Figuring Out: **How Much Is It For H&R Block To Do Taxes** This Year?

When tax season rolls around, a lot of folks start wondering about getting some help with their paperwork. One of the biggest questions that comes up, and it's a really common one, is about the cost of professional assistance. Specifically, many people ask, "how much is it for H&R Block to do taxes?" It's a completely fair thing to want to know, as budgeting for these kinds of services can be a bit tricky, you know?

It’s almost like trying to guess the price of a custom-made item without knowing all the details. There isn't just one set price tag for everyone, and that can make things feel a little uncertain. Knowing what to expect financially can really help you decide if professional tax preparation is the right move for you and your money.

This article is going to break down what you might expect when it comes to the cost of having H&R Block prepare your taxes. We'll look at the different things that can make the price go up or down, and hopefully, give you a clearer picture so you can make a good choice for your own situation. Basically, we're aiming to clear up some of that mystery.

Table of Contents

- What Influences the Cost of H&R Block Tax Services?

- A Look at H&R Block's Pricing (Current Year Focus)

- Is Paying for H&R Block Worth It for Your Taxes?

- Ways to Keep Your H&R Block Costs Down

- What About Free Options for Your Taxes?

- Frequently Asked Questions About H&R Block Costs

- Making Your Tax Decision

What Influences the Cost of H&R Block Tax Services?

The actual amount you pay H&R Block for tax help isn't a fixed number for everyone, as you might expect. It really shifts depending on several important things. Think of it like buying a car; a basic model costs less than one loaded with all the fancy features, so it's very similar to that.

Understanding these different elements can really help you get a better idea of what your personal tax preparation bill might look like. It's not just about getting the forms filled out, you know, but about the specific kind of work involved.

Your Tax Situation's Complexity

This is probably the biggest factor that plays a part in the overall price. If your tax life is fairly simple, like just having a W-2 from one job, your cost will likely be on the lower end. That's pretty straightforward, actually.

However, if your financial picture has more pieces, the price tends to go up. This means things like owning a business, having income from freelancing, dealing with investments, or needing to itemize deductions instead of taking the standard deduction. Each of these additions can make your return a bit more involved, naturally.

Consider if you have rental properties, foreign income, or even complex stock transactions. Each of these situations requires more time and specific knowledge from the tax preparer, which, you know, adds to the work involved. So, a more intricate financial story usually means a higher fee.

The Service Level You Pick

H&R Block offers different ways to get your taxes done, and your choice here also affects the price. You could opt for their do-it-yourself software, which is generally the most budget-friendly option. This is where you input all your information yourself, like your own personal tax assistant, more or less.

Then there's the option to have a tax professional help you in person at one of their offices. This provides direct, one-on-one assistance and can be a good choice if you prefer face-to-face interaction. This kind of service usually costs a bit more, as you're getting that personal touch and expert guidance.

They also have virtual services where a tax pro can help you remotely, often through video calls or secure document uploads. This combines convenience with professional help and might fall somewhere in the middle price-wise. It's a pretty flexible way to get things done, actually.

Extra Services and Add-ons

Sometimes, you might need or want additional services beyond just the basic tax preparation. These extras can add to your total bill. For instance, filing a state tax return often comes with its own separate charge.

You might also consider things like audit protection, which offers assistance if your return ever gets looked at more closely by the tax authorities. While it offers peace of mind, it's an additional cost, you know.

Specific forms or schedules that are not part of a standard basic return, such as those for business expenses or certain credits, can also increase the fee. It's like adding extra toppings to a pizza; each one adds a little to the final price.

A Look at H&R Block's Pricing (Current Year Focus)

Trying to give exact figures for H&R Block's services can be a bit challenging because prices can vary by location and change from year to year. However, we can talk about general ranges for the current tax season, which is 2024 for 2023 tax returns. It's worth noting that, you know, these are just estimates.

For a very simple tax return, perhaps just a W-2 and the standard deduction, you might find their online DIY software can even be free or cost a relatively small amount. This is a great option for many people with straightforward situations, apparently.

If you're looking for in-person help with a basic return, like just a W-2 and perhaps some interest income, the cost could start around $80 to $100 or so. This is a general ballpark, and it could be slightly more or less depending on where you are, obviously.

