How Much Does H&R Block Cost? Your Guide To Tax Prep Prices

Figuring out your taxes can feel like a big puzzle, and a lot of folks wonder about the price tag for getting some help. When it comes to tax preparation services, a name that pops up very often is H&R Block. Knowing how much you might pay for their assistance is a really smart move, especially before tax season gets into full swing. It helps you budget, and it helps you pick the right kind of support for your personal situation, too it's almost a must-do for many people.

There's a good deal of variety when we talk about what H&R Block charges. The exact amount you end up paying can change quite a bit based on what kind of tax situation you have. For some, it might be a simple return, while others have a more involved financial picture, perhaps with a business or investments. This means the cost isn't just one set number for everyone, which can be a bit confusing at first glance, you know?

This guide is here to help clear up that confusion and give you a better idea of how much H&R Block costs. We'll look at the different ways they offer help, what makes the prices change, and some ways you might be able to save a little money along the way. Our aim is to give you a clearer picture so you can decide what's best for you and your wallet, basically, that's the whole point.

Table of Contents

- Understanding Your Tax Prep Needs

- H&R Block Service Options and Their Costs

- What Makes the Price Change?

- How to Potentially Save on H&R Block Fees

- People Also Ask About H&R Block Costs

- Conclusion

Understanding Your Tax Prep Needs

Before you even think about how much H&R Block costs, it's a good idea to think about what kind of tax help you actually need. Are your taxes pretty straightforward, perhaps just a W-2 and no deductions? Or do you have things like freelance income, rental properties, or investments that make things a bit more involved? Your personal situation has a very big say in the price, you see.

Many folks just need to report their wages and maybe a few simple credits. Others might have a lot of different forms and situations, which means more work for the person or software doing the taxes. Knowing this beforehand can help you pick the right service level and avoid paying for more help than you actually require, that's a key step.

Consider how comfortable you feel doing things yourself, too. Some people like to be very hands-on with their taxes, while others prefer to have someone else handle all the details. Your comfort level and the actual complexity of your financial life will guide you to the right choice, and in turn, the right price point, in a way, it all connects.

H&R Block Service Options and Their Costs

H&R Block gives you a few different ways to get your taxes done, and each one comes with its own price tag. It's not just a single service, but rather a selection of choices that fit different needs and budgets. This variety means you can often find something that works for you, you know?

Online Tax Filing Options

For those who like to do things from home, H&R Block offers online filing. This is often a good pick for people with simpler tax situations. There are usually different tiers, or levels, of service available, each with a different set of features and a different cost, so it's worth checking them out.

The free option is generally for very basic returns, like those with just W-2 income and standard deductions. If you have a bit more going on, like student loan interest or itemized deductions, you might need to step up to a paid tier. Self-employed individuals or those with rental income will typically need a higher-priced online package, you know, because of the extra forms and calculations involved.

The cost for these online services can change from year to year, and they often have special deals early in the tax season. It's always a good idea to check their website for the most up-to-date prices for the current tax year. They are pretty clear about what each online package includes, so you can compare easily, basically.

In-Person Tax Preparation

If you prefer to sit down with a tax professional, H&R Block has offices where you can get help face-to-face. This option is great for people who have complicated tax situations or who just feel more comfortable having an expert guide them through the process. It's a very popular choice for many, actually.

The cost for in-person help can vary quite a bit, as it depends on how much work your tax return requires. A simple return will naturally cost less than one that involves many different income sources, deductions, or credits. The fee is usually based on the forms needed and the time the tax pro spends on your return, you know, it's about the effort involved.

Some people find the peace of mind that comes with in-person help to be very valuable, making the cost worthwhile. You can ask questions directly, and the professional can often spot deductions or credits you might have missed. It's a personalized service, and that often means a higher price point compared to doing it yourself online, but for many, it's worth every penny, apparently.

Tax Software for Download

Another choice is to buy H&R Block's tax software, which you can install on your computer. This is a bit like doing it yourself online, but you own the software, and it might offer a few more features or different ways of working. It's a good middle ground for those who want control but also some guidance, in a way.

