How Much Is H&R Block? Getting Your Tax Prep Costs Clear For 2025

Tax season, it's a yearly event that many people approach with a mix of dread and curiosity, especially when it comes to figuring out the costs involved. For a lot of us, a big question that pops up is, "How much is H&R Block?" It’s a common thought, too it's almost a universal one, because getting your taxes done can feel like a bit of a mystery, price-wise. You want to make sure you're getting a fair deal, and honestly, who doesn't want to save a little money when it comes to something as important as your financial obligations?

Knowing what you might pay for tax preparation is, frankly, a smart move for anyone looking to manage their money well. H&R Block is a name that most folks recognize, a household name in tax prep, and for good reason. They’ve been around for a while, helping countless people get their returns in order. But how much does using H&R Block actually cost? That's the real question, isn't it? This article aims to pull back the curtain on those costs, giving you a clearer picture of what to expect, especially as we look towards the 2025 tax season.

You might be wondering, "How much does H&R Block tax preparation cost?" It's a fair point, and the answer, as you'll see, isn't always a simple, single number. The truth is, the cost can shift quite a bit, depending on a few different things. We'll explore those factors, so you can get a better idea of what your personal tax situation might mean for your wallet. Basically, we're here to help you know how much H&R Block tax prep will cost in 2025 before you even begin, which is pretty helpful, you know.

Table of Contents

- Understanding H&R Block Services

- Factors That Influence H&R Block Costs

- H&R Block Online Pricing for 2025

- When Are You Charged for H&R Block Services?

- H&R Block for Small Business Owners

- H&R Block in the Tax Filing Landscape

- Frequently Asked Questions About H&R Block Costs

- Making Your Tax Prep Decision

Understanding H&R Block Services

H&R Block is, at its core, a tax preparation service that helps you get your tax returns submitted. They offer a couple of main ways to do this, so you can pick what fits you best. You can choose to file your own tax returns either online, using their software, or you can go to a local office and work with a tax professional there. This flexibility is, you know, pretty convenient for many people.

For those who like to take charge of their own taxes, H&R Block provides online services. These services are designed to walk you through an interview process, much like having a friendly chat where they ask you questions about your income and deductions. This step-by-step approach helps ensure you don't miss anything important. They really do guide you, which is helpful, especially if you're not a tax expert yourself.

Beyond just filing, H&R Block also offers ways to ask tax questions if you get stuck. You can, for example, file online and ask tax questions, having your return looked over by a pro if you need that extra peace of mind. This kind of support means you're not just left to figure everything out on your own, which is, honestly, a big plus for many users.

Factors That Influence H&R Block Costs

The cost of H&R Block tax preparation greatly depends on a few key things, so it’s not a one-size-fits-all price. Your personal financial situation plays a big part, as does your geographical location. And, of course, whether you’re using their online software or getting help from a tax professional at a local office will make a difference. These elements combine to shape your final bill, you see.

Online vs. In-Person Tax Prep

One of the biggest factors affecting how much H&R Block costs is whether you choose to do your taxes online or with a person. Doing your taxes yourself, especially using online software, will save you money in most instances. This is a pretty common pattern across tax services, as a matter of fact. When you use their online tools, you’re doing a lot of the work, which means less direct labor cost for them.

For example, H&R Block allows its clients to complete their own taxes online, and they even offer a 35% discount for doing so. This can be a rather significant saving, especially if your tax situation isn't too complicated. Opting for the online route is often the more budget-friendly choice, which is, you know, a good thing for many people.

On the other hand, if you prefer to sit down with a tax professional at a local H&R Block office, the cost will typically be higher. This is because you're paying for the expert's time and specialized knowledge. While it might cost a bit more, some people find the personalized guidance and assurance worth the extra expense. It's really about what kind of support you feel you need, honestly.

Your Financial Situation and Tax Complexity

The complexity of your financial situation is another big piece of the puzzle when figuring out how much H&R Block will charge. If you have a very simple tax return, maybe just a W-2 and no dependents, your cost will likely be on the lower end. However, if your taxes involve things like investments, self-employment income, rental properties, or multiple deductions, the price tends to go up. This is because more complex situations require more time and perhaps more advanced software features or professional expertise, you know.

For instance, someone with a straightforward return might qualify for a free online filing option, if available. But a small business owner with various expenses and income streams will need a more comprehensive service, which naturally comes with a higher price tag. The more intricate your financial life, the more detailed the tax preparation process becomes, and that's just how it is, basically.

