How Much Does H&R Block Charge? Your Guide To Tax Prep Costs For 2024-2025

When tax season rolls around, a lot of people, you know, start thinking about how they're going to get their taxes done. For many, H&R Block is a name that just pops right into their heads, and honestly, it's a household name in tax preparation for a good reason. But then, a pretty common question comes up, like, "how much does H&R Block charge?" It's a fair question, too, because nobody wants surprises when it comes to their money, right?

Figuring out the actual cost of using H&R Block, you see, isn't always a simple, one-size-fits-all answer. It's not like buying a gallon of milk where the price is just the price. Your personal financial situation, where you live, and even how you choose to file your taxes can all play a big part in the final bill. So, we're going to, you know, break it all down for you, to help you get a clearer picture.

Generally speaking, doing your taxes yourself, especially with online tools, will save you some money in most cases, which is a pretty good deal for a lot of folks. H&R Block, for example, actually allows its clients to complete their own taxes online, and they even offer a nice 35% discount for doing so, which, honestly, is a significant saving. So, let's get into the details, to be honest.

Table of Contents

- What Shapes H&R Block's Prices?

- H&R Block Online Tax Preparation: What to Expect

- Getting Your Taxes Done In-Person at H&R Block

- A Look at H&R Block's Offerings

- Saving Money on Your Tax Prep

- Frequently Asked Questions

- Making Your Choice

What Shapes H&R Block's Prices?

The cost of H&R Block tax preparation, you know, really depends on a few key things. It's not just a flat fee, which is important to understand. The total amount you end up paying is greatly influenced by your financial situation, where you are located, and whether you're using their online software or getting help from a tax professional at one of their local offices. So, let's unpack these, okay?

Your Personal Financial Situation

Your financial picture, honestly, plays a huge role in how much your tax preparation might cost. If your taxes are, like, very simple and straightforward – maybe you just have a W-2 form and no special deductions – then your cost will likely be on the lower side. However, if your tax situation is more involved, perhaps you own a business, have investments, or deal with rental properties, then the process becomes a bit more complex. This added complexity often means you need more advanced forms or a professional's expertise, which, you know, can increase the price. It's really about the level of detail your specific tax return needs.

Where You Are Located

Interestingly enough, your geographical location can also make a difference in how much H&R Block charges. This might be a bit surprising to some, but it's true. For instance, it could be location biased, but H&R Block services are definitely cheaper than what you might find at smaller, independent firms in the New York metro area. This suggests that pricing can vary depending on the local market and the general cost of doing business in that particular region. So, what you pay in one state or city might be, you know, different from another.

Online Software Versus a Tax Professional

This is, arguably, one of the biggest factors affecting your cost. H&R Block offers a couple of main ways to get your taxes done. You can choose to use their online software, which is designed for you to do it yourself, or you can go to a local office and have a tax professional handle everything for you. As a matter of fact, doing your taxes yourself online will almost always save you money compared to having someone else do them. The convenience of having a person do it, however, does come with a higher price tag, which is understandable in a way.

H&R Block Online Tax Preparation: What to Expect

H&R Block is a tax preparation service that helps you file your own tax returns either online or with their desktop software. Here’s our take on H&R Block’s online software features, functionality, and pricing to help you decide whether you might want to use it to file your 2024 taxes in 2025. It's pretty straightforward once you get the hang of it, you know.

Online Plans and Their Pricing

H&R Block, actually, has four different levels of online tax preparation available for you. These plans offer varying features and support, depending on what your tax situation needs. For federal tax filing, these online plans typically cost between $0 and about $84.99. State filings, on the other hand, usually come with an additional charge, which, you know, can range depending on your state's specific requirements. So, you'll want to factor that in when looking at the total cost.

The Free Version: A Closer Look

One of the, like, really appealing aspects of H&R Block's online offerings is their free version. This free option boasts that it offers a good number of forms for filing, specifically 45 forms, which is, in fact, more than what TurboTax's free version provides. This can be a significant advantage for people with relatively simple tax situations who still need access to a variety of forms without having to pay anything. It’s pretty neat, honestly, to have that much flexibility for no cost.

