How Much Does It Cost To File Taxes With H&R Block? Your Guide To Pricing

Tax season, you know, it can feel like a bit of a puzzle for many of us. Finding the right way to get your taxes done, and figuring out what that might cost, is a big deal for a lot of people. H&R Block, for instance, is a name that comes up quite a lot when folks think about tax help. They have been around for a while, helping people with their tax obligations, and so it's natural to wonder about their services.

So, you might be asking yourself, "How much does it cost to file taxes with H&R Block?" That's a really common question, and it's a good one to ask before you get too far into the process. Nobody wants a surprise bill, right? You want to have a pretty good idea of what you are getting into financially, and that's totally fair.

The truth is, the cost can change quite a bit, depending on what kind of tax situation you have and what level of help you actually need. It's not just one price for everyone, you know? There are a few different options H&R Block offers, and each one comes with its own price tag, more or less. We will talk about all of that, so you can get a clearer picture.

Table of Contents

- Understanding H&R Block's Services

- H&R Block Online Tax Filing: What You Pay

- H&R Block In-Person & Online Assist Costs

- Factors That Change Your Tax Filing Price

- Why Do Costs Vary So Much?

- Is H&R Block Right for Your Wallet?

- Tips for Saving Money on Tax Filing

- Frequently Asked Questions About H&R Block Costs

Understanding H&R Block's Services

H&R Block offers a few different ways for you to get your taxes done, and that's actually why the cost can be so different. You can, for instance, choose to do your taxes yourself using their online software. Or, you might want a little bit of help, which they also offer. And then there's the option to have a tax pro do everything for you, which is another path, you know?

Each of these options is pretty much set up for different kinds of tax situations and different comfort levels with doing your own taxes. So, it's not just about getting your taxes filed, it's about the level of support you want along the way. That, in turn, really affects what you will pay, as a matter of fact.

You see, if your taxes are really straightforward, you might pay very little, or even nothing at all. But if things are a bit more involved, with lots of different income sources or deductions, then the price will naturally go up. It’s all about matching the service to what you actually need, basically.

H&R Block Online Tax Filing: What You Pay

Let's talk about doing your taxes online with H&R Block, because that's a very popular choice for many people these days. They have a few different versions of their online software, and each one is for a specific kind of tax filer. The cost for these online products tends to be a set fee, which is nice because you usually know what you are paying upfront, more or less.

Free Online Edition

Yes, there is a free option, which is pretty great, you know? This version is usually for people with very simple tax situations. We are talking about folks who only have W-2 income, maybe claim the standard deduction, and don't have a lot of other things going on. It's designed to be straightforward, and it typically covers federal and state filing for these basic returns. So, if your taxes are simple, this could be a really good fit for you.

Deluxe Online

Moving up a step, there's the Deluxe Online option. This one is for people who might have a few more things to report, like itemized deductions, or perhaps they qualify for certain tax credits, like the Child Tax Credit or education credits. It gives you a bit more guidance than the free version, and it's generally priced a little higher, as you might expect. This is a common choice for many families, actually.

Premium Online

Then we have the Premium Online package. This is usually for folks who have investment income, like from stocks or mutual funds, or maybe rental property income. It handles those slightly more involved tax forms that come with those kinds of earnings. The price for this one is a bit more than Deluxe, which makes sense given the added complexity it helps you with. It's for those who have moved beyond just a W-2 and a few basic deductions, you know.

Self-Employed Online

For anyone who works for themselves, like freelancers, contractors, or small business owners, the Self-Employed Online option is usually the way to go. This version is built to handle all the specific forms and deductions that come with being self-employed, like Schedule C. It's generally the most expensive of the online software options, but it provides the tools needed for those unique tax situations. It helps you keep track of all those business expenses, which can be a lot, in a way.

H&R Block In-Person & Online Assist Costs

Beyond the do-it-yourself online software, H&R Block also offers services where you get more direct help from a tax professional. These options typically cost more than just using the software yourself, because you are paying for someone else's expertise and time, naturally. It's a different kind of service, and the pricing reflects that, you know.

Online Assist

Online Assist is a pretty neat option if you like to do some of the work yourself but still want a tax pro to be there if you get stuck. You start your return online, just like with the DIY software, but you can chat with a tax expert, share your screen, or even have them review your return before you file. This service adds to the cost of the online software, so you pay for the software package plus an extra fee for the professional help. It's a kind of hybrid approach, which can be quite helpful, you know.

