How Much Does H&R Block Charge To Do Taxes? Your 2024 Guide To Costs

Tax season, so it's almost here again, and for many, that brings a wave of questions. One of the biggest, quite naturally, is about the cost of getting your taxes done. If you're considering H&R Block, a household name in tax preparation, you're probably wondering, "how much does H&R Block charge to do taxes?" It's a very common question, and getting a clear picture of their fees can help you make a smart choice for your money matters.

Understanding the price structure for tax services can feel a little bit like trying to figure out a puzzle, can't it? There are different options, various service levels, and sometimes, even where you live can play a part in the final bill. We're here to help you sort through it all, giving you a good idea of what you might expect to pay when you turn to H&R Block for your tax needs this year.

We'll explore the various ways H&R Block helps people with their taxes, from doing it yourself online to getting personal help from a tax pro. Knowing the differences and what each service includes is pretty important for figuring out your potential costs. So, let's get into the details of what you could pay to get your taxes squared away.

Table of Contents

- Understanding H&R Block's Pricing: What to Expect

- Breaking Down the Costs: Online vs. In-Person

- Getting the Best Value from H&R Block

- Common Questions About H&R Block Fees (FAQs)

Understanding H&R Block's Pricing: What to Expect

When you're trying to figure out how much H&R Block charges, it's really about understanding the different ways they offer their help. They have a few distinct service types, and each one comes with its own price tag, naturally. The "much" in "how much" refers to the amount, the quantity of money you'll need to pay, and that amount can vary quite a bit based on your choice.

Online Tax Filing Options

For those who like to manage things themselves, H&R Block offers online tax preparation software. This is pretty much a do-it-yourself approach, though you get the benefit of their software guiding you. There are usually different levels of online products, each designed for different tax situations. A very simple tax return, for example, might cost you less than one with investments or self-employment income.

With online options, you'll typically pay a fee at the time you finish your transaction in the product, that is, when you're ready to file. This can be a very convenient way to handle things if you feel comfortable with a bit of independence in your tax preparation. It's often seen as a more budget-friendly choice compared to sitting down with a tax pro.

In-Person Tax Help

Then there's the option to visit an H&R Block office and have a tax professional prepare your return for you. This is where you hand over your documents, discuss your situation, and they do the heavy lifting. This service, as you might guess, tends to come with a higher price tag than the online self-service options, since you're paying for a person's time and specialized knowledge.

The cost for in-person help can depend on a few things. The complexity of your tax situation is a big one, but also, the specific office you go to might have slightly different pricing, as it could be location biased. In some areas, like the NY metro area, H&R Block is apparently cheaper than small accounting firms, which is something to consider.

The "Much" Behind the Cost: What Influences Your Fee?

So, what makes the "much" in your H&R Block bill go up or down? There are several key factors that influence the final price, whether you're using their online tools or getting help from a person. Understanding these can help you anticipate your expenses.

- The Complexity of Your Tax Return: This is probably the biggest factor. A very simple return, perhaps just W-2 income and the standard deduction, will cost a lot less than a return with multiple income sources, itemized deductions, business expenses, rental properties, or investments. The more forms and schedules needed, the higher the fee typically gets.

- Service Level Chosen: As we talked about, online self-preparation is generally the least expensive. Online help with a tax pro, or full-service in-person preparation, will cost more because you're paying for direct expert assistance.

- Add-on Services: H&R Block offers various additional services, like audit assistance, tax identity shield, or help with state tax returns. Each of these can add to your overall cost.

- Location: While H&R Block aims for consistent pricing, fees for in-person services can sometimes vary a little bit by geographical location, like in different cities or states.

- Promotions and Discounts: Sometimes, H&R Block offers special deals, especially early in tax season. Taking advantage of these can, naturally, lower your final bill.

Breaking Down the Costs: Online vs. In-Person

To really get a grip on how much H&R Block charges, let's look more closely at the typical price ranges for their online and in-person services. It's pretty helpful to see the general tiers, even though exact prices can shift.