Discounts and Ways to Save Online

As we mentioned earlier, H&R Block really encourages its clients to complete their own taxes online. To sweeten the deal, they offer a pretty generous 35% discount for doing so. This means that if you're comfortable with a bit of DIY, you can save a good chunk of money on your tax preparation fees. Plus, you know, you might even find additional savings. For instance, you can know how much H&R Block tax prep will cost in 2025 before you start with this Groupon coupons guide, which is a great way to look for extra savings.

How Payments Work for Online Filing

When you choose to pay for your online tax preparation using a credit or debit card, it's good to note how the charges work. H&R Block filing fees, you see, will be charged at the exact time you complete the transaction in the product. This means you won't be surprised by a charge later; it happens right when you finish up your filing process. It's a pretty clear system, honestly, so you know exactly when your payment goes through.

Upgrading Your Online Service

Sometimes, as you're going through the online tax preparation process, your tax situation might turn out to be a little more involved than you initially thought. If you need to upgrade your service based on your tax situation, you'll typically pay around $35 to do so. This fee covers the access to more advanced features or forms that your specific circumstances might require. It's a straightforward way to get the extra help you need without, you know, starting all over again.

Getting Your Taxes Done In-Person at H&R Block

While the online options are great for many, some people just prefer the peace of mind that comes with having a real person, a tax professional, handle their taxes. H&R Block has locations in all 50 states, so they can service pretty much anyone who wants to visit an office. This in-person service, you know, provides a different level of support and convenience, which many find worth the extra cost. It's a very personalized approach, really.

An Example of In-Person Cost

To give you a clearer idea, one person shared their experience of getting their taxes done in person at H&R Block. The total cost for filing came out to about $310. This total, you see, was broken down into a few parts: it was something like $200 for federal filing, about $70 for state filing, and then a $40 charge to get the H&R Block specific services. This kind of example gives you a pretty good ballpark figure if you're considering the in-person route, which is helpful, obviously.

Why In-Person Might Cost More

You might wonder, you know, why H&R Block costs so much when you go in person compared to doing it online. H&R Block costs a lot for a variety of reasons, from their own business expenses, like maintaining offices and employing staff, to dealing with special tax situations that require a professional's touch. When you're paying for an in-person service, you're not just paying for the forms; you're also paying for the expertise, the time, and the assurance that comes with having a trained professional review your documents. You should consider what your taxes actually need, as a matter of fact.

Support from a Tax Pro

For paid users, whether you're using a more advanced online plan or you're visiting an office, tax pro support is available. This means you can get help and answers to your questions from a knowledgeable expert. This kind of support can be really valuable, especially if you encounter something unexpected or confusing during your tax preparation. It's like having a safety net, you know, which can be very reassuring for many people.

A Look at H&R Block's Offerings

H&R Block is, honestly, a household name in tax prep, and for good reason. They offer a summary of H&R Block tax services, features, and pricing, making it easier for you to understand what you're getting. They aim to make the process as smooth as possible, which is pretty important when dealing with something as crucial as your taxes. So, let's look at some of the general benefits, alright?

Ease and Convenience

One of the main goals of H&R Block is to help you lodge your tax return with ease and convenience. Whether you choose to do it online, with their desktop software, or in person, they strive to make the experience as simple as possible. This focus on user-friendliness is a big part of their appeal, especially for those who find tax preparation a bit daunting. It's about taking some of the stress out of the process, you know.

Nationwide Reach

With locations in all 50 states, H&R Block can service a huge number of people across the country. This widespread presence means that no matter where you live, you likely have access to an H&R Block office or their online services. This kind of accessibility is a significant advantage, ensuring that help is often just around the corner or a few clicks away. It’s pretty convenient, to be honest, knowing they are so widely available.

Saving Money on Your Tax Prep

As we've touched upon, doing your taxes yourself will save you money in most instances. This is especially true if your tax situation is, you know, relatively simple. H&R Block makes this easier by offering online options and discounts. For example, the 35% discount for online self-preparation is a significant saving that many people can take advantage of. Also, keeping an eye out for things like Groupon coupons, which can help you know how much H&R Block tax prep will cost in 2025, can lead to even more savings. It's about being a bit savvy, really, when it comes to managing your money.

