How Much Does It Cost To Get Your Taxes Done At H&R Block?

For many people across the United States, getting taxes sorted each year can feel like a really big chore. It's often confusing, causes a lot of stress, and, you know, takes up quite a bit of time. That feeling of dread when tax season rolls around is pretty common, actually. The paperwork, the rules, the deadlines—it can all pile up and seem rather overwhelming, can't it? People might spend hours trying to figure out what goes where, or, you know, just stressing about making a mistake. This annual task, for a good number of folks, is seen as a significant drain on their energy and their calendar. It’s a yearly event that, frankly, many would rather just avoid if they could, yet it is a must-do for nearly everyone.

H&R Block comes into the picture here, offering a good number of tax preparation services and, well, a lot of know-how to make the whole thing simpler. They aim to smooth out the bumps in the road, so to speak, when it comes to filing what you owe. The company has, for quite some time, provided expertise to simplify the process for folks who find it all a bit much. It's about taking some of that heavy lifting off your shoulders, or so it seems, by providing tools and people to help. They try to give people an easy way to get through tax season with less worry, which is pretty helpful, really.

But, a question that naturally comes up for many is, how much does using H&R Block actually cost? You might be wondering about the price tag for their help, and that's a very fair thing to ask. Knowing the costs upfront, you see, helps you plan and decide what's best for your money situation. It’s quite common to ask, "How much should tax preparation cost you this year?" because, well, nobody wants surprises when it comes to money, do they? So, let's look at what you can expect when it comes to H&R Block's services and their fees, so you can get a clearer picture.

Table of Contents

- Understanding H&R Block's Pricing Structure

- Is H&R Block the Right Choice for Your Tax Needs?

- Frequently Asked Questions About H&R Block Costs

Understanding H&R Block's Pricing Structure

The cost you pay to get your taxes done at H&R Block isn't, you know, a single fixed number for everyone. It really depends on a few different things, which is pretty typical for services like this. The overall price can change quite a bit based on your personal money situation, where you live, and whether you choose to use their software online or get help from a tax professional at one of their local offices. It’s not just a one-size-fits-all kind of deal, which makes sense when you think about how different everyone’s taxes can be. So, let's break down these elements a bit more, shall we?

Factors Influencing Your H&R Block Tax Prep Cost

Your own financial situation plays a very big part in how much you'll pay. For instance, if your tax return is pretty straightforward, with just a W-2 and maybe a few simple deductions, your cost will likely be on the lower side. But, if you have, say, investments, a small business, rental properties, or other more complex income sources, then your tax situation is, well, more involved. This extra complexity often means more work for the preparer or the software, and that, naturally, can make the cost go up. So, the more twists and turns your money life has, the more you might end up paying, which is fair enough, I suppose.

Another thing that matters quite a bit is your geographical location. Average tax preparation costs can, you know, vary depending on where you are in the country. What someone pays in a big city might be different from what someone pays in a smaller town, even for the same kind of tax return. This is just how service prices work across different areas, really. So, if you're looking up prices, it's a good idea to remember that what you see might be an average, and your local office's fees could be a bit different. It’s something to keep in mind, definitely, when you are trying to figure out your own potential bill.

Finally, the type of preparer or service you pick makes a huge difference to the overall cost. Are you someone who likes to do things yourself, perhaps using online software? Or do you prefer sitting down with a real person, a tax professional, at a local office? Doing your taxes yourself, generally speaking, will save you money in most instances. This is because you are doing a good chunk of the work. If you choose to go with a professional, you are paying for their time and their specific knowledge, which, you know, adds to the price. It’s a choice between saving money by doing it yourself or paying for the convenience and peace of mind that comes with professional help, which is a rather common decision people face.

H&R Block Online Tax Software Costs

H&R Block offers an easy way to file taxes online, and you can choose to do it all by yourself or get some help from a tax pro, which is pretty neat. When it comes to their online tax prep and filing software, the costs can vary, typically ranging from $0 to $84.99, depending on just how involved your tax return is. For example, if you have a very simple tax return, you might be able to file it for free, which is a big plus for many people, especially those with straightforward finances. This free option is, you know, a good starting point for a lot of folks.

For those with slightly more complicated situations, the online software tiers are usually priced at $29.99, $49.99, or $84.99. These different price points reflect the various features and forms you might need as your tax situation becomes, well, a bit more detailed. Back in February 2023, when people were filing their 2022 tax returns, prices for the H&R Block basic tax software started as low as $19.95. This gives you a bit of a historical look at their pricing, showing that basic options can be quite affordable, at least they have been, so that's something.

