all your questions, explain things clearly, and guide you through the whole process. This is the highest level of support they offer, basically.

Consider your own comfort level with technology and your knowledge of tax rules. If you are new to taxes, or if your situation is complex, more support might be worth the extra cost. You want to feel confident in your filing, after all.

Getting Your Documents Ready

No matter which H&R Block service you choose, having all your tax documents organized and ready will make the process smoother. This can even save you money, especially if you are paying for an hourly service, you know. Time is money, after all.

Gather your W-2s, 1099s, receipts for deductions, and any other relevant financial statements before you start. This includes things like mortgage interest statements, student loan interest forms, or childcare expenses. The more prepared you are, the better, you see.

If you are using online software, having everything ready means you can enter the data quickly and efficiently. This prevents you from stopping and starting, which can make the process feel longer and more frustrating. A smooth flow is much better, naturally.

For in-person appointments, being organized means your tax preparer can work more efficiently, potentially reducing the time they spend on your return. This could translate to a lower fee, as some preparers charge based on complexity and time. It is a very practical tip, honestly.

A little preparation goes a long way in making your tax filing experience less stressful and possibly less expensive. So, take some time to get your paperwork in order, you know. It will pay off.

Frequently Asked Questions

People often have specific questions about H&R Block's pricing, so we have put together some common ones here. These are questions many people ask, which is pretty typical, you know.

Hopefully, these answers will clear up any remaining doubts you might have. It is good to have all the information before you make a decision, after all. You want to be well-informed.

Here are some of the things people often want to know, basically.

Is H&R Block free for simple taxes?

Yes, H&R Block usually offers a free online filing option for very simple tax returns. This often applies to people with just W-2 income and those who take the standard deduction. Always check their website for the exact criteria for the current tax season, you know. They also participate in the IRS Free File program for eligible taxpayers.

What is the cheapest way to file taxes with H&R Block?

The cheapest way to file taxes with H&R Block is typically through their free online software if your tax situation qualifies. If your taxes are more complex, their paid online software versions are generally less expensive than using an in-person tax professional. Comparing the online tiers based on your specific needs is a good idea, you see.

Does H&R Block charge for state taxes?

Yes, H&R Block generally charges a separate fee for state tax filing, even with their paid federal online products. This is an additional cost on top of the federal filing fee. The price for state filing can vary, and sometimes a free state filing is included with certain federal products, but this is not always the case, so it is important to check the details, naturally.

Choosing Your Path to Tax Filing

Understanding how much H&R Block charges to file taxes involves looking at several factors. It is not a single price, but rather a range that depends on your tax situation, the service you pick, and any extra features you might want. Knowing these details helps you make a choice that fits your budget and your comfort level, which is very helpful, you know.

Whether you choose to file online yourself or get help from a professional, H&R Block provides different avenues. By considering the complexity of your taxes, looking for discounts, and comparing options, you can find the right fit. It is about being smart with your money and getting your taxes done right, after all. To learn more about tax preparation services, check out our detailed guide.