Frequently Asked Questions

Q: Is it cheaper to do taxes yourself with H&R Block online or go to an office?

A: Generally speaking, doing your taxes yourself using H&R Block's online software will save you money in most instances. They even offer a 35% discount for clients who complete their own taxes online. Going to a local office for in-person help from a tax professional typically costs more, like the example of $310 total for federal and state filings.

Q: What factors affect the cost of H&R Block tax preparation?

A: The cost of H&R Block tax preparation greatly depends on your financial situation, your geographical location, and whether you’re using their online software or a tax professional at a local office. More complex financial situations usually mean a higher cost, and prices can vary by region, too.

Q: How much do H&R Block's online federal tax filing plans cost?

A: H&R Block’s online federal tax filing plans, you know, cost between $0 and about $84.99. State filings usually come with an additional charge. They have four levels of online preparation, including a free version that offers 45 forms for filing, which is pretty good.

Making Your Choice

Ultimately, when you're asking "how much does H&R Block charge," the answer truly comes down to your specific needs and how you prefer to handle your taxes. You have choices, from the free online version for simpler returns to the comprehensive support of an in-person tax professional. Consider your financial situation, how comfortable you are with doing things yourself, and your budget for tax preparation. Knowing these details can help you pick the right H&R Block service for you, which is pretty important for a smooth tax season.

Learn more about tax preparation services on our site, and you can also find more information about filing your taxes here. To get further details on various tax topics, please check out this page .

