H&R Block Tax Prep: How Much Does H&R Block Cost To Do Your Taxes?

Filing taxes can feel like a real puzzle, a bit overwhelming, and it certainly takes up a lot of time for many folks in America each year. It's a task that, you know, just seems to loom large, causing a good deal of stress for some. You might find yourself staring at forms, wondering where to even begin, and thinking about all the hours it could take away from other things you'd rather be doing. So, it's pretty natural to look for ways to make this yearly chore a little less painful, isn't it?

That's where a name like H&R Block often comes into the picture. They offer a wide array of tax preparation services, and they really bring a lot of knowledge to the table, all with the goal of making the whole tax process simpler. They've been around for a long time, so they're, like, a household name in tax preparation, which gives many people a sense of trust and reliability. They aim to help you get through it all with less fuss, whether your tax situation is straightforward or a bit more involved.

But, you know, a big question that often pops up when you're thinking about using a service like this is, "How much does using H&R Block actually cost?" It's a fair point, because while simplifying things sounds great, nobody wants a surprise bill at the end. So, figuring out the potential expenses upfront is, like, a pretty smart move before you jump in.

Table of Contents

- Understanding H&R Block Tax Costs

- Why Do H&R Block Prices Change?

- Is There a Free Option?

- Making the Switch or Choosing H&R Block

- Frequently Asked Questions About H&R Block Costs

- Your Next Steps in Tax Prep

Understanding H&R Block Tax Costs

When you're trying to figure out how much H&R Block charges to get your taxes done, it's not always just one set number, you know? The cost of H&R Block tax preparation really depends a lot on a few different things. It's not a one-size-fits-all kind of deal, which is something you should keep in mind. So, like, the final amount can swing quite a bit depending on your personal financial story and how you choose to get your taxes completed.

Factors That Shape Your Bill

There are, actually, several key things that play a big role in what you'll end up paying for H&R Block's services. First off, your financial situation is a major piece of the puzzle. If your tax return is pretty simple, maybe just a W-2 and no special deductions, your cost will likely be on the lower side. However, if you have, say, investments, a small business, rental properties, or other more complex income sources, then your tax return becomes more involved, and that typically means a higher fee. It's just how it tends to be with these things, you know?

Another thing that really matters is your geographical location. Prices for tax preparation can, in fact, vary from one place to another, even within the same state. This is due to different operating costs for offices, local market conditions, and other regional factors. So, what someone in one city pays might be slightly different from what someone in another city pays, even for the exact same service. It's a bit like how the price of, say, groceries changes depending on where you live, isn't it?

And then, probably the biggest factor in determining your cost is whether you're using their online software to do your taxes yourself, or if you're getting help from a tax professional at one of their local offices. Doing your taxes yourself online will save you money in most instances, which is a pretty common pattern across tax services. Opting for a professional's direct help usually comes with a higher price tag because you're paying for their time and specialized knowledge.

Online Filing Options and Their Prices

H&R Block offers an easy way to file taxes online, and they have different options based on how complicated your tax situation is. This means they have various price points for their online tax preparation and filing software. For example, some folks might even qualify for a completely free option, which is pretty great for simple returns. It's almost like they have a tier for everyone, you know?

As of, say, February 2023, when people were typically filing their 2022 tax returns, prices for H&R Block's basic tax software started as low as $19.95. That's a pretty accessible starting point for many. But, if your return gets a little more involved, the cost goes up. Their online tax prep and filing software can cost $0, $29.99, $49.99, or even $84.99, depending on just how complex your tax return turns out to be. So, it's not just one price, but a range that matches the level of service you need.

In some respects, these different package options are designed to meet various needs. A basic package might cover simple W-2 income, while higher-priced packages would handle things like itemized deductions, investments, or self-employment income. So, you're basically paying for the features and support that fit your specific tax picture. We've, like, taken a look at all of these package options in our H&R Block tax software review to help people understand the pros and cons of using it to file their taxes.

The DIY Advantage and Discounts

Doing your taxes yourself using H&R Block's online tools can, in fact, lead to some nice savings. For example, H&R Block allows its clients to complete their own taxes online, and they often offer a pretty significant discount for doing so. They've, like, been known to give a 35% discount for those who choose the self-prepared online route. That's a substantial chunk of change that stays in your pocket, which is pretty appealing, isn't it?