Tax Pro Review

This is sort of a specialized version of getting help. If you've completed your tax return using H&R Block's online software, but you want a professional to give it a final look before you hit "file," you can pay for a Tax Pro Review. A tax expert will go over your return, check for errors, and look for any deductions or credits you might have missed. This is an add-on service, so it's an extra charge on top of the cost of your online software. It's like having a second pair of eyes, which can give you some peace of mind, basically.

In-Person Tax Preparation

Having a tax professional at an H&R Block office prepare and file your taxes for you is usually the most expensive option. The cost here isn't a fixed price, like the online software. Instead, it really depends on how complex your tax situation is. If you have a lot of different income sources, many deductions, or special circumstances, the fee will be higher. They charge based on the forms needed and the time it takes. So, it's not really a one-size-fits-all price, you know? You typically get a quote after they look at your documents, which is how it often works.

Factors That Change Your Tax Filing Price

As we have been talking about, the cost to file your taxes with H&R Block isn't just one number. There are several things that can make the price go up or down. Knowing these factors can help you understand why your bill might be what it is, or how you might be able to save some money, you know.

Return Complexity

This is probably the biggest thing that changes the price. A simple return, like just a W-2 and a standard deduction, will always cost less than a return with a small business, rental properties, investments, or lots of itemized deductions. Each extra form or calculation adds to the work involved, and that means a higher fee, more or less. It's like building a house; a simple one costs less than a very large, fancy one, you know?

State Filing

For most people, you have to file both a federal tax return and a state tax return. While the federal filing might be free or a certain price, filing your state taxes is often an extra charge, even with the online software. So, remember to factor that in when you are looking at the total cost. It's an additional step, and usually an additional fee, too it's almost always the case.

Add-On Services

H&R Block, like many tax preparers, offers extra services that you can choose to add on. These might include things like audit support, where they help you if the IRS questions your return, or tax identity theft protection. These services are optional, but if you decide you want them, they will add to your total cost. It's like getting extra features on a car, you know?

Promotions and Discounts

It's always a good idea to keep an eye out for special offers or discounts. H&R Block, and other tax companies, often run promotions, especially early in tax season. Sometimes they offer discounts for new customers, or for certain types of filers. Checking for these deals can definitely help you save some money, so it's worth a look, you know?

Why Do Costs Vary So Much?

You might wonder why the cost can be so much, you know, a really large amount, depending on what you need. It's a fair question. The meaning of "much" here is truly a great quantity or degree of difference in price. It's not just a small change; it can be quite a significant jump from one service level to another. This is actually pretty common in service industries, where the price reflects the amount of work and specialized knowledge involved.

Think about it like this: when you use the free online software, you are doing almost all the work yourself. H&R Block is providing the tool, but your effort is a great quantity of what gets the job done. So, the cost is very low, or even nothing. As you ask for more help, like having a tax professional review your return or prepare it entirely for you, you are paying for their time, their training, and their knowledge. That's a far larger amount of specialized service, you know?

The more complex your tax situation, the more time and specialized skills a tax professional needs to use. If you have a small business, for example, there are many more forms and rules to follow compared to someone who just has a simple W-2. This extra work, and the need for a tax expert who understands all those rules, naturally means the price will be higher. It's about the value of the service provided, and how much effort goes into it, you know?

So, the variation in cost isn't just random. It reflects the different levels of service, the amount of professional time, and the complexity of your personal tax picture. It really is a great quantity of factors that play into the final price, more or less. It's all about tailoring the service to what you need, and that means the cost will be different for different people, naturally.

Is H&R Block Right for Your Wallet?

Deciding if H&R Block is the right choice for you, especially when it comes to cost, really depends on your own situation and what you are comfortable with. For some people, the free online option is perfect, and it saves them a lot of money, which is great. For others, the peace of mind that comes from having a professional handle everything is worth the higher fee, you know?

If your taxes are pretty simple, and you feel okay doing things yourself, their online software can be a very cost-effective way to go. You can save quite a bit compared to paying for in-person help. But if your tax situation is more involved, or you just don't feel confident doing it alone, then paying for professional assistance might actually save you money in the long run by helping you avoid mistakes or find deductions you might miss. It's a trade-off, basically.

It's always a good idea to look at what you need versus what you are willing to pay. Think about the value you place on your time and your peace of mind. Sometimes, paying a bit more for expert help can be a really good investment, especially if it means you get your taxes done right and don't have to worry about them later. It's a personal choice, you know, what works best for you and your finances, more or less.

Tips for Saving Money on Tax Filing

Even if you decide to go with H&R Block, there are still some things you can do to try and keep your costs down. Nobody wants to pay more than they have to, right? So, here are a few ideas that might help you save a little cash when it's time to file, you know.