For returns that involve a bit more complexity, such as itemized deductions, education credits, or child tax credits, the price will likely be higher. You might be looking at something in the range of $150 to $300 or more, depending on how many forms are needed. This is where the cost can really start to climb, you see.

When you get into more intricate situations, like self-employment income, rental properties, or significant investment activity, the cost can go up quite a bit. These types of returns often require more specialized knowledge and time, pushing the price potentially into the $300 to $500+ range, or even higher for very complex cases. It's almost like a custom project, in a way.

It's always a good idea to get a personalized quote directly from H&R Block for your specific situation. They can give you the most accurate pricing based on your unique tax needs. You can often find general pricing information or get a quote on their official website. For the most up-to-date pricing details, you might want to check out their official site directly. Learn more about H&R Block's tax preparation fees.

Is Paying for H&R Block Worth It for Your Taxes?

Deciding whether to pay for professional tax preparation, especially from a service like H&R Block, often comes down to weighing the cost against the benefits. For some people, the value they get is quite substantial, you know?

One major benefit is the time you save. Preparing taxes can be a time-consuming task, particularly if your situation isn't simple. Handing it over to a professional frees up your valuable hours for other things. That can be a huge relief, actually.

Another important aspect is accuracy. Tax laws can be really confusing and they change often. A professional preparer is trained to understand these rules and can help make sure your return is filled out correctly, reducing the chance of errors or audits. This peace of mind is worth a lot to many people, obviously.

They might also spot deductions or credits you didn't even know you qualified for, which could potentially lead to a bigger refund or a smaller amount owed. Sometimes, the money they save you or help you get back can easily cover their fee, making it a pretty good deal. So, in some respects, it pays for itself.

For those with complex tax situations, like small business owners or investors, professional help can be almost essential. It helps ensure everything is reported correctly and that you're taking advantage of all possible tax breaks. It’s definitely a consideration for anyone with a bit more going on financially.

Ways to Keep Your H&R Block Costs Down

Even if you decide to use H&R Block for your tax preparation, there are some things you can do to help manage the cost. A little preparation on your part can go a long way, you know.

First off, be super organized. Gather all your documents—W-2s, 1099s, receipts for deductions, etc.—before your appointment. Having everything ready saves the preparer time, and time often equals money. It's a simple step, but really effective, apparently.

Consider whether your tax situation is truly complex enough to warrant full-service help. If you have a very basic return, their online software might be all you need, and it’s generally much cheaper. Don't pay for more service than you actually require, basically.

Keep an eye out for promotions or discounts. H&R Block often runs specials, especially early in tax season or for new clients. Checking their website or local ads could save you some cash, you know.

If you have both federal and state returns, be aware that state returns are usually an additional charge. If your state return is very simple, you might be able to do it yourself even if you get help with your federal one. This could be a way to save a little, in a way.

What About Free Options for Your Taxes?

It's worth mentioning that for many people, especially those with lower incomes or very simple tax situations, there are free options available for tax preparation. These might be a good alternative if you're trying to figure out how much is it for H&R Block to do taxes and find it's more than you want to spend.

The IRS offers Free File, which provides free tax preparation software for eligible taxpayers, usually based on income. This can be a really helpful resource for many individuals and families, you know.

There are also programs like Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE), which offer free tax help from IRS-certified volunteers. These services are fantastic for those who qualify and need a bit of hands-on help, actually.

For those with very straightforward tax situations, some tax software companies, including H&R Block itself, offer free versions of their online products. These typically cover basic W-2 income and the standard deduction. So, it's worth checking if your situation fits these free options first, obviously.

Frequently Asked Questions About H&R Block Costs

People often have very similar questions when they're thinking about using H&R Block for their taxes. Let's look at some of the common ones to help clarify things a bit more.

How much does H&R Block charge for a basic tax return?

For a very basic tax return, which typically means just W-2 income and taking the standard deduction, H&R Block's online software might even be free. If you prefer in-person help for this kind of simple return, the cost usually starts somewhere around $80 to $100. It's a pretty common starting point, you know.