This self-service option means you're inputting all your information yourself, but you're still using their guided software, which helps catch errors and ensures you're putting things in the right place. It's a good middle ground for people who want to save money but still want the structure and reliability of a well-known tax service. It's, you know, a way to get some professional-grade tools without the full professional price.

In-Person Help and Upgrades

Sometimes, you might start doing your taxes online, but then realize you need a little more help, or perhaps your tax situation turns out to be more complicated than you first thought. H&R Block understands this, and they make it fairly easy to get additional support. If you need to upgrade based on your tax situation, maybe to get help from a tax pro, you might pay an additional fee. For instance, you could pay $35 to upgrade to a different service tier or to get some professional assistance, which is a fairly common kind of charge.

H&R Block has locations in all 50 states, so they can service a wide range of people who prefer face-to-face help or who have more complex tax needs that really call for a professional's eye. The cost for in-person tax preparation with a tax professional at a local office will generally be higher than using the online software. This is because you're paying for the expertise, experience, and direct time of a trained professional, which, you know, adds a lot of value for many people.

These in-office services are often chosen by people who have very intricate financial lives, or who simply prefer the peace of mind that comes from having a person review their documents and answer specific questions. It's a different level of service, and the pricing reflects that, naturally.

Why Do H&R Block Prices Change?

You might wonder why H&R Block costs what it does, or why the prices can seem to vary so much. Well, H&R Block costs a lot for a variety of reasons, and it's not just about what they charge you. A big part of it comes down to their own business expenses, you know? They have to pay for office spaces, technology, training for their tax professionals, advertising, and all the other things that go into running a large company with locations everywhere. These operational costs are built into the prices they set for their services.

Also, special tax situations can really drive up the cost. If your tax return requires a lot more time, research, or specialized knowledge from a tax professional, then it's only fair that the price would be higher. For instance, if you have multiple businesses, foreign income, or very specific investment types, your tax preparer will need to spend more time ensuring everything is correct and that you're getting all the deductions you're due. You should consider what your taxes actually involve before you pick a service, you know?

The level of support you want also plays a part. If you just want to use the software and handle everything yourself, that's one price. But if you want the option to call a tax professional for help, or have someone review your return before you file, those added layers of support typically come with a higher price tag. It's about how much hand-holding you need, in a way.

Is There a Free Option?

Yes, it's pretty common for people to look for free ways to file their taxes, especially if their situation is simple. While, say, you can file a simple tax return for free with TurboTax, H&R Block also offers ways for more filers to qualify for free tax filing with their Block platform. This is a pretty big deal for many people who just have, like, a basic W-2 income and maybe the standard deduction.

The free options are usually for very straightforward tax returns, perhaps those without dependents, without itemized deductions, or without complex investments. It's a good starting point for many individuals, and it helps make tax filing accessible. So, it's worth checking if your situation fits their free criteria, because, you know, saving money is always a good thing.

Making the Switch or Choosing H&R Block

If you've been using another tax service, like TurboTax, and you're thinking about trying H&R Block, you might be wondering how easy it is to make that change. Well, switching from TurboTax to H&R Block is, actually, fairly easy. Both companies understand that people move between platforms, so they've usually made the process quite smooth for importing prior year data or simply starting fresh. This means you don't have to feel locked into one service if you think another might be a better fit for your needs or your budget.

Before you start with H&R Block, especially if you're looking ahead to tax season, say, in 2025, it's a good idea to know how much H&R Block tax prep will cost. You can often find guides, like those from Groupon coupons, that give you an idea of their features, pricing, and ease of use. This kind of research helps you find out if H&R Block is the right tax service for you, and whether its features and cost align with what you're looking for. It's about being informed, basically.

Ultimately, the decision comes down to your comfort level with doing things yourself, the complexity of your financial life, and how much you're willing to spend for convenience and professional help. H&R Block offers a wide range of options, from completely DIY online filing to full-service professional assistance, so there's usually something for everyone. You can learn more about tax preparation on our site, and even check out our detailed review of H&R Block's online services to get a better sense of what they offer.

Frequently Asked Questions About H&R Block Costs

People often have specific questions when they're thinking about H&R Block's prices. Here are a few common ones that might be on your mind too.

Is H&R Block more expensive than doing taxes yourself?