Much (canal de televisión) - Wikipedia, la enciclopedia libre

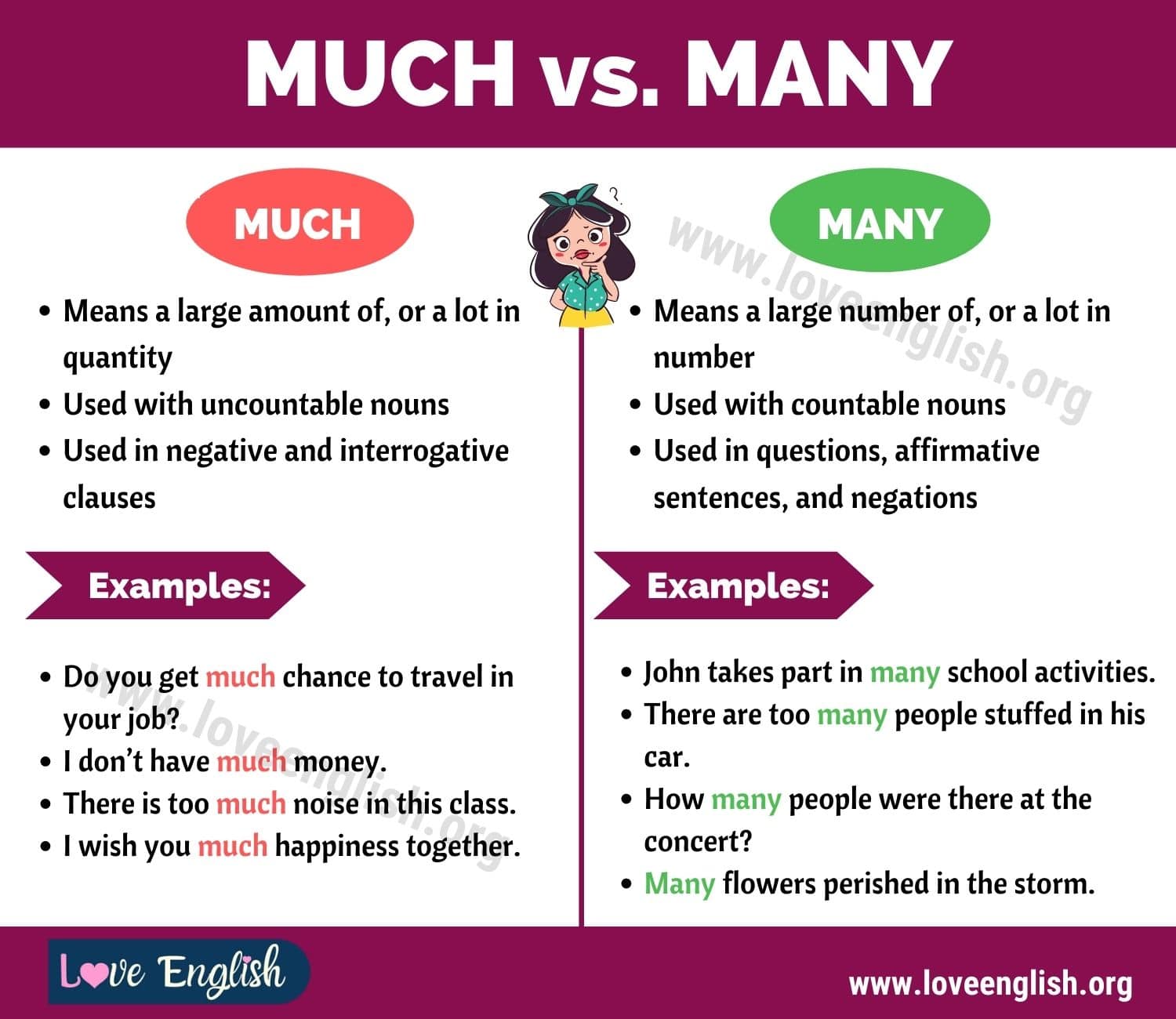

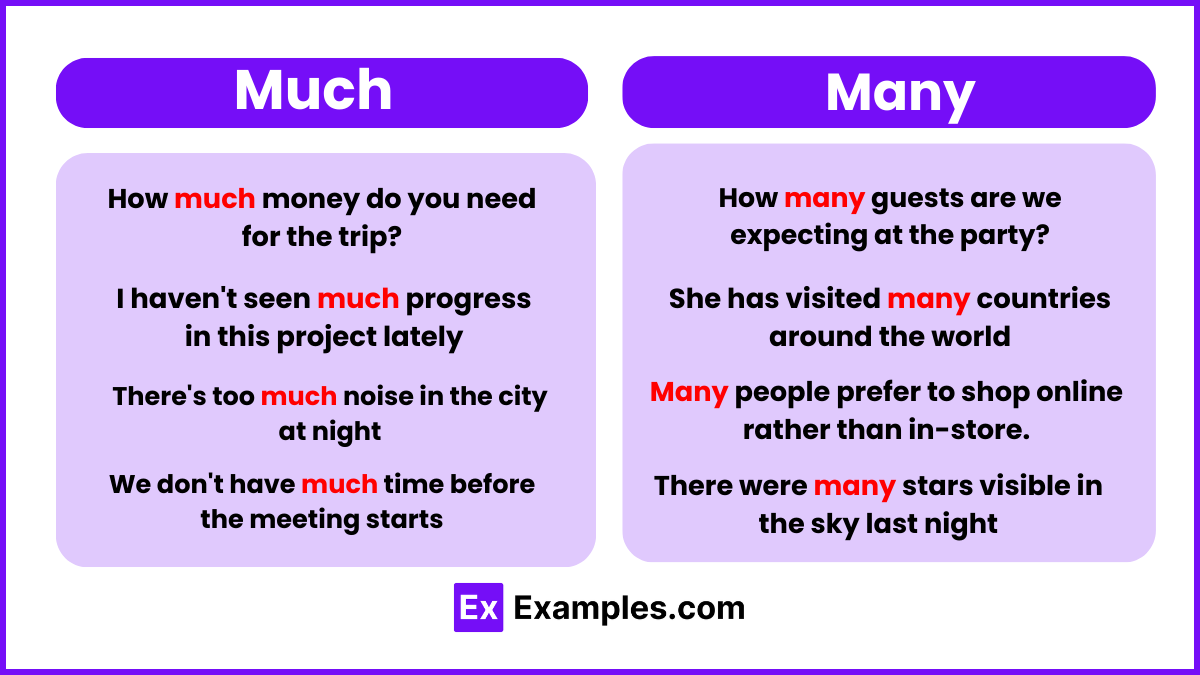

Much vs. Many: How to Use Many vs Much in Sentences - Love English

Much vs Many - Examples, Difference, Tricks, How to use