A pretty cool thing H&R Block does is allow its clients to complete their own taxes online, and they even offer a 35% discount for doing so. This is a nice incentive if you’re comfortable handling things yourself. It means you can potentially save a good chunk of money just by taking the reins and using their online tools. You know, doing it yourself really can make a difference to your wallet. So, if you are looking to keep costs down, the online self-prep option with that discount is certainly something to consider, it really is.

Professional Tax Preparation at H&R Block Offices

Sometimes, your tax situation is just, well, too complicated to tackle on your own, or perhaps you just prefer having a professional handle it. It's quite common to ask yourself, "How much does it cost for tax preparation services from a professional?" when planning your finances. For those who choose to visit a local H&R Block office and get help from a tax professional, the fees can be higher than using the software alone. This is because you're paying for the preparer's expertise, their time, and their personal assistance, which is, you know, a different kind of service entirely.

On average, customers can expect to pay around $200 for professional tax preparation services at H&R Block. This figure is, of course, an average, and your actual cost might be a bit different based on all those factors we talked about earlier, like your location and the specific details of your return. Finding the right seasonal business professionals to help you with your taxes is, honestly, very essential. They can help make sure everything is done correctly and, you know, that you're getting all the deductions you deserve, which can be pretty valuable in the long run. The company has guides that explain why their charges are what they are, especially for these more involved services.

Because tax planning and even basic tax filing can become so complicated, it’s understandable why many people seek out professional help. A good tax professional can offer peace of mind, knowing that your return is accurate and filed correctly. This can be particularly helpful if you have, say, a new business, or perhaps you've had a big life change like buying a home or having a child, which can all affect your taxes in ways you might not fully understand. So, paying for that professional touch can be a worthwhile investment for many, really.

Potential Discounts and Free Filing Options

As mentioned, H&R Block does offer ways to reduce your costs or even file for free, which is pretty good news for many people. If you have a simple tax return, you can often file it for free with their online service. This is a great option for students, single filers with just a W-2, or anyone whose financial picture isn't too involved. It’s a very accessible way to get your taxes done without spending any money, which is, you know, a real benefit, especially if you're on a tight budget. So, checking if your situation qualifies for the free option is definitely a smart first step.

For those who choose to do their own taxes online but have a more complex situation that requires a paid tier, H&R Block often provides a 35% discount for clients who complete their own taxes online. This self-service discount means you can get professional-grade software features at a reduced price, which is, honestly, a pretty sweet deal. It encourages people to take control of their own filing while still getting the benefit of H&R Block's platform. So, if you're comfortable with computers and your own financial records, this discount can make a noticeable difference to your final bill.

Also, it's a good idea to keep an eye out for other savings. For instance, you can find information on how much H&R Block tax prep will cost in 202

