Understanding What Happens If You File Single When Married

It is a common question, and one that carries significant weight: "what happens if i file single when married?" Many people find themselves wondering about this, perhaps due to a simple misunderstanding, a change in life circumstances, or even a desire to simplify things. The truth is, your tax filing status is a really important detail, and getting it wrong can lead to some unexpected issues with the tax authorities.

When you fill out your tax forms, choosing the right status is more than just picking an option from a list; it actually sets the whole stage for your tax situation. Your filing status helps determine your standard deduction, what tax brackets apply to you, and even which credits you might be able to claim. It's a foundational piece of your annual tax picture, and making a mistake here could mean missing out on money or, worse, owing more.

This article will help you understand the true meaning of "married" for tax purposes, what might lead someone to file incorrectly, and, very importantly, the real repercussions if you do file single when you are married. We'll also look at how you can put things right if you've made a mistake, and some ways to avoid these kinds of problems in the future. So, let's explore this topic together, making sure you have the clear information you need.

Table of Contents

- What Does "Married" Mean for Taxes?

- The Legal Definition

- Common Misconceptions

- Why Someone Might File Single While Married

- Mistake or Confusion

- Intentional Misrepresentation

- The Serious Repercussions: What Happens If You File Single When Married

- Financial Penalties and Back Taxes

- Legal Consequences

- Impact on Benefits and Credits

- Married Filing Separately vs. Single: A Key Difference

- Understanding the Options

- When Married Filing Separately Makes Sense

- How to Fix a Wrong Filing Status

- Amending Your Return

- What to Expect After Amending

- Preventing Future Mistakes

What Does "Married" Mean for Taxes?

For tax purposes, the definition of "married" is, you know, pretty specific. It is not always about how you feel or whether you live together; it really comes down to your legal status on the last day of the tax year, which is typically December 31st. If you were legally married on that day, even if you got married on December 31st itself, the tax authorities consider you married for the entire year. This rule applies whether you are living with your spouse or not, unless you have a formal separation agreement that qualifies you for a different status, like Head of Household.

The Legal Definition

The tax rules say that if you are legally wed under state law, you are married for tax purposes. This includes traditional marriages, common-law marriages recognized in your state, and same-sex marriages. There are no exceptions for, say, living apart or having marital problems, unless a formal legal separation or divorce decree is in place by that year-end date. So, it is almost, you know, a very clear cut rule: if you are married, you are married for tax purposes.

Common Misconceptions

Many people hold ideas that do not quite align with tax law. For instance, some think that if they are separated but not yet divorced, they can file as single. This is actually incorrect. Unless you have a specific decree of legal separation, you are still considered married. Another common thought is that if one spouse lives in a different state, they can file separately as single. This is also not how it works. Your marital status for tax purposes depends on your legal bond, not your living arrangements. You might also think that if your spouse has no income, you can just file single, but that is not the case either. You are still married, and you should pick a married filing status, even if one spouse has no income.

Why Someone Might File Single While Married

There are several reasons why someone might end up filing as single when they are, in fact, married. Sometimes, it is an honest mistake, a simple misunderstanding of the rules, which happens quite a bit. Other times, it could be a deliberate choice, perhaps to gain a perceived advantage, which, you know, can lead to much bigger problems. It is important to understand the different motivations behind this incorrect filing, as the tax authorities might view them differently.

Mistake or Confusion

A lot of people just do not fully grasp the specific definitions for tax filing statuses. They might think "single" means "not filing with my spouse," rather than "not legally married." For instance, someone might be legally separated but without a court order, and they mistakenly believe that allows them to file as single. Or, perhaps they had a difficult year with their spouse and, in a way, just wanted to handle their taxes completely on their own, thinking "single" was the easiest path. This kind of confusion is, sadly, very common, especially for those new to filing taxes or those whose marital status has recently changed. They might not realize that "Married Filing Separately" is the actual option for married people who want to file individual returns.

Intentional Misrepresentation

On the other hand, some individuals might knowingly choose to file as single even when married. This could be done to hide income from a spouse, to avoid including a spouse's income on their return, or even to try and qualify for certain tax credits or benefits that are not available to married couples. For example, some education credits or premium tax credits for health insurance might have income limits that are easier to meet if one files as single rather than married. This kind of deliberate action is, you know, a very serious matter. It can be seen as tax fraud, and the consequences for that are much more severe than for an honest mistake. It is almost like trying to cheat the system, and the tax authorities really do not take kindly to that kind of behavior.

