How Much To File Taxes H&R Block: Unpacking The Costs For Your 2024-2025 Return

Figuring out how much to file taxes H&R Block can feel like a bit of a puzzle for many folks each year. Tax season, as you know, sometimes brings along a mix of confusion, stress, and just plain takes up a lot of time. It's a common feeling, honestly, for a lot of Americans trying to get their tax returns squared away.

H&R Block, as you might be aware, offers quite a range of tax preparation services and plenty of know-how to make the whole process a lot simpler. They are, after all, known for having thousands of tax offices, very nearly within driving distance of most people in the country. They give you choices, whether you prefer to handle things in person or do your taxes online.

So, the big question often pops up: how much does using H&R Block actually cost? Or, more specifically, how much does H&R Block cost to file taxes online for 2024 and 2025? We'll look at the different ways they charge, what might make your price go up, and how you can find the right fit for your own tax needs, so to speak.

Table of Contents

- Understanding H&R Block Pricing Models

- Online Filing Options and Discounts

- In-Person Tax Preparation and Its Cost

- What Makes the Cost Change?

- Making Your Payment

- Is H&R Block the Right Choice for You?

- Frequently Asked Questions About H&R Block Costs

- Finding Your Best Tax Filing Path

Understanding H&R Block Pricing Models

H&R Block, as a matter of fact, tries to be quite clear about how much you'll pay right from the start. They call it upfront pricing, which means you should have a good idea of the cost of preparing your tax return before you really get deep into the filing process. This approach, you know, helps take some of the guesswork out of the whole thing.

They want you to know the cost of tax preparation before you start filing with H&R Block's upfront pricing. This transparency, it's almost, helps you plan your budget and choose the service that fits your situation best. You can see H&R Block's prices and then let a tax pro, if you choose that path, help determine your specific filing cost.

The company offers a few different ways to get your taxes done, and each way, naturally, comes with its own price tag. You can choose to complete your own taxes online, which, as it happens, can often be the most cost-effective route. Or, you might prefer to have a tax professional assist you, either online or at one of their many physical locations.

Online Filing Options and Discounts

For those who like to handle things themselves, H&R Block allows its clients to complete their own taxes online. This option, very often, comes with a pretty nice perk: they offer a 35% discount for doing your taxes this way. So, that's a significant saving right there, you know, if you're comfortable with the online self-service.

When you're looking at how much it really costs to file your taxes online at H&R Block, you'll find that they have several categories. These online filing options, typically, are designed to fit different tax situations, from the very simple to those with a bit more going on. There are ways, for instance, to file your taxes online for free, which is a great starting point for many people.

However, it's also true that many of us will end up paying something to get through tax season. This is because, quite simply, our tax situations are not always, well, simple. H&R Block offers an easy way to file taxes online by yourself or with the help of a tax pro, depending on what you need.

The Free Tier: What It Covers

Yes, free online filing is available from H&R Block for taxpayers with simple federal and state tax returns. This is a pretty big deal for a lot of people, especially those whose financial lives aren't too complicated. The free tier, for example, allows you to file IRS Form 1040, which is the standard individual income tax return.

Beyond just the basic 1040, this free option also covers certain schedules. Specifically, it lets you report income and deductions using Schedules 1, 2, and 3. These schedules, you know, handle things like additional income (unemployment, alimony), certain deductions (student loan interest, educator expenses), and nonrefundable credits, among other things.

So, if your tax situation fits neatly into these categories, you could potentially get your taxes done without spending a dime. It's a really good option, in a way, for students, retirees with straightforward income, or individuals with just a W-2 and perhaps a bit of interest income. This free option is, quite frankly, a lifesaver for many.

Paid Online Tiers and What They Offer

For those whose tax situations go beyond the free tier, H&R Block's online filing option comes in four categories, including the free version. The other paid tiers, naturally, offer more features and handle more complex tax forms. These tiers, basically, are designed for people with investments, self-employment income, rental properties, or other specific tax needs.

Each paid tier, you know, has a different price point, and the cost typically reflects the level of complexity it can handle and the types of forms it supports. For instance, if you have to report capital gains from stock sales, or if you're a solopreneur with business expenses, you'll likely need to move up to a higher-priced package. These packages are, after all, built to simplify those trickier parts of tax season.

It's worth looking at their comprehensive H&R Block tax review to discover its features, pricing, and ease of use. This kind of review, in fact, can really help you find out if H&R Block is the right tax software for you in 2025. It's about finding the right fit for your tax needs, exploring pricing tiers, features, and smart savings strategies.