Much (canal de televisión) - Wikipedia, la enciclopedia libre

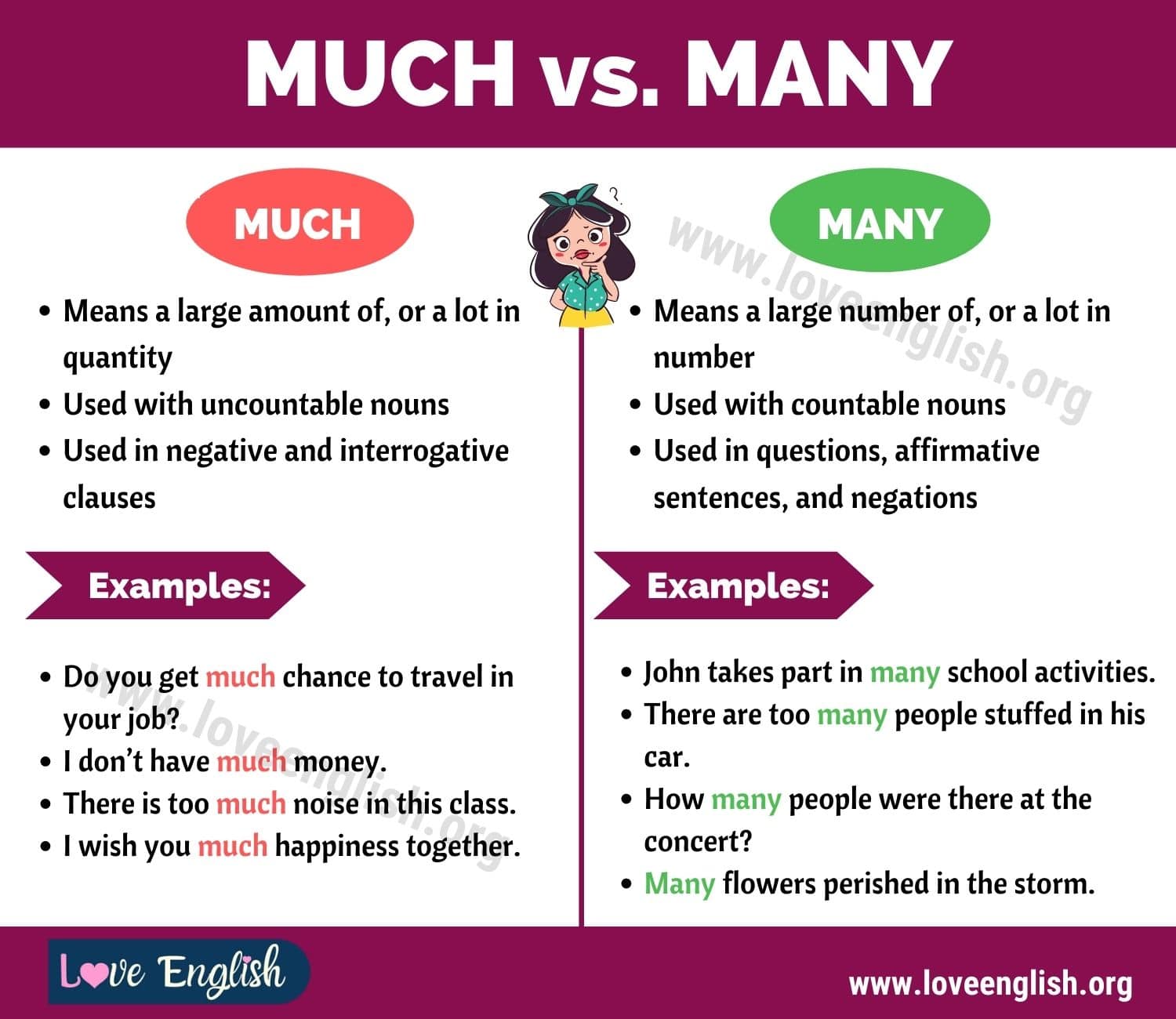

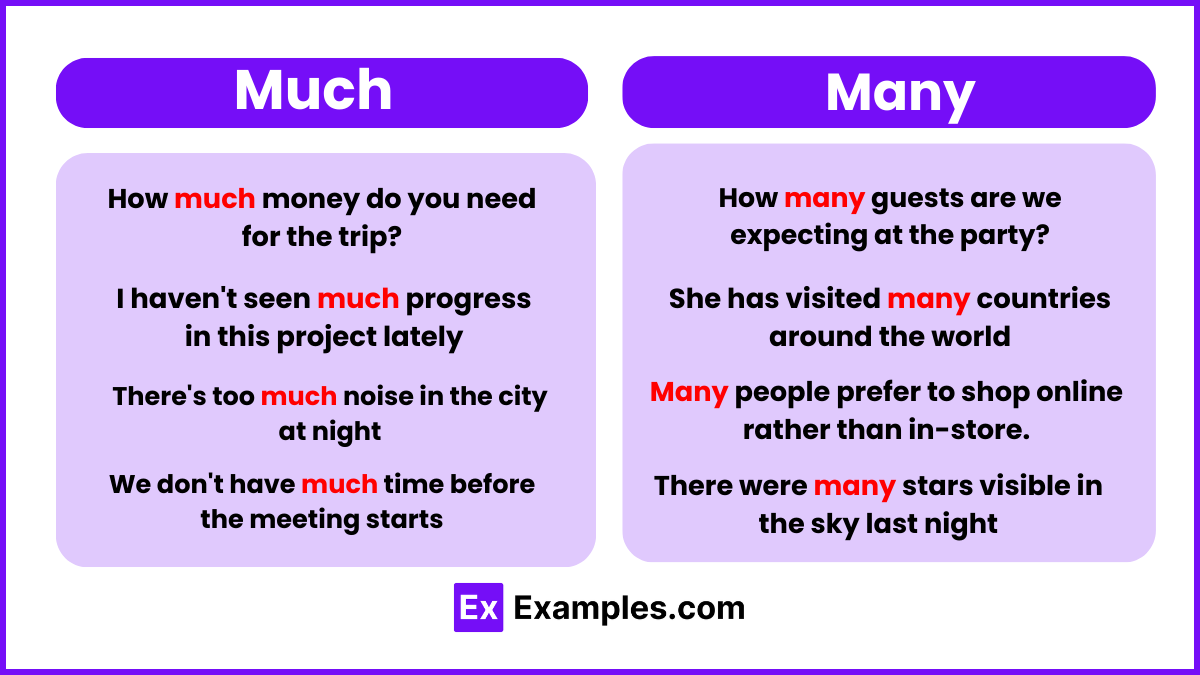

Much vs. Many: How to Use Many vs Much in Sentences - Love English

Much vs Many - Examples, Difference, Tricks, How to use