The Serious Repercussions: What Happens If You File Single When Married

Filing as single when you are married is not just a small error; it can bring about some pretty significant problems. The tax authorities take tax filing status very seriously, as it affects everything from the amount of tax you owe to the benefits you can claim. The consequences can range from financial penalties to more serious legal issues, which, you know, no one wants to deal with. It is really important to understand what might happen if this mistake occurs.

Financial Penalties and Back Taxes

One of the most immediate outcomes of filing incorrectly is that you will likely owe more money. If you filed as single, you probably paid less tax than you should have, or you received a larger refund than you were entitled to get. This is because the "single" filing status often has lower standard deductions and different tax brackets compared to "Married Filing Jointly" or "Married Filing Separately." When the tax authorities discover the error, they will reassess your tax liability. This means you will owe the difference in taxes, plus interest, and possibly penalties for underpayment or for providing false information. These penalties can add up, making the initial "saving" or larger refund seem very small in comparison to the total amount you will eventually have to pay back. It is, you know, a situation where a small error can become quite costly.

Legal Consequences

Beyond the financial hit, there can be legal repercussions, especially if the tax authorities believe you intentionally misrepresented your status. If they think you committed tax fraud, you could face criminal charges. This might involve hefty fines, and in some very serious cases, even jail time. While an honest mistake is usually handled with civil penalties, a deliberate attempt to deceive the government is viewed much more gravely. It is a bit like, you know, trying to hide something, and the law has strong ways of dealing with that. The tax authorities have ways to find out about these things, and they do pursue cases where they suspect fraud. So, you know, it is really not worth the risk.

Impact on Benefits and Credits

Filing status also affects your eligibility for various tax benefits and credits. For example, certain education credits, the Earned Income Tax Credit, or even the Premium Tax Credit for health insurance often have different income thresholds or eligibility rules for married individuals compared to single filers. If you filed as single, you might have claimed credits or benefits you were not actually eligible for as a married person. This means you would have to repay those amounts, adding to your overall tax bill. It is, you know, a cascade effect; one wrong choice can impact many different parts of your financial picture. Just as making good life choices, whether single or married, often comes down to following clear principles, so too does proper tax filing. It is about being truthful and accurate with your information.

Married Filing Separately vs. Single: A Key Difference

It is very common for people to mix up "Married Filing Separately" with "Single." While both statuses mean you are filing your own tax return without your spouse, they are actually quite different in the eyes of the tax authorities. Understanding this distinction is, you know, absolutely vital for anyone who is married but wants or needs to file their taxes individually. It is not just a matter of semantics; it has real financial implications.

Understanding the Options

When you are legally married, you generally have two main choices for filing: "Married Filing Jointly" (MFJ) or "Married Filing Separately" (MFS). The "Single" status is reserved only for those who are unmarried, divorced, or legally separated by a court order on December 31st of the tax year. So, if you are married, even if you are estranged from your spouse, "Single" is not an option. MFS allows each spouse to report their own income, deductions, and credits on a separate tax return. This means you are still acknowledging your marital status, but you are not combining your financial information onto one return. It is, in a way, a compromise for married couples who prefer or need to keep their tax affairs distinct.

