How Much Does H&R Block Charge For Filing Taxes? Getting Your Money's Worth

Tax season, it's almost here, can feel like a really big puzzle for many people. Figuring out what you owe or what you might get back, well, that can be a little stressful, too. Lots of folks, perhaps you, wonder about using a service like H&R Block to help them out. A really common question that pops up, you know, is about the cost. So, how much does H&R Block charge for filing taxes? It's a fair thing to ask, isn't it?

Knowing the fees up front can certainly help you plan your budget. It's not always a simple, one-size-fits-all price, which is why it can be a bit confusing. There are different ways to file, and each way, you might find, has its own price tag. We'll look at the various options they offer, from doing it yourself online to getting help from a tax pro, so you can pick what feels right for you.

This article will help you get a clearer picture of what to expect when it comes to H&R Block's tax filing services. We'll talk about the different factors that can change the price, like the kind of tax forms you need or how much help you want. You'll get some good ideas, perhaps, on how to figure out the best approach for your own tax situation this year, for the 2023 tax year, filed in 2024.

Table of Contents

- Understanding H&R Block Pricing: What Affects the Cost?

- H&R Block Online Filing: Options and Their Prices

- In-Person and Tax Pro Assisted Filing: How Much Help Do You Need?

- Extra Services That Might Add to Your Bill

- Smart Ways to Potentially Save Money on H&R Block Fees

- How H&R Block Compares to Other Ways to File

- Frequently Asked Questions About H&R Block Costs

- Making Your Choice for Tax Filing

Understanding H&R Block Pricing: What Affects the Cost?

When you're thinking about how much H&R Block charges for filing taxes, it's a bit like asking how much a car costs. There's a wide range, really, and it all depends on what you need. A big factor, you know, is the kind of tax situation you have. Someone with a very simple return, perhaps just a W-2 form, will pay a lot less than someone who owns a business or has rental properties, for example.

The method you pick for filing also plays a very big part. Do you want to do it all yourself online? Or would you prefer to sit down with a tax professional? Maybe you'd like a little help, but not full service. Each of these choices, you'll find, comes with a different price. It's pretty important, too, to remember that prices can change a bit from year to year, and sometimes even by location.

So, the more complicated your taxes are, or the more help you want, the more it will likely cost. This is a pretty common approach for tax preparation services, actually. It's about matching the service level to the complexity of your financial life, and that, in a way, makes a lot of sense.

H&R Block Online Filing: Options and Their Prices

H&R Block has several online options, and they're usually the most budget-friendly way to file your taxes with them. These options are really designed for people who feel comfortable doing most of the work themselves, with the software guiding them along. It's a pretty popular choice for many, you know, because of the convenience and, often, the lower price.

Free Online Filing: Is That Even a Thing?

Yes, it is! H&R Block, like some other tax software companies, offers a free online filing option. This is typically for very simple tax situations. If you just have W-2 income, claim the standard deduction, and don't have a lot of other tax credits or deductions, then this might be for you. It's a great option, you know, for many students or people with straightforward jobs.

This free version usually covers things like unemployment income and the Earned Income Tax Credit, too. But, you know, if you start adding things like itemized deductions, or certain education credits, or perhaps even a health savings account, then you'll likely need to upgrade to a paid version. So, it's free for the basics, but the moment your taxes get a little more involved, the cost can change.

Deluxe Online: For Those with More Than Just the Basics

The Deluxe online option is generally for people who have a bit more going on than just a W-2. This tier, you know, is often a good fit if you need to itemize deductions, perhaps because you own a home and pay mortgage interest, or you have a lot of medical expenses. It also often covers things like child and dependent care credits, which is pretty common for families.

The price for Deluxe online will be more than the free version, naturally. It gives you access to more forms and guidance for those slightly more complex situations. It's a good middle-ground choice, in a way, if your taxes aren't super simple but also not extremely complicated. This option, you know, tends to be a popular one for many middle-income households.