In most cases, yes, doing your taxes yourself will save you money. For example, H&R Block allows its clients to complete their own taxes online and offers a 35% discount for doing so. When you pay for H&R Block, especially for in-person help, you're paying for the convenience, the software, and the expertise of their tax professionals. So, if your main goal is to save money, doing it yourself online is usually the cheapest route, which is, you know, pretty straightforward.

Can I get a free tax filing with H&R Block?

Yes, you might be able to file a simple tax return for free with H&R Block. They do offer options for free filing, usually for very basic tax situations, like those with just W-2 income and standard deductions. It's worth checking their website or starting the online filing process to see if your specific tax situation qualifies for their free tier. This is a pretty common offering from tax software companies, actually.

What makes H&R Block's costs go up?

The cost of H&R Block tax preparation greatly depends on your financial situation, your geographical location, and whether you're using their software or a tax professional at a local office. If your tax return is more complex, involving things like investments, self-employment, or rental properties, the cost will typically be higher. Also, choosing to have a tax professional prepare or review your return will generally cost more than doing it yourself with their online software. So, complexity and the level of help you want are big factors, you know?

Your Next Steps in Tax Prep

Figuring out your taxes doesn't have to be a total headache, and H&R Block really does offer a lot of ways to make it simpler, as we've seen. The key is to understand that the cost isn't fixed; it changes based on what you need and how you choose to file. You can definitely save some money by doing your taxes online yourself, especially with that 35% discount they sometimes offer. But, if your situation is a bit more involved, or you just prefer the peace of mind of having a pro look things over, their in-person services are there for you, even if they cost a bit more.

So, before you jump in, it's a good idea to think about your own tax situation. Do you have a simple W-2, or are there, like, multiple income streams and deductions? Knowing this will help you pick the right H&R Block service tier for you. You can always visit their official website to get the most current pricing for your area and your specific needs, or check out independent reviews to compare features and ease of use. This way, you can make a choice that feels right for your budget and your comfort level, which is pretty important, you know?