Geographical Location

It might seem a little odd, but where you live can also play a part in how much H&R Block costs, especially if you're visiting a local office. Prices for in-person tax preparation can vary by geographical location, just like many other services. In areas with a higher cost of living or where there's less competition, you might find the fees are a bit higher. This is pretty typical for service-based businesses, as a matter of fact.

This variation mostly applies to the services provided by a tax professional at a physical office. Online services, by contrast, tend to have more standardized pricing, regardless of where you are. So, if you're looking to keep costs down and your location is a factor, the online option might be something to consider, you know.

H&R Block Online Pricing for 2025

When it comes to H&R Block’s online services, there's a range of plan pricing and service fees to consider. These plans are usually tiered, meaning they offer different levels of features and support, with the price going up as you add more complexity or assistance. It's really about choosing the plan that matches your specific tax needs, which is, arguably, a good way to do things.

Federal and State Filing Fees

For the 2025 tax season, H&R Block’s online federal tax filing plans typically cost between $0 and $84.99. This range accounts for different levels of service, from very basic filings to those that include more deductions or credits. State filings, on the other hand, usually range from an additional charge, meaning they come with their own separate fee on top of the federal cost. So, you'll need to factor in both if you live in a state with income tax, you know.

It’s important to remember that the free option is generally for the simplest tax situations, perhaps just a W-2. As your tax return gets a bit more involved, you'll likely move into one of the paid tiers. Always check the current pricing directly on their site, as these figures can sometimes shift a little from year to year, even if the general range stays similar, as a matter of fact.

Discounts and Ways to Save

One notable way to save money with H&R Block, as mentioned earlier, is by completing your own taxes online. They offer a 35% discount for doing this, which is a pretty substantial saving. This encourages users to take a more hands-on approach to their tax preparation, and it benefits their wallet, too it's almost a win-win situation. Keep an eye out for other promotions or special offers that might pop up, especially as tax season gets into full swing.

Knowing how much H&R Block tax prep will cost in 2025 before you start is key, and this can often be found through guides that might even include Groupon coupons or other deals. Checking for these kinds of discounts can really help bring down your overall expense. It's always a good idea to look for ways to reduce costs, isn't it?

When Are You Charged for H&R Block Services?

A common question people have is, "Are you wondering when you’ll be charged after filing your return with H&R Block?" This is a very practical concern, as nobody likes surprises when it comes to money. Generally, with online tax filing services, you are typically charged when you are ready to submit your return. This means you can often go through the entire process of inputting your information and seeing your estimated refund or payment before you commit to paying. You learn more about the H&R Block filing fees here, as a matter of fact.

This approach allows you to review everything, including the final cost of the service, before you authorize the payment and send off your taxes. It provides a sense of control and transparency, which is, you know, pretty reassuring. So, you won't usually be charged until you're completely finished and ready to hit that "file" button, which is a good thing.

H&R Block for Small Business Owners

Small business owners have unique tax situations that often require more specialized support. H&R Block recognizes this and offers services tailored to these needs. If you run a small business, you can learn more about H&R Block tax software for small business owners. These services usually account for different business structures, various income streams, and a wider range of deductions and credits that are specific to businesses. It’s a bit more involved than a personal return, typically.

The pricing for small business tax preparation with H&R Block will likely be higher than for a simple personal return, reflecting the added complexity and the need for more robust software or expert advice. These plans include H&R Block pricing, key information, and FAQs that address common concerns for business owners. It’s a good idea to look into these specific options if you have a business, you know, to make sure you get the right support.

H&R Block in the Tax Filing Landscape

H&R Block is, as mentioned, a household name in tax prep, and they are certainly not alone in the market. Turbotax, H&R Block, TaxAct, and TaxSlayer are the major players that really dominate the online tax filing landscape. This competition is generally a good thing for consumers, as it often means services are trying to offer competitive pricing and features. So, you have choices, which is nice, honestly.

To really figure out if H&R Block is the right tax software for you in 2025, it can be helpful to read a comprehensive H&R Block tax review. Such reviews typically discover its features, pricing, and ease of use. Comparing H&R Block to other services can help you make a very informed choice that fits your budget and your tax preparation style. It's like shopping around for anything else, you know.