Premium Online: When You Have Investments or Rental Income

Moving up the ladder, the Premium online option is usually for folks with investments or rental properties. If you've sold stocks, have mutual funds, or perhaps own a rental home, this is probably the tier you'll need. It helps you handle things like Schedule D for capital gains and losses, and Schedule E for supplemental income and loss, which can be a bit tricky to get right on your own.

The cost for Premium online is higher than Deluxe, as you might expect. It's designed to give you the specific tools and forms for these more involved financial situations. If you're someone who actively manages investments, or if you're a landlord, this option, you know, could save you a lot of headaches, even with the added cost.

Self-Employed Online: For the Business Owners and Gig Workers

The Self-Employed online option is, quite clearly, for independent contractors, freelancers, small business owners, and anyone else who gets a 1099-NEC form. This is the most comprehensive online package, and it's also the most expensive. It helps you with all the specific deductions and credits that self-employed people can claim, like business expenses and home office deductions.

Filing as self-employed can be pretty complex, you know, because you have to report income and expenses, and also calculate self-employment taxes. This package is built to guide you through all of that, making sure you don't miss out on any potential savings. It's really important, too, to get this right if you're running your own show, and this option is basically set up for that.

In-Person and Tax Pro Assisted Filing: How Much Help Do You Need?

If you'd rather have someone else handle your taxes, or at least have a professional look them over, H&R Block offers various assisted services. These options typically cost more than the online self-prep versions, but they provide the peace of mind that comes with professional help. It's a different kind of value, in a way, for people who want that extra layer of assurance.

Drop-Off and In-Office Services

When you choose to visit an H&R Block office, you can either drop off your documents or sit down with a tax professional. The price for these services, you know, is usually based on the complexity of your tax return. A very simple return, just a W-2, will cost less than a return with multiple income sources, investments, or business expenses.

The benefit here is getting personalized advice and having an expert prepare your return. They can answer your specific questions and help you find deductions or credits you might have missed. It's a pretty hands-on approach, and for many people, the extra cost is worth the time saved and the confidence that their taxes are done correctly. This service, you know, is usually quoted after they look at your documents.

Tax Pro Review and Full Service

H&R Block also has options where you start your return online, and then a tax professional reviews it before you file. This "Tax Pro Review" is a popular choice for those who want to save a little money by doing some of the work themselves, but still want an expert's eyes on it. It's like a safety net, really, for your online efforts.

For those who want absolutely no fuss, the "Full Service" option means an H&R Block tax pro handles everything from start to finish. You just provide your documents, and they do the rest. This is generally the most expensive option, as it provides the highest level of assistance and expertise. It's basically a complete done-for-you service, which, you know, can be very appealing if you have a lot going on.

Extra Services That Might Add to Your Bill

Beyond the basic filing fees, there are often additional services that can increase your total cost at H&R Block. These are usually optional, but sometimes they can be quite helpful, depending on your situation. It's good to be aware of them, you know, so there are no surprises when you're ready to pay.

One common add-on is the "Refund Transfer" or "Refund Advance." A Refund Transfer lets you pay your tax preparation fees directly from your tax refund, so you don't have to pay anything out of pocket when you file. There's usually a fee for this convenience, though. A Refund Advance is a short-term loan based on your expected refund, and while the loan itself might be interest-free, there can be fees associated with setting it up or getting the funds quickly.

Another extra service is audit assistance or protection. For an additional fee, H&R Block might offer to represent you or provide support if your tax return is audited by the IRS. This can be a very valuable service, especially if you have a complex return or are worried about an audit. It's basically an insurance policy, in a way, for your tax filing.

State tax filings are also usually an additional charge. While the federal tax return price covers your main federal forms, you'll typically pay a separate fee for each state return you need to file. This is pretty standard across most tax software and preparers. So, if you live in one state and work in another, or have income from multiple states, those costs can add up a little.

Finally, some specific, very unusual forms or situations might incur an extra charge, even within a particular service tier. For instance, if you have foreign income, or very specialized business deductions, that might be a bit more. It's always a good idea, you know, to ask about any potential extra fees upfront, especially if your tax situation is a little out of the ordinary.