Just like the online options, the software usually comes in different versions, from basic to premium, each designed for different tax complexities. The price for the software is a one-time purchase, and it allows you to prepare and file your taxes. You might still pay a small fee for e-filing your state return, even if the federal return is included, you know, that's a common thing.

This option can be a good value if you're comfortable with computers and want to manage your tax preparation process yourself, but still want the structured help the software provides. It guides you step-by-step, helping you enter your information correctly. It's a pretty user-friendly approach for many, I mean, it's designed to be.

What Makes the Price Change?

Several things can make the final price of your H&R Block service go up or down. It's not just about picking a service type; there are other elements at play. Understanding these can help you anticipate how much you might pay, which is rather helpful.

First off, the complexity of your tax return is a huge factor. A simple W-2 income, with the standard deduction, will cost a good deal less than a return with business income, capital gains, or multiple state filings. Each extra form or schedule often adds to the total cost, you know, it's like adding extra ingredients to a recipe.

State tax returns are another consideration. While federal filing might be included in some packages, many services charge an additional fee for preparing and filing your state taxes. If you live in a state with income tax, this will be an extra cost you need to consider, that's just how it is.

Add-on services can also increase the price. Things like audit protection, which gives you support if the IRS questions your return, or help with past-due taxes, will come with their own separate charges. While these can be very useful, they do add to the overall bill, so you need to decide if you need them, basically.

Promotions and discounts can also affect the price. H&R Block often runs specials, especially early in the tax season, or for new customers. Keeping an eye out for these deals can save you some money. Sometimes, there are discounts for students or military personnel, too it's almost worth asking about.

Finally, the specific tax professional you work with for in-person services might have a slight impact, though H&R Block generally has standardized pricing. However, the amount of time they spend and the particular forms they need to complete for your unique situation will directly influence the fee, you know, it's all about the work involved.

How to Potentially Save on H&R Block Fees

Even if you decide to use H&R Block, there are ways you might be able to reduce how much you pay. A little planning and awareness can go a long way in keeping your tax preparation costs down. It's about being smart with your choices, really.

One good way to save is to get your documents organized before you start. Having all your W-2s, 1099s, receipts for deductions, and other relevant papers ready means less time for a tax professional to sort through things, which could mean a lower bill for in-person services. For online or software use, it just makes the process quicker and less frustrating, too it's almost a no-brainer.

Consider using the free online options if your tax situation is simple. If you only have W-2 income and plan to take the standard deduction, H&R Block's free online service might be all you need. Don't pay for features you won't use; that's just throwing money away, you know?

Look for early bird discounts or promotions. As mentioned, H&R Block often has special offers, especially at the beginning of tax season. Filing early or keeping an eye on their website for coupons or deals can save you a good deal of money. These promotions can sometimes make a big difference in the final cost, you know, they really can.

If you're using their online services, be careful about upgrading to higher tiers unless you truly need the features. Sometimes, people pick a more expensive option just in case, when a lower-priced one would have been perfectly fine for their needs. Understand what each tier offers before you commit, that's pretty important.

For those who use the in-person service, ask about the fee structure upfront. A good tax professional will be able to give you an estimate of the cost based on your documents. This helps you avoid surprises when the work is done, which is rather nice to know.

Finally, consider if you truly need all the add-on services. While audit protection can be comforting, not everyone needs it. Evaluate your personal risk and decide if the extra cost is worth it for you. It's about making choices that fit your specific needs, basically, and not just buying everything offered.

People Also Ask About H&R Block Costs

Here are some common questions people have about H&R Block's prices:

Is H&R Block Free for Simple Taxes?

Yes, H&R Block typically offers a free online filing option for very simple tax returns. This usually covers W-2 income and the standard deduction. If your tax situation is more involved, like having investments or self-employment income, you will likely need to use a paid service tier. It's a good way to get started for many, you know.

What Is the Average Cost of H&R Block In-Person Tax Prep?