Frequently Asked Questions About H&R Block Costs

Here are some common questions people often ask about the cost of H&R Block services:

Is H&R Block free for everyone?

No, H&R Block is not free for everyone. While they do offer a free online federal tax filing plan, it's generally for very simple tax situations, like those with just a W-2 form. If your tax situation is more complex, involving things like itemized deductions, investments, or self-employment, you will typically need to pay for one of their higher-tier online plans or use their in-person services. It really depends on what your tax needs are, you know.

How can I get a discount on H&R Block services?

One of the best ways to get a discount on H&R Block services is by completing your taxes online yourself. They often provide a significant discount, such as a 35% reduction, for clients who choose this self-service option. Additionally, it's a good idea to look for special promotions, coupons, or deals, sometimes found through guides or websites that track tax season offers. These can help reduce your overall cost, which is pretty helpful, you know.

Does H&R Block charge extra for state tax filing?

Yes, H&R Block typically charges an additional fee for state tax filings. While their online federal tax filing plans range from free to around $84.99, state filings usually come with their own separate charge on top of the federal cost. This means you should factor in both federal and state fees when calculating your total tax preparation expense, especially if you live in a state that requires income tax filing. It's a common practice across many tax software providers, as a matter of fact.

Making Your Tax Prep Decision

Ultimately, figuring out how much H&R Block will cost you for your tax preparation in 2025 involves looking at your unique financial picture. The cost will depend on whether you go online or visit an office, the complexity of your tax situation, and even your location. Remember, doing your taxes yourself online can often save you money, especially with available discounts. You can learn more about tax preparation options on our site, which might help you decide.

Taking the time to understand the different service levels and their associated fees is a smart move. It allows you to choose a service that fits both your tax needs and your budget. Consider what kind of support you feel you need, and then compare that with the various options H&R Block offers. If you're looking for more information on tax software in general, you can also check out this page from the IRS, which is a good place to start, honestly.