H&R Block Online: A Closer Look at Plans

H&R Block's online offerings usually come in a few different packages, each designed for a particular level of tax situation. These are often named something like "Free," "Deluxe," "Premium," or "Self-Employed."

- Free Edition: This is typically for very simple returns, often just W-2 income and the standard deduction. It might be suitable for students or those with straightforward finances. As the name suggests, it could cost you nothing for federal filing, though state filing might have a small fee.

- Deluxe Edition: This step up is usually for those with itemized deductions, like mortgage interest or charitable contributions, or perhaps those with Health Savings Accounts (HSAs). This plan has a modest fee, which is a bit more than the free option, but less than the higher tiers.

- Premium Edition: If you have investments, rental property income, or other more complex scenarios, the Premium edition is generally what you'd need. This plan comes with a higher price tag than Deluxe, as it handles more forms and calculations.

- Self-Employed Edition: For freelancers, independent contractors, or small business owners, this is the top-tier online product. It's designed to handle all the specific deductions and income reporting for self-employment. This is naturally the most expensive online option, given the added complexity it covers.

It's worth noting that these online prices are generally for the federal return, and there's often an additional fee for each state return you need to file. This is a common practice across most online tax software providers, too.

In-Person Services: When a Human Touch Costs More

When you choose to have a tax pro at an H&R Block office prepare your taxes, the pricing model is different. Instead of fixed software packages, the cost is based on the forms required and the time involved. This is where the "much" can really vary.

For a very simple return, like a single W-2 and no deductions beyond the standard, you might pay a base fee that's quite reasonable. However, as soon as you add things like:

- Multiple W-2s or other income statements (1099s, etc.)

- Itemized deductions (Schedule A)

- Business income and expenses (Schedule C)

- Rental property income (Schedule E)

- Investment income (Schedule D, K-1)

- Education credits or deductions

- Child tax credits or other family-related credits

...each of these items, naturally, adds to the overall cost. A tax professional needs to input this information, ensure accuracy, and apply the correct tax laws. This takes more time and expertise, and that's reflected in the price. A large amount or to a large degree of complexity means a larger amount of cost, so to speak.

While H&R Block does not typically publish a standard price list for in-person services, you can generally expect a simple return to start somewhere in the low to mid-hundreds of dollars. Returns with business income or extensive investments could easily go into the several hundreds, or even more, depending on just how much detail is involved. It's always a good idea to ask for an estimate upfront when you visit an office.

Getting the Best Value from H&R Block

No matter which H&R Block service you choose, there are ways to try and get the most for your money. It's pretty smart to be a bit proactive about finding good deals and comparing your options, too.

Finding Discounts and Deals

H&R Block often has promotions, especially at the start of the tax season. Keep an eye out for these. They might offer discounts for early filers, special rates for new clients, or bundles that include state filing at a reduced price. Checking their website directly or looking for coupons before you start is always a good plan.

Sometimes, if you're a returning client, they might have specific offers for you. It's worth asking about any current promotions when you contact them or visit an office. You might be surprised at what you find, which could save you a bit of cash.

Comparing H&R Block to Other Options

Before you commit, it's a good idea to compare H&R Block's pricing with other options out there. This includes other online tax software providers, local independent tax preparers, or even certified public accountants (CPAs). While H&R Block is a very well-known name, its cost-effectiveness can vary depending on your specific situation.

For a very simple return, a free online option might be all you need. For very complex situations, a local CPA might offer more personalized advice, though potentially at a higher cost. H&R Block often sits somewhere in the middle, providing a good balance of professional help and generally competitive pricing, especially for straightforward or moderately complex returns. In the NY metro area, they are apparently cheaper than small firms, which is a definite plus for some.

Consider what "much" means to you in terms of value. Is it simply the lowest price, or is it getting peace of mind, expert advice, or a user-friendly experience? Weighing these factors can help you decide if H&R Block's charges align with what you're looking for.

Common Questions About H&R Block Fees (FAQs)

How much does H&R Block charge for a simple tax return?