Smart Ways to Potentially Save Money on H&R Block Fees

Even though H&R Block charges for filing taxes, there are some clever ways you might be able to reduce your overall cost. It's worth looking into these options, you know, to make sure you're getting the best deal for your needs. Every little bit of savings can help, right?

First, consider using the online self-preparation options if your tax situation is simple enough. As we talked about, the free version is truly free for many basic returns. If you can manage your taxes with the Deluxe or Premium online software, you'll usually pay less than going into an office for a tax pro. It's a bit of a trade-off, really, between cost and convenience.

Look out for discounts and promotions. H&R Block, like many businesses, often runs special offers, especially early in tax season. You might find coupons, early bird discounts, or even special deals for new customers. Checking their website or signing up for their email list can help you catch these savings. Sometimes, you know, they'll have promotions for specific groups, like military personnel.

Another tip is to gather all your documents before you start. Whether you're using the online software or going to an office, having everything organized can save you time and, potentially, money. If you're paying for a tax professional's time, being prepared means they can work more efficiently, which could mean a lower bill. It's a simple step, actually, that can make a difference.

Also, think about whether you truly need every single add-on service. While audit protection or a refund advance can be useful, they do come with a cost. If you're confident in your return, or if you don't need your refund immediately, you might skip these extras. It's about weighing the benefits against the additional expense, you know, for your own peace of mind.

Finally, if you're comfortable, doing your own state taxes can save you a bit. The federal online software often guides you through the state portion, and if you feel capable, you can avoid the extra fee for professional state filing. It's a way, you know, to take a little more control over your tax preparation budget.

How H&R Block Compares to Other Ways to File

When you're trying to figure out how much H&R Block charges for filing taxes, it's natural to wonder how their prices stack up against other options. There are, you know, several different paths you can take for your tax preparation, and each has its own set of costs and benefits. It's not just about the price tag, but also about the service you get.

For example, you could use other online tax software providers. Companies like TurboTax, TaxAct, or FreeTaxUSA also offer various tiers of service, from free basic filing to comprehensive self-employed packages. Their pricing structures are often quite similar to H&R Block's online options, but it's always a good idea to compare the specific features and prices for your tax situation. Sometimes, you know, one might be a bit cheaper for your particular needs.

Another option is to hire a Certified Public Accountant (CPA) or an enrolled agent. These professionals usually charge a higher fee than H&R Block, especially for complex returns. However, they often provide more in-depth tax planning advice and can handle very intricate financial situations. If you have a business with many employees, or extremely high income, a CPA might be worth the extra cost. It's a more personalized service, basically, that comes with a premium price.

Then there's the truly free option: doing your taxes yourself with IRS Free File. If your adjusted gross income (AGI) is below a certain threshold, you might qualify to use free tax software provided through the IRS website. This is completely free, but it requires you to be comfortable navigating tax forms on your own, with software guidance. It's a great choice, you know, if you meet the income requirements and feel confident in your abilities.

So, H&R Block sits somewhere in the middle. Their online options are competitive with other major software providers, and their in-person services offer a balance between professional assistance and a generally lower cost than a full-service CPA firm. It's about finding that sweet spot that fits your comfort level, your tax complexity, and your budget, too.

Frequently Asked Questions About H&R Block Costs

Is H&R Block free for simple taxes?

Yes, for very simple tax situations, H&R Block does offer a free online filing option. This usually covers W-2 income, standard deductions, and common credits like the Earned Income Tax Credit. If your tax situation is a bit more involved, you'll likely need to use one of their paid online versions or an assisted service. It's free for the very basics, you know, which is pretty good for many people.

How much does H&R Block charge for a W2?

If you only have W-2 income and qualify for their simple tax situation, filing with H&R Block online can be free. However, if you have other forms or deductions that push you into a higher tier, or if you choose an in-person service, the cost will increase. A W-2 alone doesn't mean it's always free, you know, as other factors come into play.

Does H&R Block charge per form?