When Married Filing Separately Makes Sense

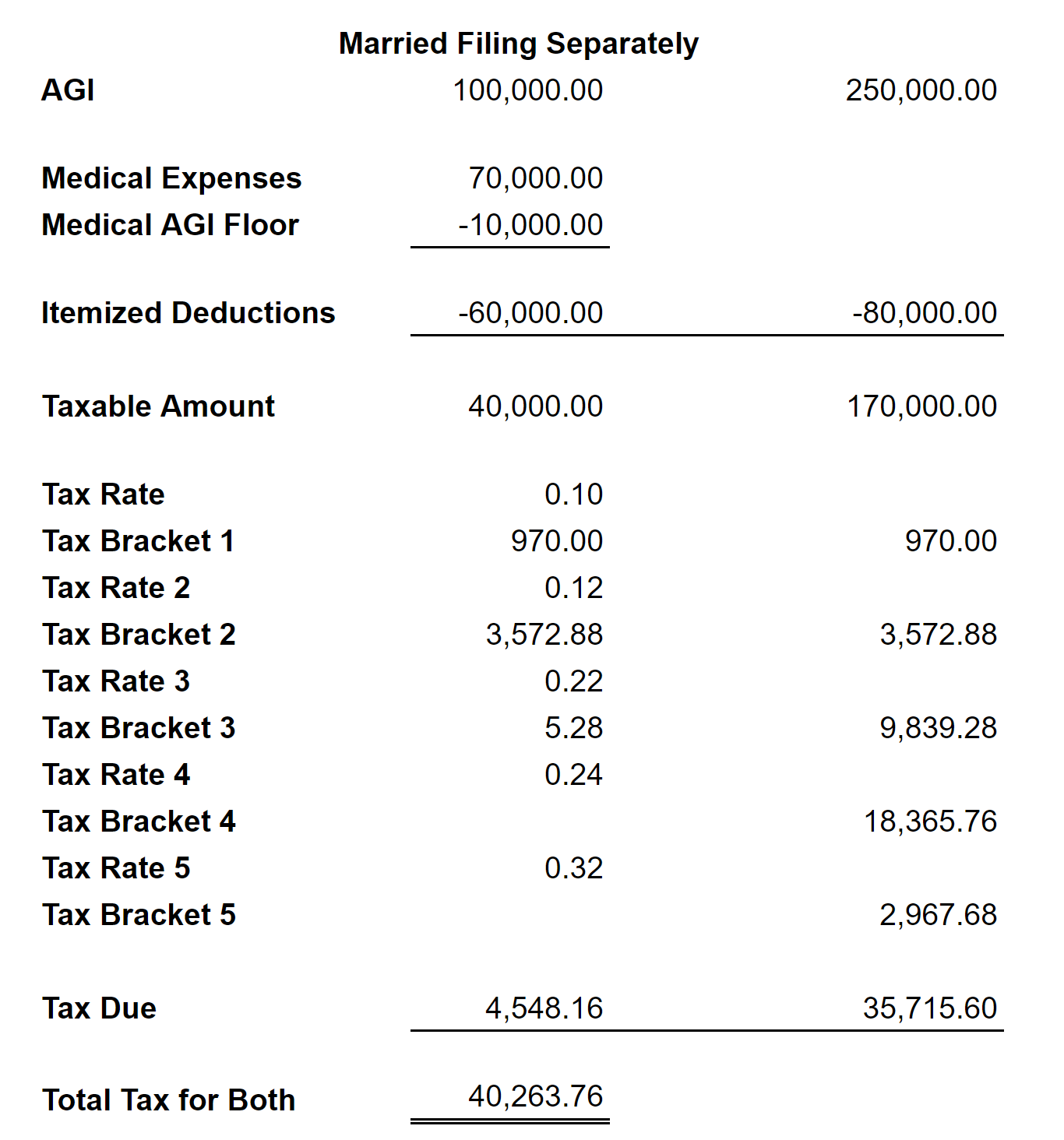

While "Married Filing Jointly" often results in the lowest overall tax liability for most couples, there are specific situations where "Married Filing Separately" can be a better choice. For instance, if one spouse has a lot of medical expenses or other deductions that are limited by a percentage of their Adjusted Gross Income (AGI), filing separately might allow them to reach that threshold more easily. This is because their individual AGI would be lower than a combined AGI. Another common reason is if one spouse has significant debt, like student loans, and they want to keep their tax refund separate from any potential offsets for that debt. Also, if you suspect your spouse is not being truthful about their income or deductions, filing separately can protect you from liability for their errors or fraud. It is, you know, a way to keep your finances distinct, which can be important in certain circumstances. However, choosing MFS often means you cannot claim certain tax benefits, like the Earned Income Tax Credit or education credits, and your standard deduction might be lower. So, it is really important to weigh the pros and cons carefully.

How to Fix a Wrong Filing Status

If you realize you have filed as single when you were actually married, do not panic. The good news is that this kind of mistake can usually be corrected. The tax authorities understand that people make errors, and they have a process in place for you to amend your return. Acting quickly to fix the issue is, you know, the best course of action. It shows good faith and can help reduce potential penalties. It is really important to get this right.