For a very simple tax return, typically just W-2 income and the standard deduction, H&R Block often has a "Free" online edition for federal filing. If you opt for in-person help, the cost will be higher, but still on the lower end of their service fees, usually starting in the low to mid-hundreds of dollars, depending on location and any state filings needed.

Is H&R Block expensive to do taxes?

Whether H&R Block is considered "expensive" really depends on your specific tax situation and what you compare it to. For very complex returns, their in-person services can add up, but they are often more affordable than a full-service CPA firm. For simple returns, their online options are quite competitive, with a free tier available. So, it's not universally expensive, but the cost definitely goes up with the complexity of your taxes.

What is the average cost of H&R Block for tax preparation?

It's pretty hard to give one "average" cost because of how much it varies by service type and tax complexity. Online self-preparation can range from free to over $100 for federal and state. In-person services can start around $100-$200 for simple returns and go up to several hundred dollars, or even more, for very detailed or business-related filings. The average would really depend on the mix of services people choose.

For more general information on tax preparation costs, you might find it useful to check out a resource like the National Society of Accountants' annual fee survey, which gives a broader look at tax preparation fees across the industry. You can often find such surveys online.

Learn more about tax preparation options on our site, and link to this page for more details on understanding your tax obligations.

Much (canal de televisión) - Wikipedia, la enciclopedia libre

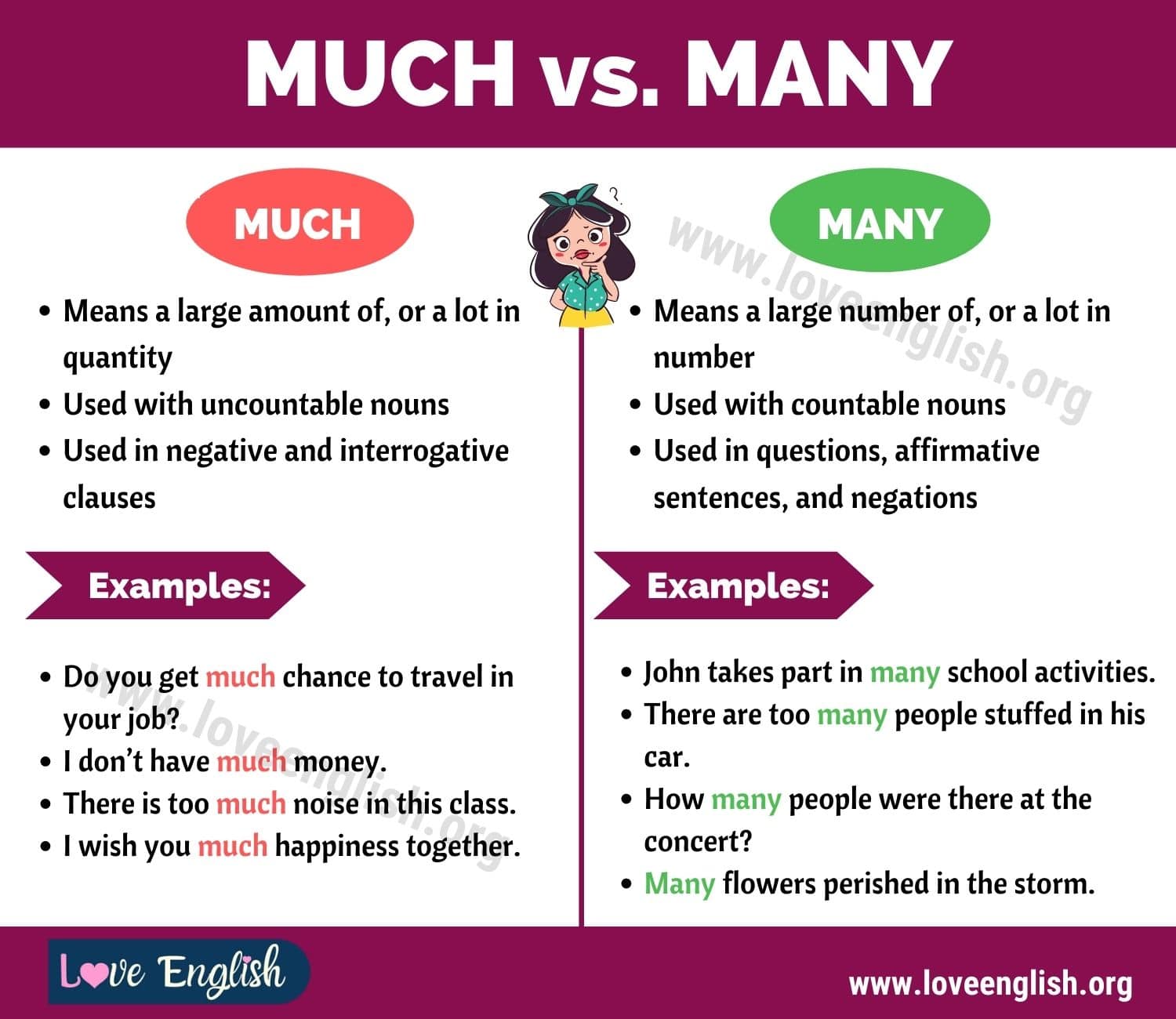

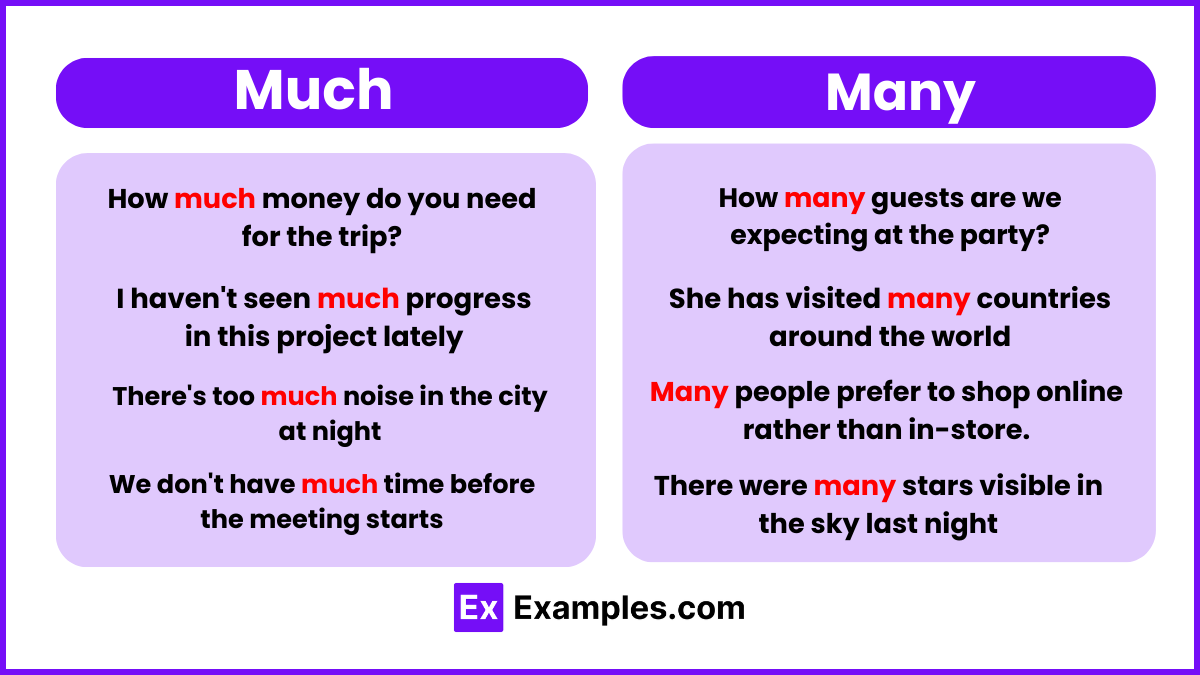

Much vs. Many: How to Use Many vs Much in Sentences - Love English

Much vs Many - Examples, Difference, Tricks, How to use