H&R Block generally charges based on the complexity of your tax situation, which is often tied to the types of forms you need to file, rather than a strict per-form fee. For example, their Premium online tier includes all the forms for investments and rental income. While the number of forms affects which tier you need, they don't usually charge a separate fee for each individual form within that tier. It's more about the package, you know, than individual pieces of paper.

Making Your Choice for Tax Filing

Deciding how much H&R Block charges for filing taxes, and whether it's the right fit for you, really comes down to a few key things. Think about how comfortable you feel doing your own taxes. Are you someone who enjoys figuring out forms, or do you prefer to hand it all over to a professional? Your comfort level, you know, is a big part of this decision.

Also, consider the complexity of your financial life. If you have a straightforward job and no investments, a free or low-cost online option might be perfect. But if you own a business, have lots of different income streams, or complex deductions, investing in a higher-tier online product or even a tax pro could save you headaches and, potentially, money in the long run. It's about matching the service to your needs, really.

No matter what you choose, remember that getting your taxes done accurately is the most important thing. Whether you pick an online self-prep option or get help from a tax pro, make sure you feel confident in your return. You can learn more about tax filing options on our site, and if you want to explore more about assisted services, you might find more details on H&R Block's official website. It's all about making the best choice for you this tax season, you know, for your peace of mind.