First off, if your tax situation is simple, really try to use the Free Online Edition. It's there for a reason, and if you qualify, it means you pay nothing for federal and state filing. That's a huge saving right there. Don't pay for a higher tier if you don't actually need the features it offers, you know?

Also, keep an eye out for those promotions and discounts we talked about earlier. Sometimes, they offer early bird specials, or deals if you file by a certain date. Checking their website or signing up for their emails can help you catch these offers. It's like finding a good deal on something you were going to buy anyway, basically.

Gather all your documents early. This might seem like a small thing, but if you are using an in-person tax preparer, being organized can save them time, and that might save you money. If they have to wait for you to find things, or if your documents are a mess, it could take them longer, and that could mean a higher fee. Being prepared is always a good idea, you know, it really helps things move along smoothly.

And finally, if you are using the online software, make sure you understand which version you are selecting. Sometimes people pick a more expensive version than they need because they aren't quite sure what their tax situation requires. Take a moment to read the descriptions for each product so you pick the one that fits your needs best without overpaying. You can always learn more about tax filing options on our site, and link to this page for other financial tips.

Frequently Asked Questions About H&R Block Costs

Can I really file for free with H&R Block?

Yes, you actually can file for free with H&R Block, but it's for very specific situations. The Free Online Edition is usually for simple tax returns, like if you only have W-2 income and take the standard deduction. If your taxes are more complex, with investments or self-employment income, you will likely need to use a paid version, you know.

Does the cost include state taxes?

Not always, no. While some of the paid online versions might include state filing, the free federal option often requires an extra payment for your state return. When you are looking at the prices, make sure to check if the state filing fee is included or if it's an additional charge. It's a common thing to overlook, so be sure to double-check, basically.

What makes in-person filing more expensive?

In-person filing is generally more expensive because you are paying for the direct time and expertise of a tax professional. They sit down with you, gather your documents, and prepare your return from start to finish. The fee usually depends on how complicated your tax situation is, because more complex returns take more of their time and specialized knowledge. It's a personalized service, which naturally comes at a higher price, you know. For more general tax information, you can always check out resources like the IRS website.