The average cost for in-person tax preparation at H&R Block can change quite a bit, depending on how complex your tax situation is. A very basic return might be less, while a more involved return with many forms and schedules will cost more. It's best to bring your documents to an office for a personalized estimate, as they charge based on the services your specific return needs, you see.

Does H&R Block Charge Per Form?

While H&R Block's pricing isn't strictly "per form," the number and type of forms needed for your tax return directly influence the overall cost, especially for in-person services. More complex forms, like those for self-employment or rental income, will typically lead to a higher fee because they require more work and expertise to complete correctly. It's about the effort and the specifics, basically.

Conclusion

Knowing how much H&R Block costs involves looking at a few things: the type of service you pick, the complexity of your tax situation, and any extra services you might want. Whether you go for online filing, software, or in-person help, there's a range of prices to think about. Your financial picture and how comfortable you are doing things yourself will guide your choice, you know.

To get the most accurate idea of how much you'll pay, it's always best to visit the official H&R Block website or speak with a tax professional directly. Prices can change, and they often have specific deals at different times of the year. For current offers and detailed pricing information, you can always check their official site, H&R Block's website, for the latest updates. Learn more about tax preparation strategies on our site, and for additional insights, you can also link to this page here.

Much (canal de televisión) - Wikipedia, la enciclopedia libre

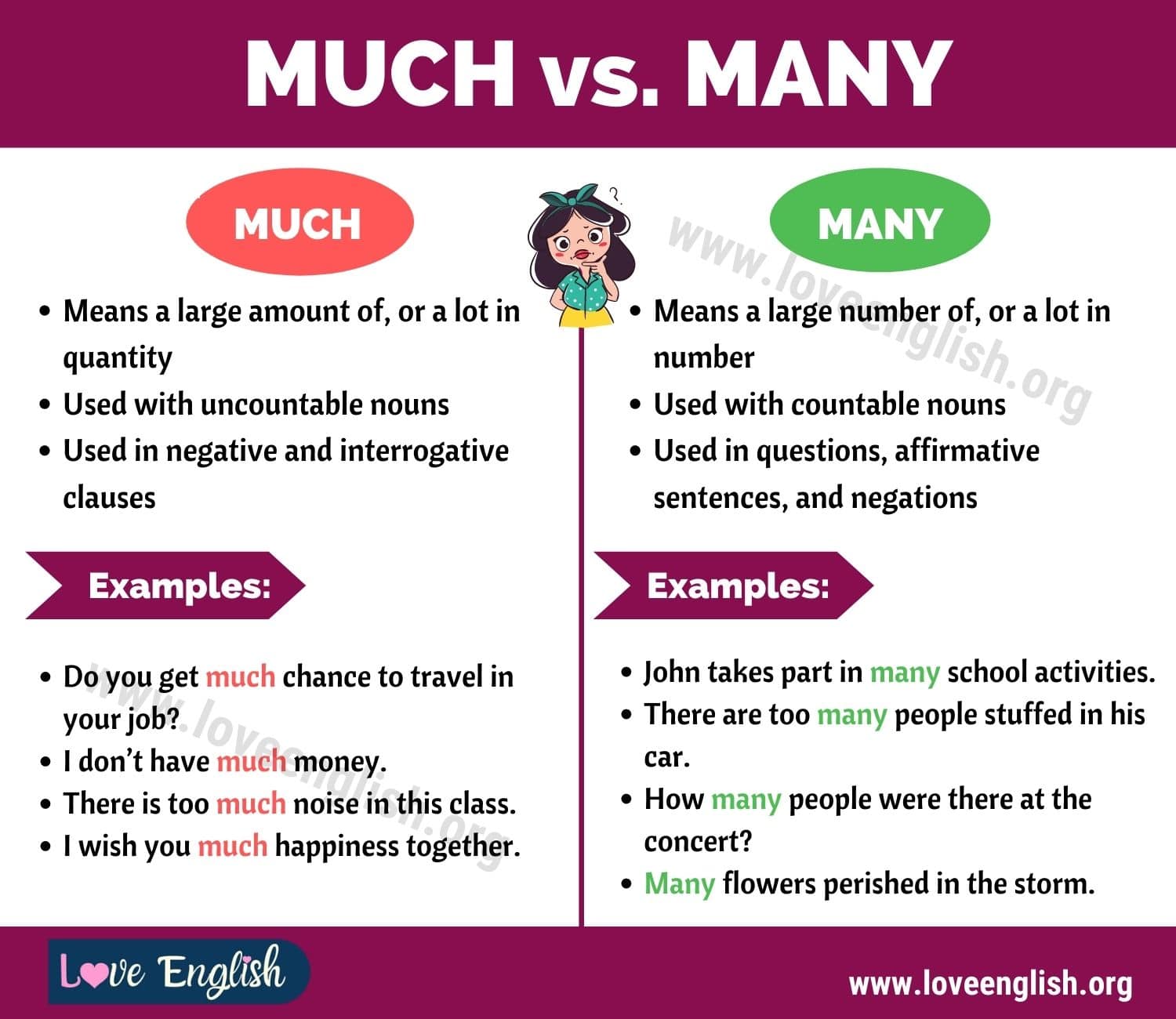

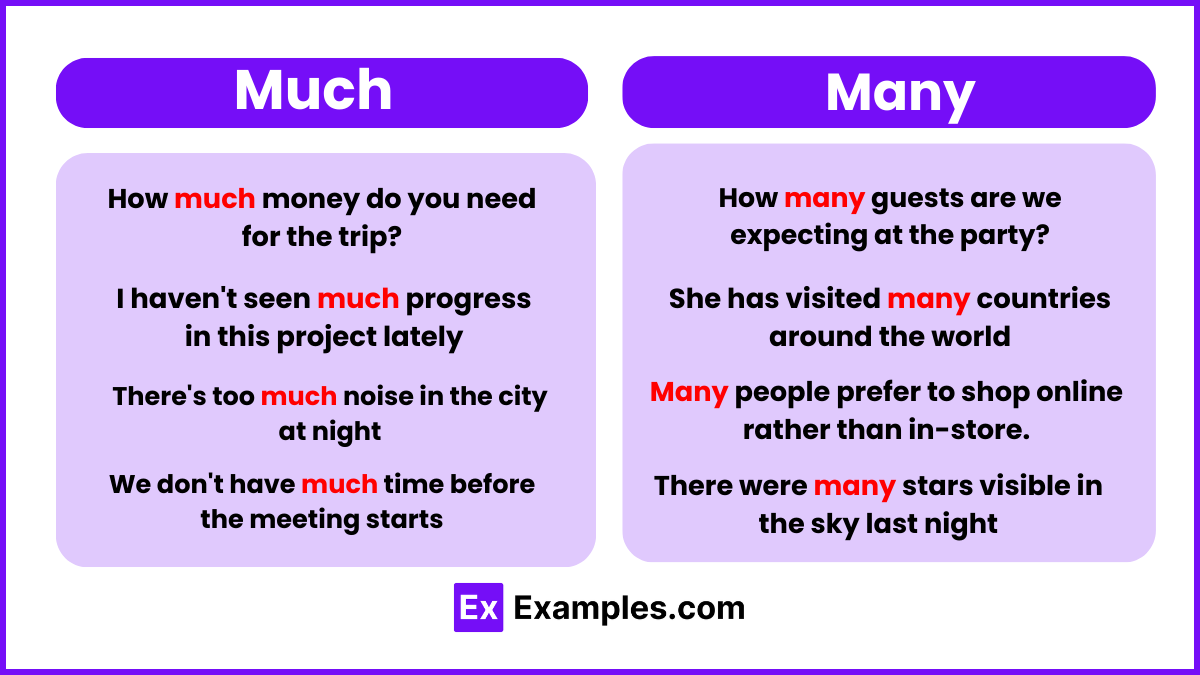

Much vs. Many: How to Use Many vs Much in Sentences - Love English

Much vs Many - Examples, Difference, Tricks, How to use