In-Person Tax Preparation and Its Cost

H&R Block is, perhaps, most widely known for its network of physical tax offices. With over 12,000 locations, there's a good chance you have an H&R Block office within driving distance, which is quite convenient for many people. These offices offer a different kind of service, where you can sit down with a tax professional who will prepare your return for you.

The cost for in-person tax preparation, as you might guess, is generally higher than filing online by yourself. This is because you're paying for the expertise and personalized attention of a tax professional. They can help you sort through your documents, answer your questions, and, very importantly, help determine your filing cost based on your specific situation.

The price for in-person service can vary a lot depending on the complexity of your return. A simple W-2 return will cost less than a return with multiple income sources, itemized deductions, or business expenses. They aim to guarantee you get your maximum tax refund, which, honestly, is a big draw for many people who choose this option.

What Makes the Cost Change?

H&R Block costs a lot for a variety of reasons, from their own business expenses to special tax situations. It's not just a flat fee for everyone, you know. The amount you pay really depends on a few key factors that are unique to your financial picture.

You should consider what your taxes might look like and how much filing will involve. For example, if you have a straightforward job with just one W-2, your cost will likely be on the lower side. But if you own a small business, have investments, or deal with rental properties, the price will almost certainly go up.

Your Tax Situation Matters

The complexity of your tax situation is, without a doubt, the biggest factor influencing the cost. If you have a simple federal and state tax return, you might qualify for the free online filing. This means, basically, you're reporting income from a W-2, maybe some interest, and taking the standard deduction. That's a pretty simple return, after all.

However, if your financial life is a bit more intricate, the cost will increase. For instance, if you have self-employment income (1099-NEC), own a home and want to itemize deductions, or have income from investments like stocks or cryptocurrency, you'll need a higher-tier service. These situations, in a way, require more specialized forms and calculations, which adds to the work involved.

H&R Block is a tax filing provider that offers services to individuals, solopreneurs, and SMEs. So, whether you're just filing for yourself or running a small business, they have options. The services for solopreneurs and small to medium-sized enterprises, naturally, are more comprehensive and come with a higher price tag because they deal with more complex business tax matters.

Upgrading Your Service

Sometimes, you might start with one service tier and then realize your tax situation is more complicated than you first thought. If you need to upgrade based on your tax situation, you'll typically pay around $35 to do so, according to the information. This upgrade fee, you know, moves you from a lower-cost or free tier to one that supports your specific needs.

For example, you might begin with the free online filing, but then remember you sold some stock during the year. That usually means you need to report capital gains, which the free tier doesn't cover. So, you'd pay the upgrade fee to access the features that handle investment income. It's a pretty common scenario, actually, for many people.

This flexibility allows you to start simple and only pay for what you truly need. It means you don't have to guess at the beginning what your exact requirements will be. You can begin, and if things get more complex, you can then add on the necessary features. This system, in some respects, offers a good balance of cost and coverage.

Making Your Payment

When it comes to paying for H&R Block's services, the process is pretty straightforward. If you receive statements monthly or periodically, the H&R Block payment will appear on your next credit card or bank statement. This means, basically, it's just like any other online purchase or service fee you might pay.

They accept various payment methods, making it easy to settle your bill once your taxes are prepared. You can typically use a credit card or debit card. Some people, of course, might look for an H&R Block payment alternative, but their standard payment options are usually quite sufficient for most clients.

It's important to remember that the payment is for the tax preparation service itself, not necessarily for filing your return. The act of filing, whether it's e-filing or mailing, is usually included once the preparation is complete. So, you pay for the expertise and the software that helps you get your return ready to send off.

Is H&R Block the Right Choice for You?

Deciding if H&R Block is your best bet for taxes really depends on what you're looking for. As we've seen, they offer a wide range of services, from free online self-preparation for simple returns to full-service, in-person assistance for more complex situations. Their reputation, after all, is built on helping millions of people with their taxes each year.

One of the big draws is their guarantee to help you get your maximum tax refund. This assurance, you know, gives many people peace of mind. They stand by their work, aiming to ensure you receive every dollar you're owed. You can file your tax return online, with their tax software, or at one of their offices today.

In our H&R Block tax software review, we’ll take a look at all of the package options and the pros and cons of using it to file your taxes. It's a good idea to check out reviews and compare them with other services to see which one aligns best with your needs and budget. For example, you might want to consider the user interface, the level of support offered, and, of course, the pricing structure.

Ultimately, the best way to figure out if H&R Block is right for you is to consider your own tax situation. Do you prefer doing things yourself online, or do you need a bit of hand-holding? How complex are your income sources and deductions? These questions, you know, will guide you toward the best choice.