Amending Your Return

To correct your filing status, you will need to file an amended tax return using Form 1040-X, Amended U.S. Individual Income Tax Return. This form allows you to change your filing status, income, deductions, and credits for a previously filed return. You should prepare a new tax return with the correct "Married Filing Jointly" or "Married Filing Separately" status, and then use the information from that new return to fill out Form 1040-X. You will need to explain the changes you are making and why. It is a bit like, you know, going back and correcting a test answer. Make sure to include all necessary supporting documents with your amended return. You generally have three years from the date you filed your original return, or two years from the date you paid the tax, whichever is later, to file an amended return. This gives you, you know, a bit of time to sort things out.

What to Expect After Amending

After you submit your amended return, the tax authorities will review it. This process can take some time, often several weeks or even months. You might receive correspondence from them asking for more information or clarifying details. If your amended return shows that you owe more tax, you should pay that amount as soon as possible to stop additional interest and penalties from building up. If, on the other hand, the correct filing status means you are due a larger refund, you will receive that amount once your amended return is processed. It is really important to keep good records of everything you send, including copies of the amended return and any supporting documents. You can check the status of your amended return online using the "Where's My Amended Return?" tool on the tax authority's website. Learn more about amending your tax return on our site, and for general tax information, you can also link to this page here.

Preventing Future Mistakes

Avoiding these kinds of tax filing errors in the future is, you know, pretty straightforward with a bit of care and planning. It is all about being informed and, when in doubt, seeking professional help. Getting it right the first time saves you a lot of hassle, stress, and potential financial headaches down the road. So, let's look at some very practical ways to make sure your tax filing status is always correct.

Get Professional Help

One of the best ways to prevent mistakes is to consult with a qualified tax professional. A Certified Public Accountant (CPA) or an Enrolled Agent (EA) can help you determine your correct filing status based on your specific circumstances. They stay up-to-date on all the latest tax laws and can advise you on the most advantageous way to file, whether that is Married Filing Jointly or Married Filing Separately. This is especially helpful if your marital situation is complex, like if you are separated but not divorced, or if you have recently married. Their expertise can save you money and, you know, a lot of worry in the long run. It is a bit like having a guide for a very tricky path.

Stay Informed

Taking the time to understand the basic tax rules that apply to your situation can also go a long way. The tax authority's website is a great resource, offering publications and tools that explain filing statuses and other tax topics. For example, you can find detailed information about different filing statuses and what qualifies you for each one. Regularly reviewing this information, especially if there are changes in your life, like getting married, divorced, or having a child, is a good habit to form. You could, you know, set a reminder to check for updates each year before tax season. Also, paying attention to official tax news and updates, particularly around the start of the tax year, can help you catch any new rules or changes that might affect your filing status. This proactive approach really helps keep you on the right track, making sure you are always making the best decisions for your tax situation.

Frequently Asked Questions (FAQs)

Here are some common questions people ask about filing status when married:

Can you file single if legally married but separated?

No, not usually. If you are legally married, even if you are separated, you generally cannot file as "Single." You would typically need to file as "Married Filing Jointly" or "Married Filing Separately." The only exception is if you have a court decree of legal separation and meet certain other criteria, which might allow you to file as "Head of Household." So, you know, legal separation is key here.

What are the penalties for filing taxes incorrectly?

The penalties for filing incorrectly can vary. If it is an honest mistake, you might owe back taxes plus interest on the underpayment. There could also be penalties for failure to pay or for accuracy-related issues. If the tax authorities believe you intentionally filed incorrectly to avoid taxes, you could face much more severe penalties, including substantial fines and, in very serious cases, criminal charges. It is, you know, a serious matter.

How do you change your tax filing status after filing?

You can change your tax filing status after filing by submitting an amended tax return using Form 1040-X, Amended U.S. Individual Income Tax Return. You will need to prepare a new return with the correct status and use that information to fill out the 1040-X, explaining the changes. It is usually best to do this as soon as you realize the error. For more information, you can check the official tax authority website, which has detailed guides on amending returns.

Can a Married Couple File as a Qualified Joint Venture? | KDK

What happens if I’m married but file single? Leia aqui: Can you get

Married or Single? – Young Adults of Worth Ministries