Remember, this is just an estimate for the simplest cases. Any additional forms or complexities will likely increase that initial price. So, it’s not a fixed amount for everyone, naturally.

Is H&R Block expensive compared to other options?

Whether H&R Block is considered "expensive" really depends on what you're comparing it to. Their DIY software is often competitive with other major tax software brands, and sometimes even offers a free tier. For professional in-person preparation, their prices are generally in line with other large tax preparation chains.

Compared to a local, independent CPA or an enrolled agent, H&R Block might sometimes be a bit less expensive for similar services, especially for less complex returns. However, the value you get, like the peace of mind and potential for more deductions, might make the cost worthwhile for you. It's a balance, you know.

What things affect the price of H&R Block tax help?

Several key factors play a part in determining the final price you pay. The main one is how complicated your tax situation is; more forms and different types of income or deductions mean a higher cost. The level of service you choose also matters, like using their software versus getting in-person help.

Also, any extra services, such as filing a state return or getting audit protection, will add to the total. It’s pretty much like building a custom order, where each piece adds to the overall expense.

Making Your Tax Decision

So, when you're trying to figure out how much is it for H&R Block to do taxes, remember that the answer isn't a single, simple number. It's really about your personal financial picture, the kind of help you want, and any extra services you might need. Getting a personalized quote is always the best way to know for sure.

We hope this breakdown helps you feel a bit more confident about understanding the costs involved and making a good decision for your tax preparation needs this year. Learn more about tax preparation options on our site, and link to this page for more insights into managing your finances.