Much (canal de televisión) - Wikipedia, la enciclopedia libre

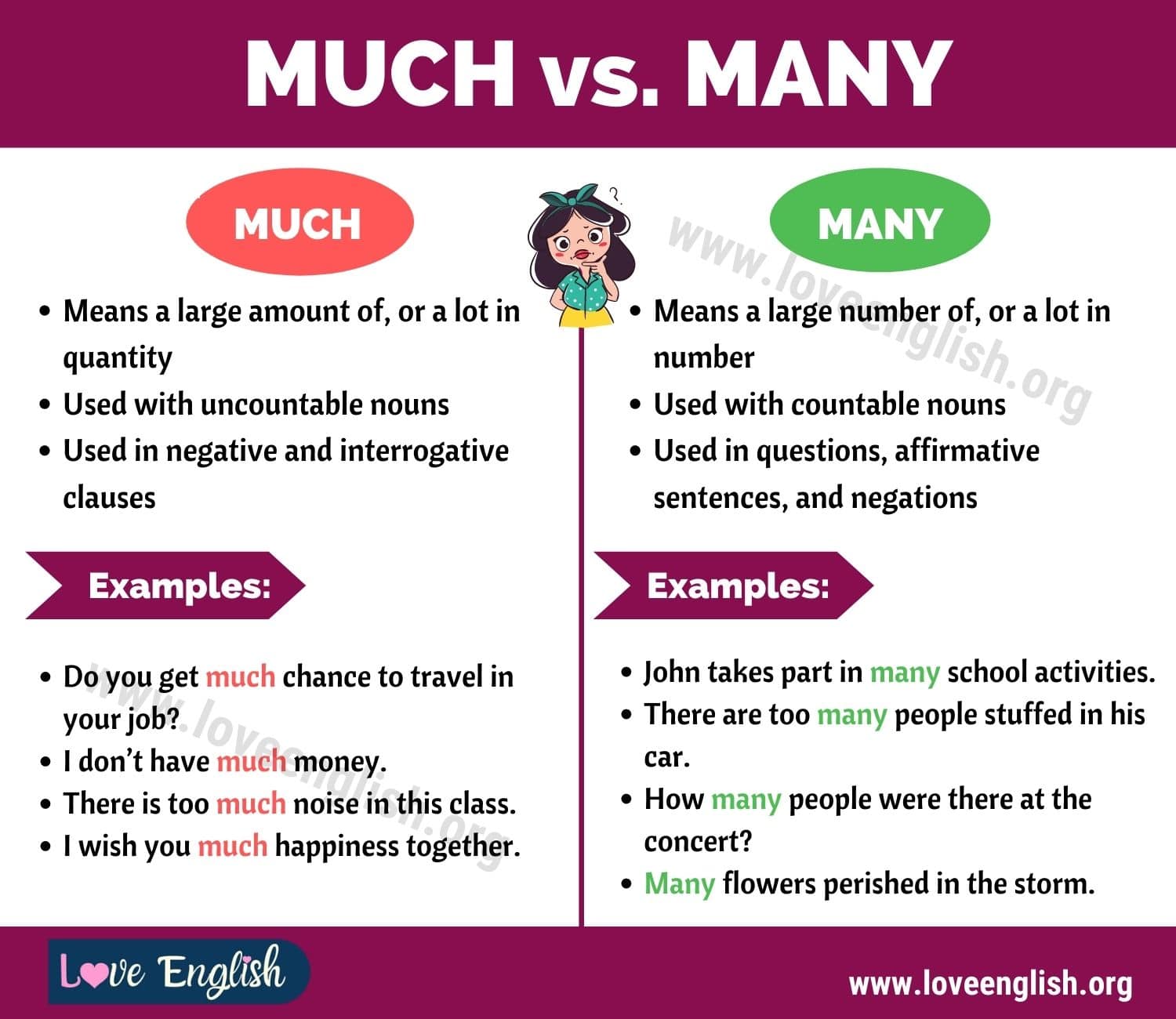

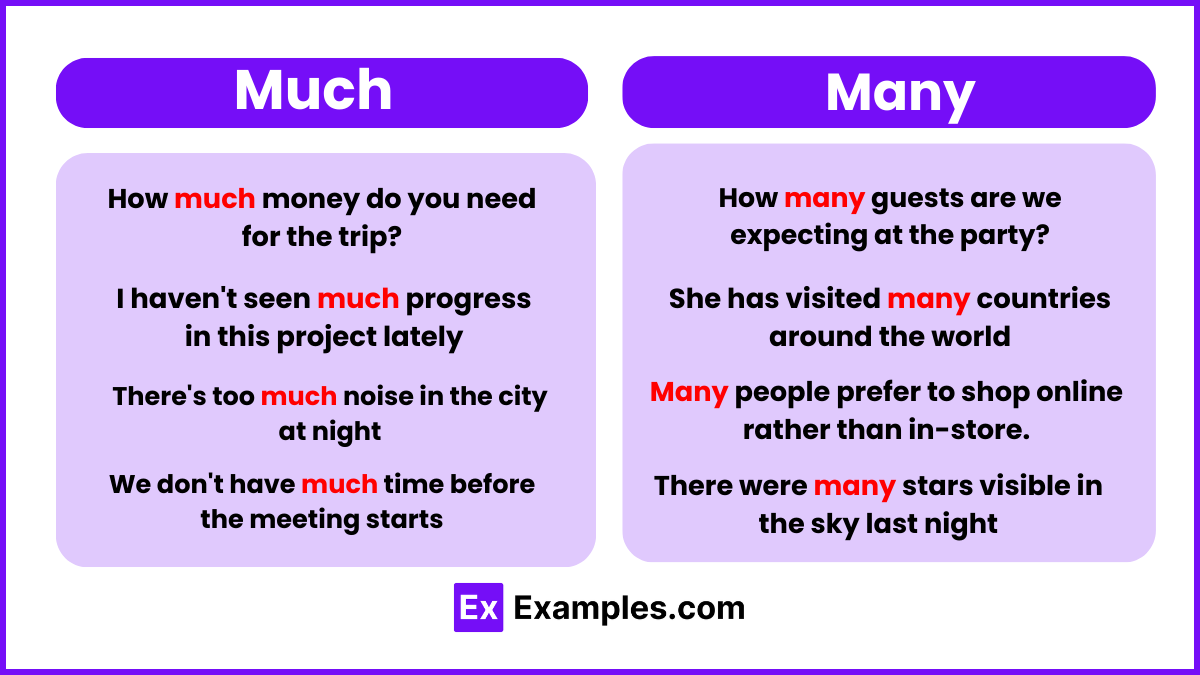

Much vs. Many: How to Use Many vs Much in Sentences - Love English

Much vs Many - Examples, Difference, Tricks, How to use