Much (canal de televisión) - Wikipedia, la enciclopedia libre

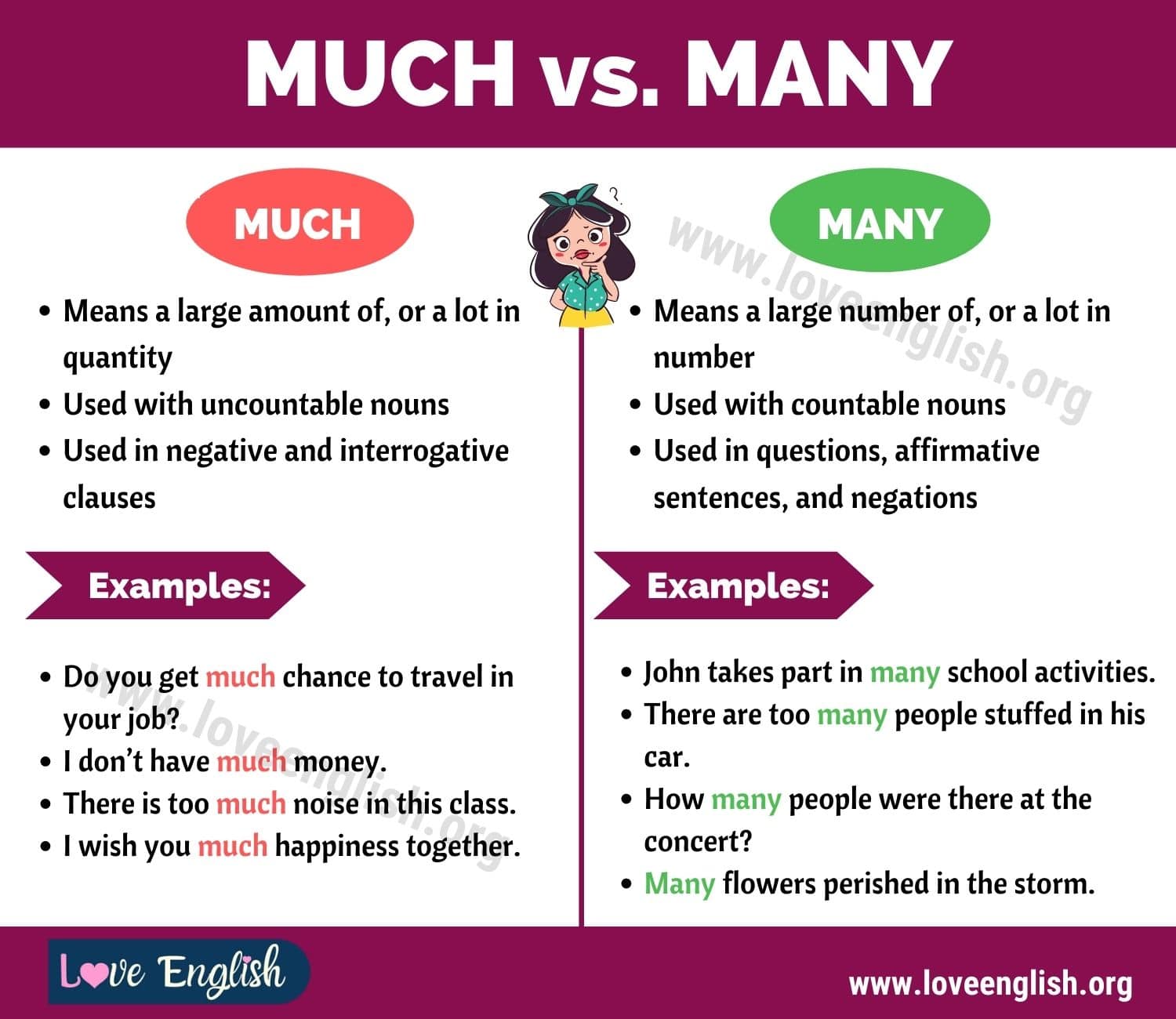

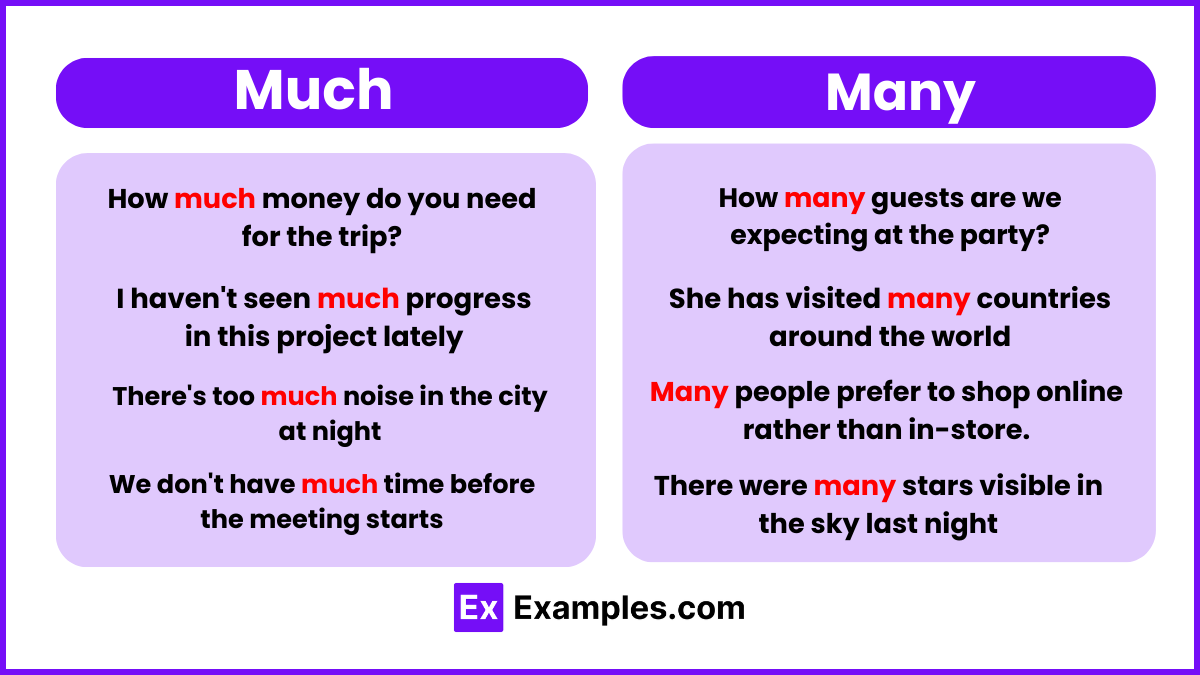

Much vs. Many: How to Use Many vs Much in Sentences - Love English

Much vs Many - Examples, Difference, Tricks, How to use