Frequently Asked Questions About H&R Block Costs

1. Can I really file my taxes for free with H&R Block?

Yes, you can, actually. H&R Block offers a free online filing option for taxpayers who have simple federal and state tax returns. This usually means you're just filing IRS Form 1040 and perhaps a few basic schedules like 1, 2, or 3. So, if your income is from a W-2 and you're taking the standard deduction, you're probably good to go with the free version. It's a very helpful option for many, honestly.

2. What makes H&R Block more expensive for some people?

The cost of using H&R Block, or any tax service for that matter, tends to go up when your tax situation becomes more complex. For instance, if you have self-employment income, rental property income, investments (like stocks or cryptocurrency), or if you need to itemize deductions, you'll likely need a higher-tier service. These situations, in a way, require more specialized forms and calculations, which adds to the service fee. It's about the extra work involved, you know.

3. Is it cheaper to file online or in person with H&R Block?

Generally speaking, filing your taxes online by yourself with H&R Block is cheaper than having a tax professional prepare your return in person. They even offer a 35% discount for clients who choose to complete their own taxes online. While in-person service offers personalized help and advice, that convenience and expertise come with a higher price tag. So, if cost is your main concern and your taxes aren't too complicated, the online self-service is usually the more budget-friendly path.

Finding Your Best Tax Filing Path

Knowing how much to file taxes H&R Block is a big part of choosing the right tax preparation service for you. It's not just about the price, though that's certainly a major consideration for most people. It's also about the level of support you need, the complexity of your financial life, and how comfortable you are doing things yourself.

H&R Block, with its upfront pricing and various service tiers, tries to make the cost clear before you get too far along. Whether you're a student with a simple W-2, a freelancer with multiple income streams, or a small business owner, they likely have a service that fits. Remember, too it's almost, that you can start with a free option and upgrade if your situation calls for it.

To learn more about tax preparation services on our site, you can explore the different options available. You might also find it helpful to look at resources that compare various tax software providers to help you make an informed decision. For example, you could check out this page on choosing the right tax software to see how H&R Block stacks up against other options for your tax needs in 2025.

Ultimately, the goal is to get your taxes done accurately and to secure your maximum refund, all while feeling good about the process and the cost. Take some time to review your own tax situation, consider the options H&R Block provides, and pick the path that makes the most sense for you this tax season.

For more general information on tax filing, you can visit the IRS website, which is a very good source for official tax guidance and forms. It's always a good idea to get information straight from the source, you know, when it comes to taxes.