Much (canal de televisión) - Wikipedia, la enciclopedia libre

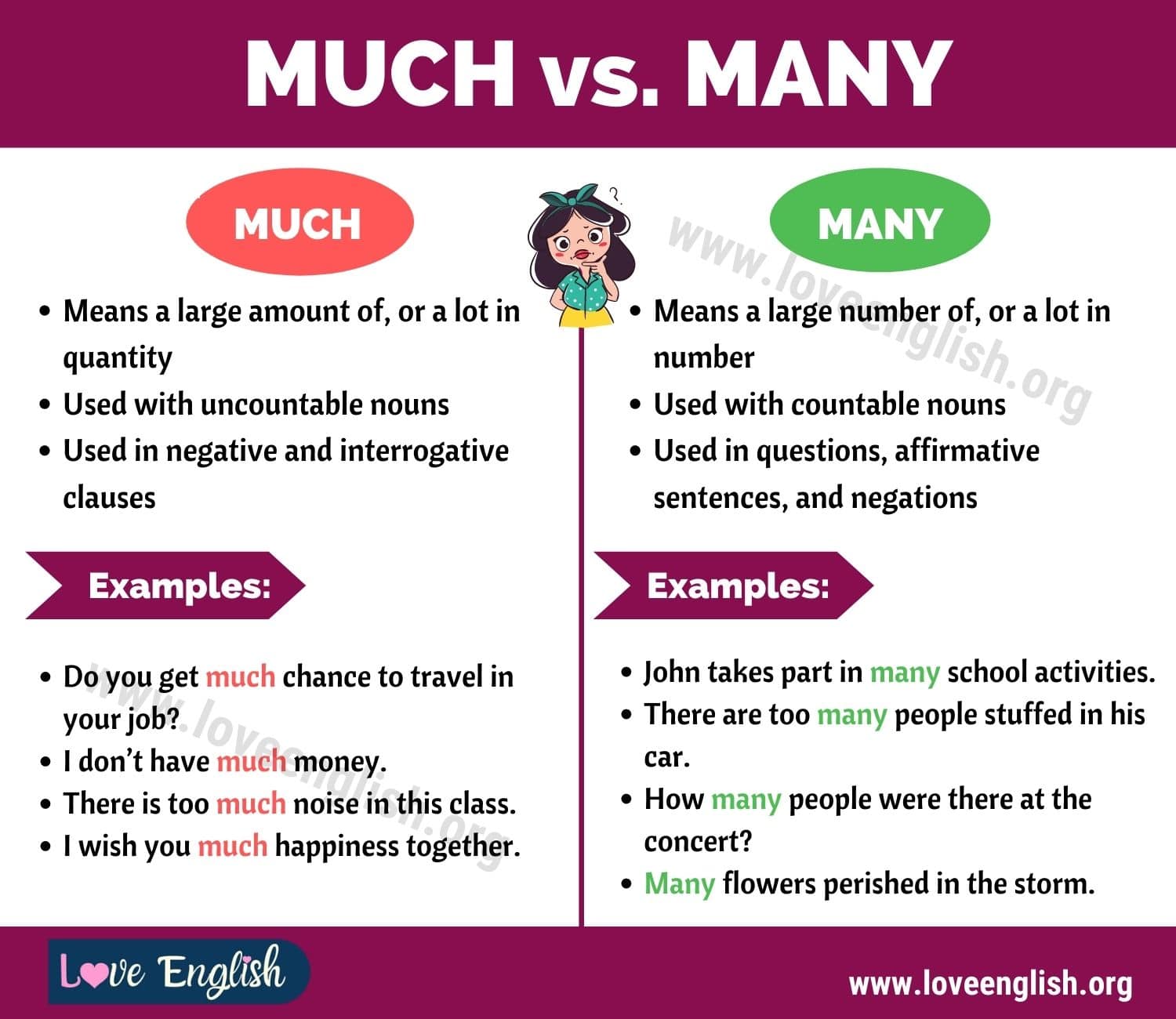

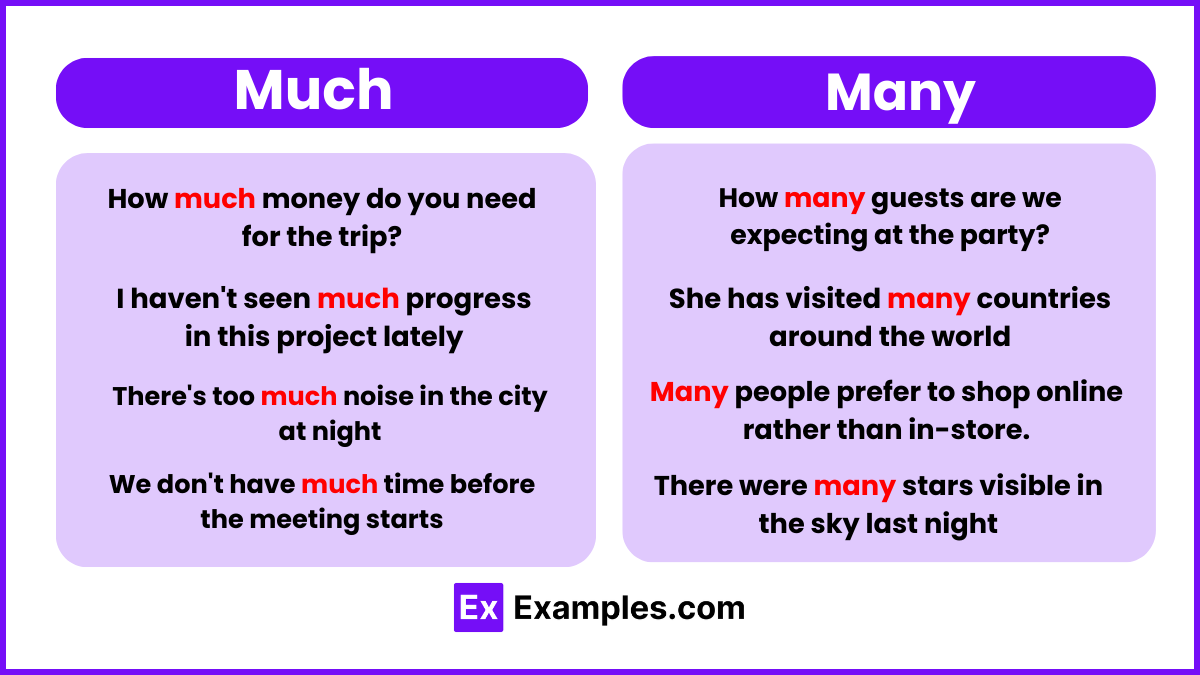

Much vs. Many: How to Use Many vs Much in Sentences - Love English

Much vs Many - Examples, Difference, Tricks, How to use