Much (canal de televisión) - Wikipedia, la enciclopedia libre

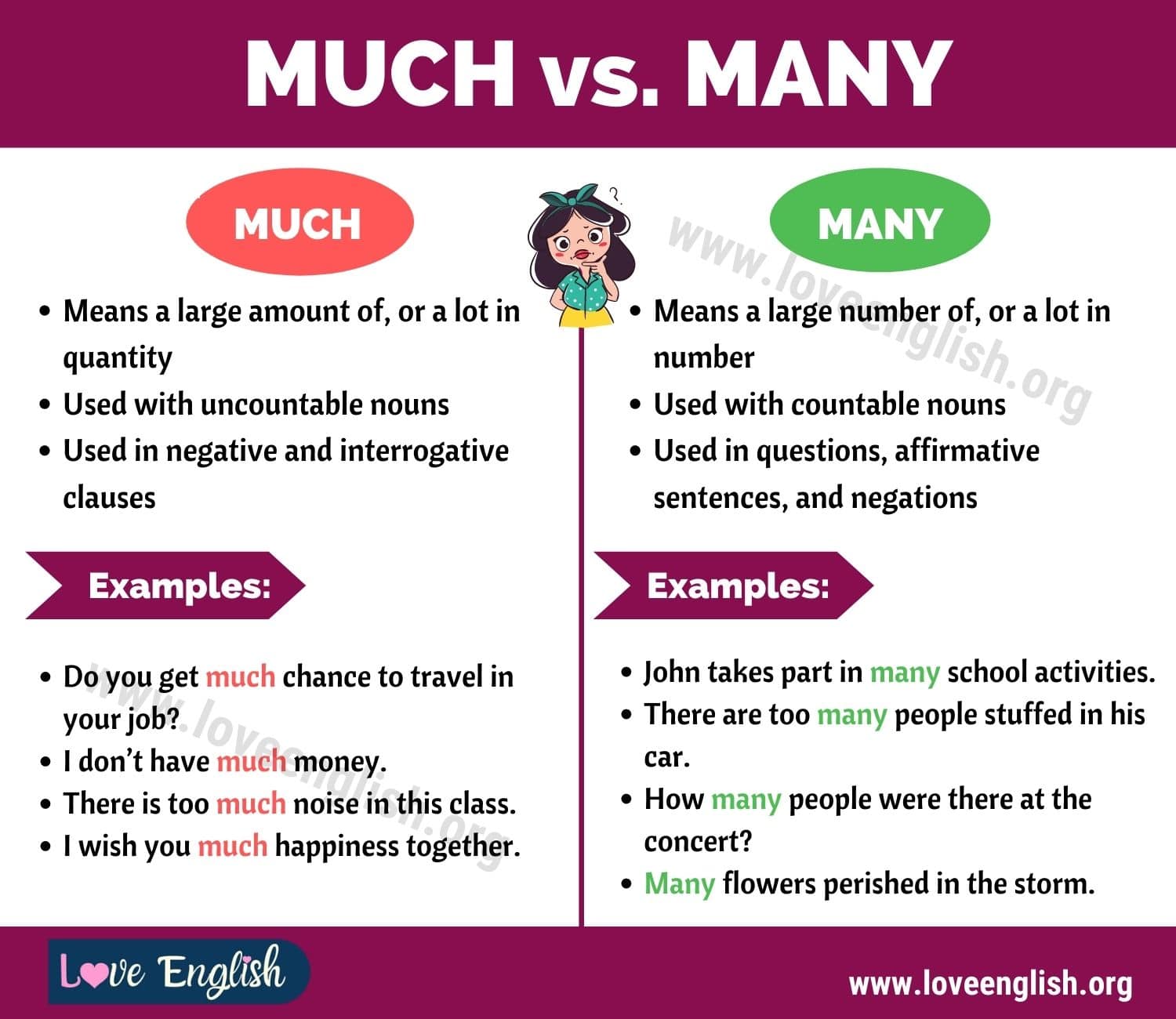

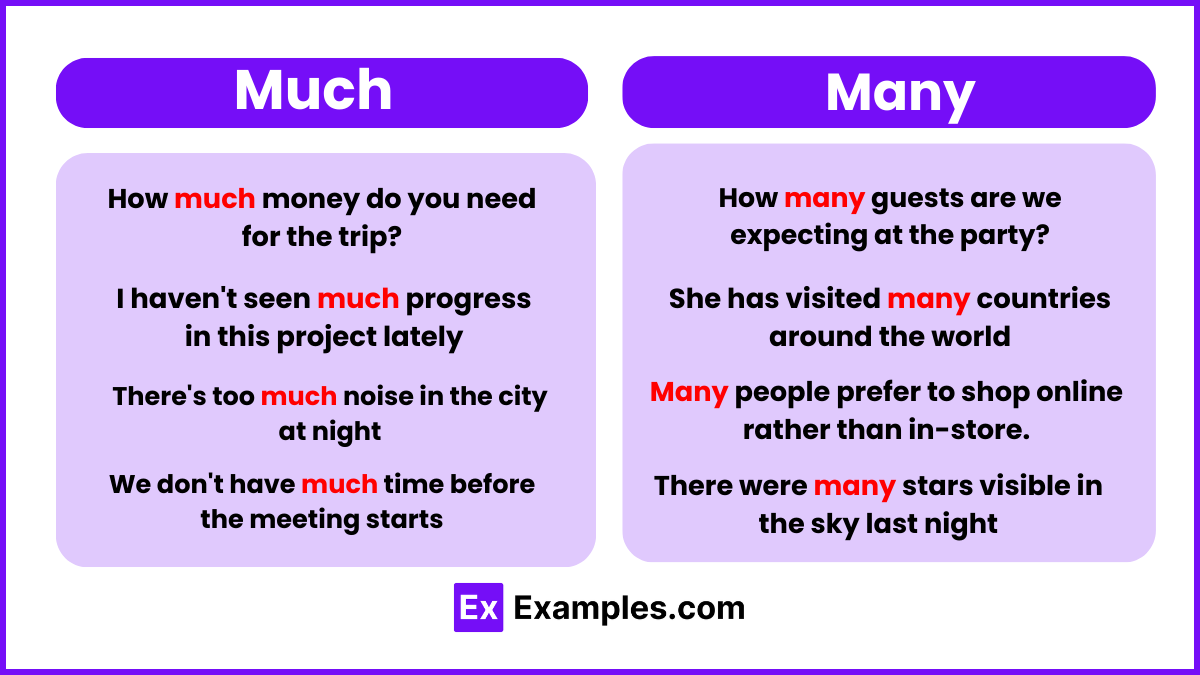

Much vs. Many: How to Use Many vs Much in Sentences - Love English

Much vs Many - Examples, Difference, Tricks, How to use