Much (canal de televisión) - Wikipedia, la enciclopedia libre

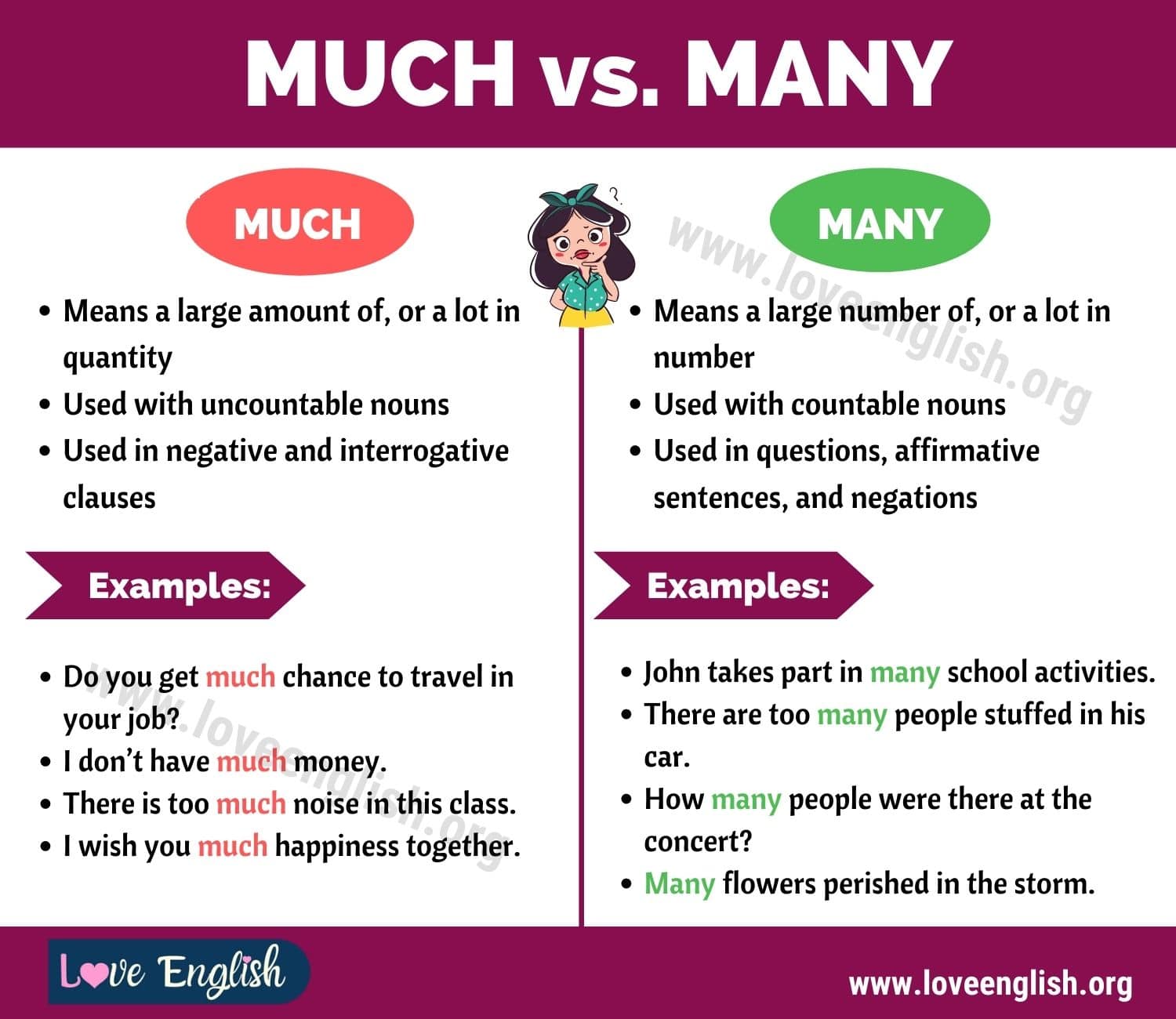

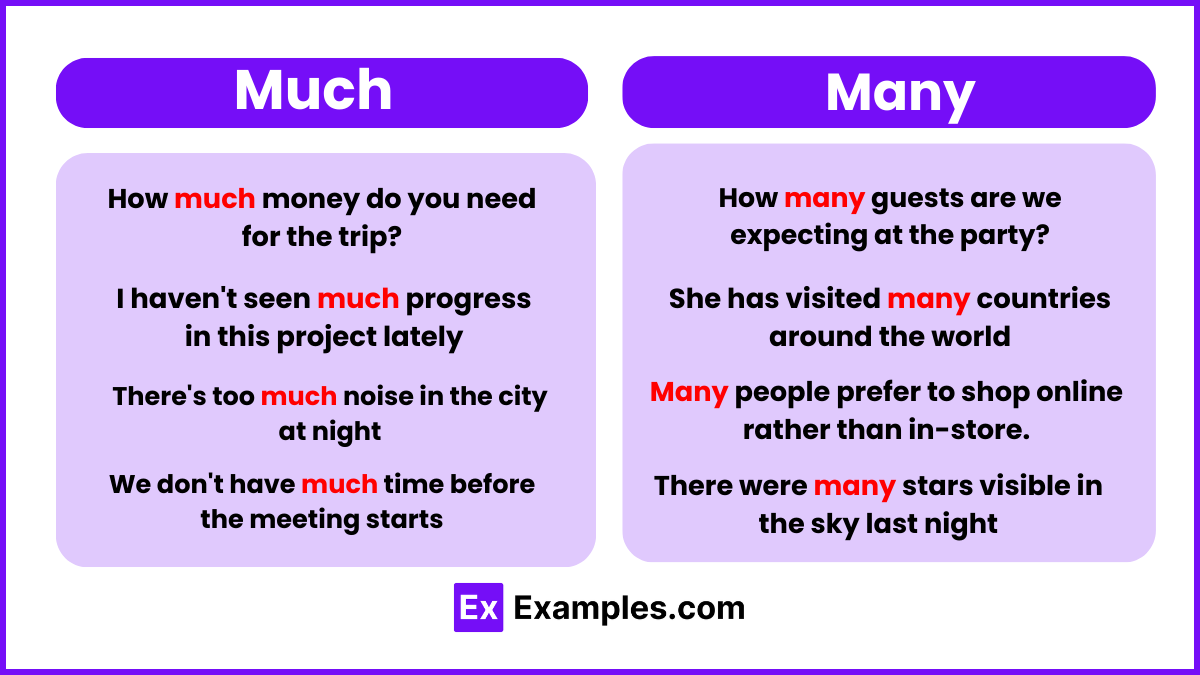

Much vs. Many: How to Use Many vs Much in Sentences - Love English

Much vs Many - Examples, Difference, Tricks, How to use