Much (canal de televisión) - Wikipedia, la enciclopedia libre

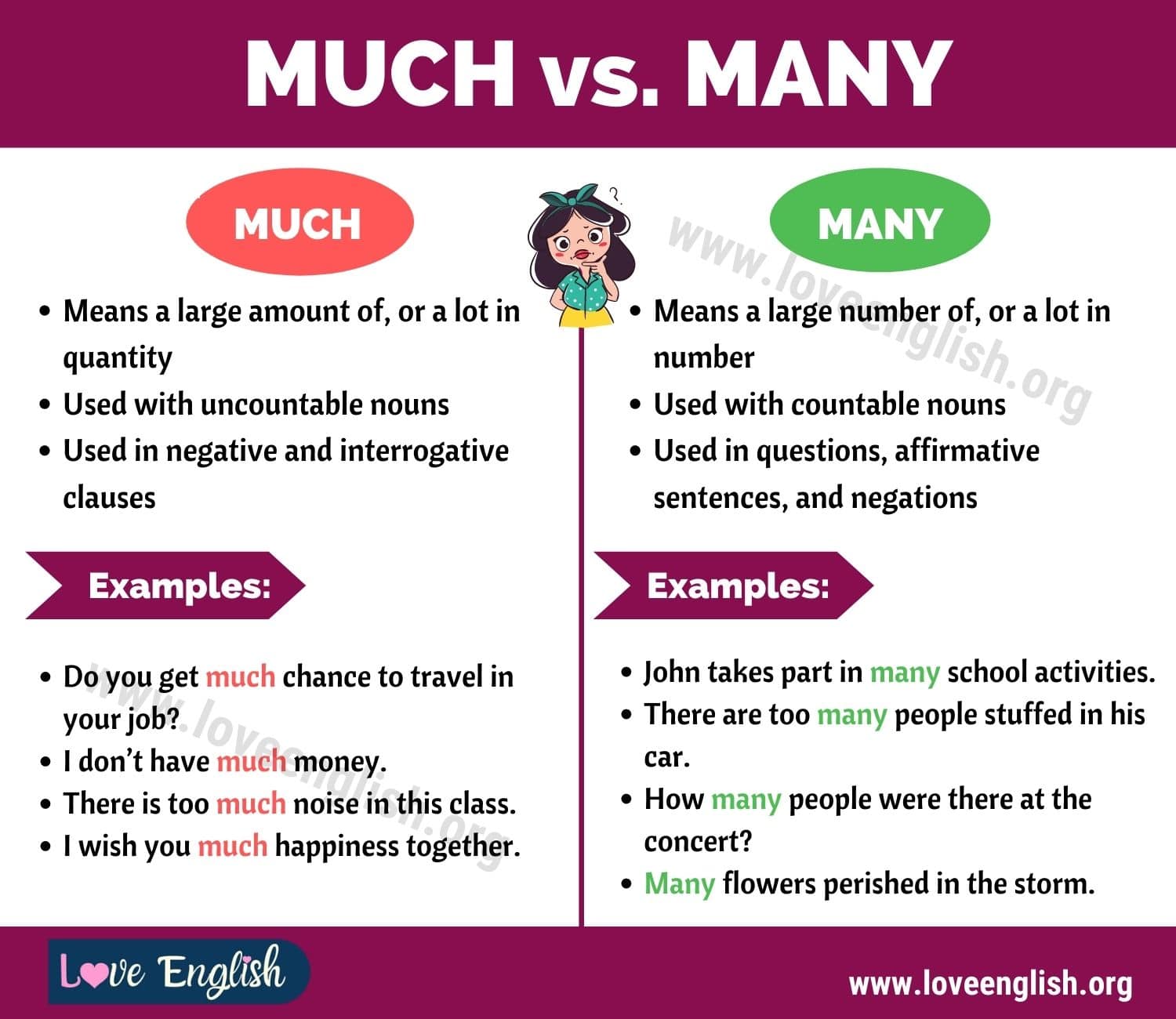

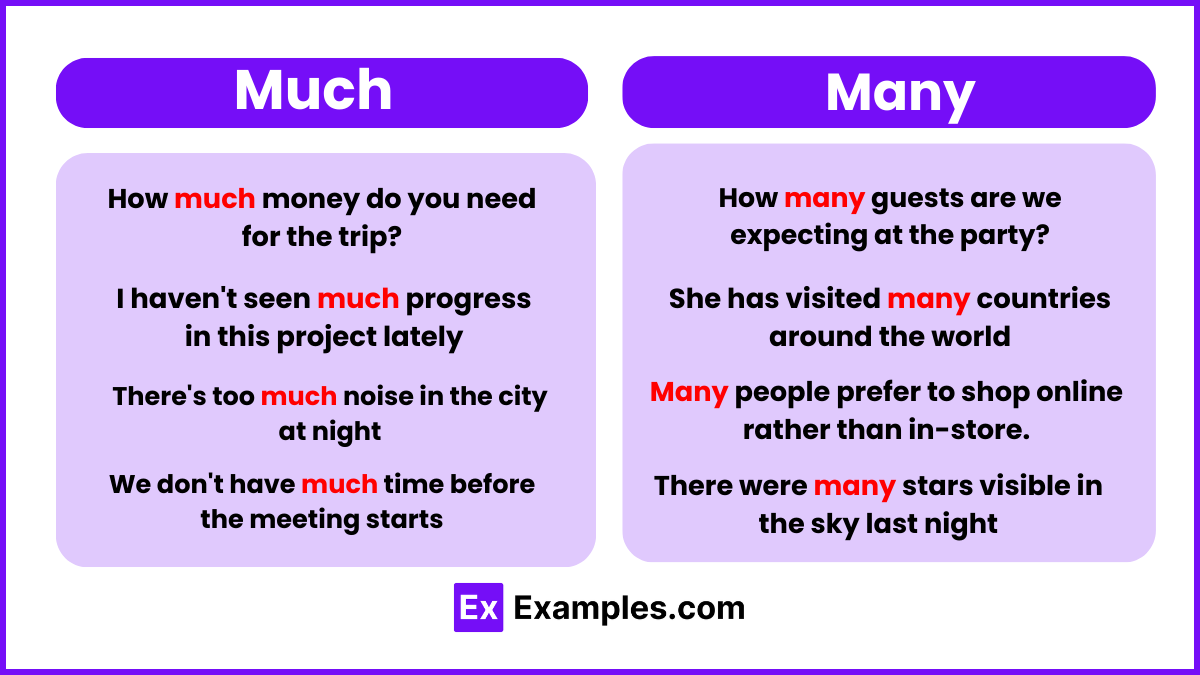

Much vs. Many: How to Use Many vs Much in Sentences - Love English

Much vs Many - Examples, Difference, Tricks, How to use