Much (canal de televisión) - Wikipedia, la enciclopedia libre

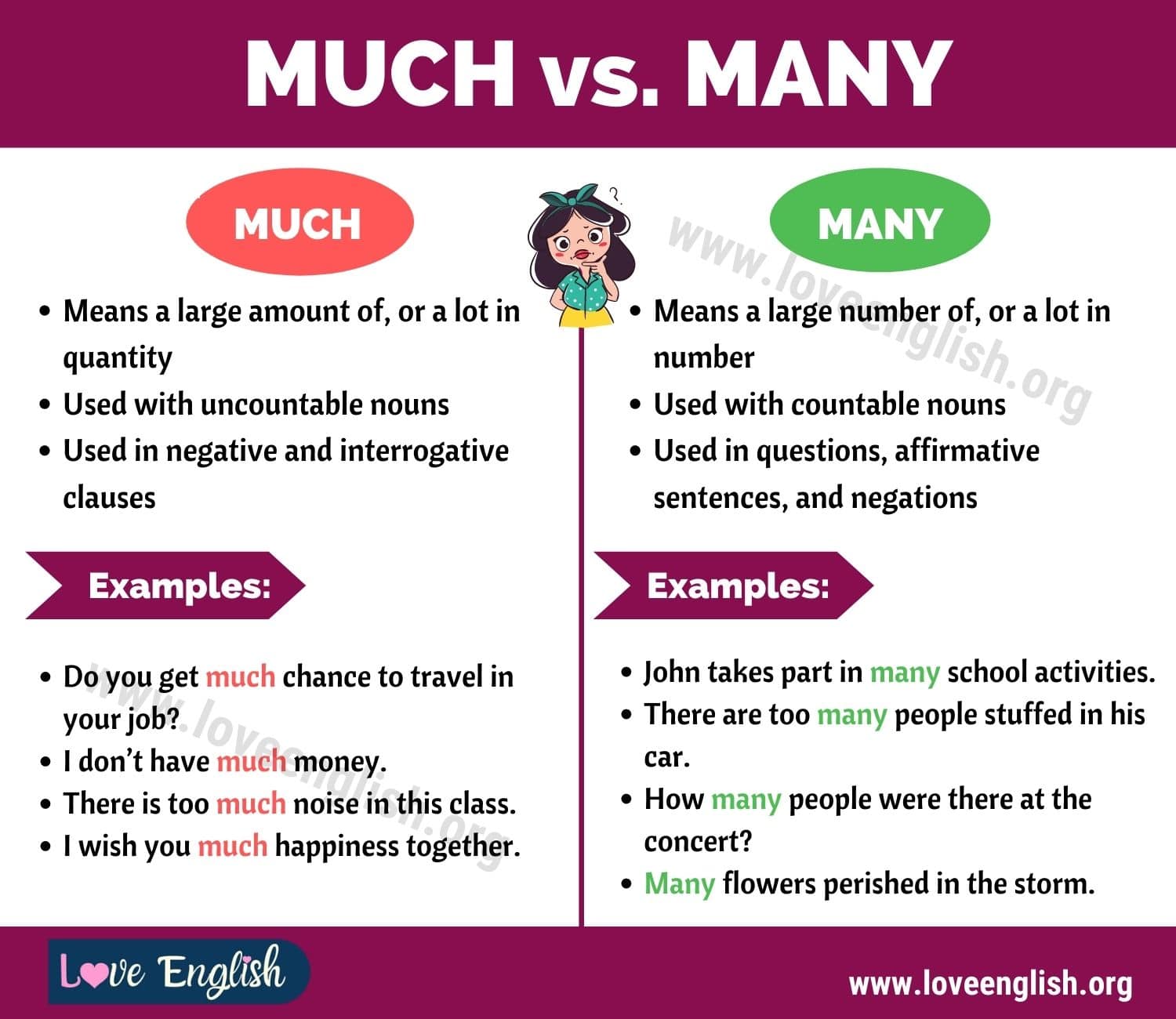

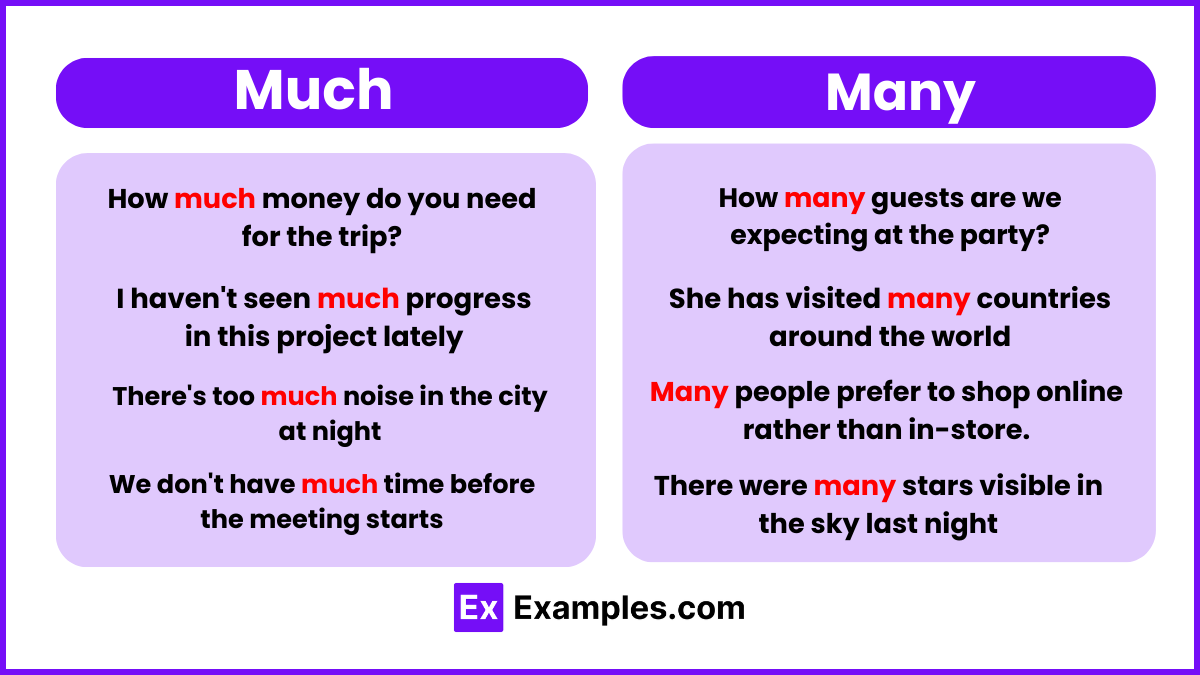

Much vs. Many: How to Use Many vs Much in Sentences - Love English

Much vs Many - Examples, Difference, Tricks, How to use