Understanding Your **CRE Mortgage** Options For Commercial Property

Are you thinking about purchasing a commercial property, or maybe refinancing one you already own? Getting a loan for commercial real estate, often called a CRE mortgage, is quite different from getting a home loan. It's a big financial step, one that can really shape your future business endeavors or investment plans. You see, these kinds of loans are for properties that generate income or serve a business purpose, like office buildings, retail spaces, warehouses, or apartment complexes.

Knowing the ins and outs of a CRE mortgage is pretty important for anyone looking to make a smart move in the commercial property market. It's about more than just finding a building; it’s about figuring out the best way to pay for it, which can be a little bit complex, honestly. There are various options, each with its own set of rules and benefits, so understanding them helps you pick the right path.

This guide is here to help you get a clear picture of what a CRE mortgage involves. We will look at what these loans are, who typically gets them, and the different kinds available. Our goal is to give you useful information so you can approach commercial property financing with a bit more confidence, perhaps making your property dreams a reality.

Table of Contents

- What Exactly is a CRE Mortgage?

- Who Usually Gets a CRE Mortgage?

- Different Types of CRE Mortgages

- What Lenders Look at for a CRE Mortgage

- The CRE Mortgage Application Steps

- Things That Can Make Getting a CRE Mortgage Tricky

- Tips for Getting Your CRE Mortgage

- A Look at the CRE Mortgage Market Right Now

- Why Think About CRE Investment?

- Frequently Asked Questions About CRE Mortgages

What Exactly is a CRE Mortgage?

A CRE mortgage, simply put, is a loan used to buy or refinance commercial real estate. Unlike a home loan, which is for personal residences, a CRE mortgage is for properties that are used for business activities or to generate income. This could be anything from an office building where many companies rent space, to a retail store where goods are sold, or even a large apartment building with many units. So, it's a financial tool for businesses and investors.

These loans tend to be more involved than residential mortgages, as a matter of fact. Lenders look at the property's potential to earn money, the borrower's business plans, and their financial strength. The terms, like interest rates and repayment schedules, can vary quite a bit depending on the property type, the borrower's credit, and the overall market conditions.

For example, a loan for a small local shop might have different terms than a loan for a massive industrial complex. The key is that the property itself is often seen as a primary source of repayment, through its rental income or business operations. This makes the property's financial performance a very important part of the lending decision.

Who Usually Gets a CRE Mortgage?

Many different people and groups seek out a CRE mortgage, you know. Small business owners might need one to buy the building their business operates from, giving them a stable place to work and build equity. This is a pretty common reason.

Then there are real estate investors. These individuals or groups often buy commercial properties with the goal of renting them out to tenants, generating rental income. They might use a CRE mortgage to acquire an apartment complex, an office building, or a shopping center. Their focus is usually on the property's ability to produce steady cash flow and appreciate in value over time.

Sometimes, even larger corporations might use CRE mortgages to expand their operations, perhaps building new facilities or acquiring existing ones. So, whether you are a small entrepreneur or a seasoned investor, a CRE mortgage can be a very useful way to fund your commercial property goals.

Different Types of CRE Mortgages

There's a whole range of CRE mortgage options out there, each designed for slightly different situations. Knowing these can really help you choose what fits best.

Conventional Commercial Loans

These are perhaps the most straightforward type of CRE mortgage, offered by traditional banks and credit unions. They are pretty common for stable, income-producing properties with established tenants. Lenders offering these loans usually prefer borrowers with strong financial backgrounds and properties that are in good condition and have a clear history of making money. The terms can vary, but they often come with competitive interest rates for qualified borrowers, as a matter of fact.

SBA Loans (Small Business Administration)

The Small Business Administration (SBA) doesn't lend money directly, but it guarantees a portion of loans made by commercial lenders. This makes it easier for small businesses to get a CRE mortgage, especially if they might not qualify for a conventional loan. The SBA 7(a) and SBA 504 programs are two popular options for commercial real estate. These loans often have longer repayment periods and lower down payment requirements, which can be a big help for smaller businesses looking to own their space.

CMBS Loans (Commercial Mortgage-Backed Securities)

CMBS loans are a bit different. They are essentially a collection of many commercial mortgages bundled together and then sold as bonds to investors. This process can offer borrowers more flexible terms and sometimes lower interest rates compared to traditional bank loans. However, they can also be less flexible once the loan is in place, as the loan is held by many investors rather than a single bank. They are often used for larger, more complex commercial properties, you know.

Bridge Loans

Bridge loans are short-term loans, often used to "bridge" the gap between a current financial need and a more permanent financing solution. For instance, you might use a bridge loan to buy a property quickly, or to fund renovations, while you wait for a long-term CRE mortgage to be approved. They usually have higher interest rates because they are short-term and can be a bit riskier, but they offer quick access to funds when time is of the essence.

Construction Loans

If you're planning to build a new commercial property or undertake a major renovation, a construction loan is what you'll need. These loans are disbursed in stages as the construction progresses, rather than all at once. The funds are released as specific milestones are met, which helps manage the project's finances. Once the construction is complete, these loans are typically converted into a permanent CRE mortgage or refinanced with another long-term loan.

Hard Money Loans

Hard money loans are typically provided by private investors or companies, not traditional banks. They are secured by the property itself, rather than the borrower's credit score, making them easier to get for those with less-than-perfect credit or unique situations. They are very fast to close, but they come with much higher interest rates and shorter repayment terms. These are often used for quick purchases, property flips, or when traditional financing isn't an option, so they are a bit of a last resort for many.

What Lenders Look at for a CRE Mortgage

When you apply for a CRE mortgage, lenders will examine several key areas to decide if they want to lend to you, and on what terms. It's not just about your personal credit score, you see.

Borrower's Financial Standing

Lenders will look at your personal and business credit history. They want to see a record of responsible financial management. This includes your past payment history, any outstanding debts, and your overall financial stability. A strong credit profile shows that you are likely to repay the loan on time, which is very important to lenders.

The Property Itself

The type of commercial property you're looking to finance plays a huge role. Lenders assess the property's location, condition, market value, and its potential to generate income. A well-located property in good shape with a history of strong occupancy is generally more appealing. They will also consider the specific market sector, whether it's retail, office, industrial, or multifamily, as each has different risks and opportunities.

Cash Flow and Debt Coverage

For income-producing properties, the projected cash flow is absolutely critical. Lenders want to be sure that the property's income (from rent, for example) will be enough to cover the mortgage payments and other operating expenses. They will often ask for detailed financial projections and historical income statements to verify this. This is a very important part of their assessment, as it shows the property's ability to sustain itself.

Loan-to-Value (LTV) and Debt Coverage Ratio (DCR)

These are two key metrics. LTV compares the loan amount to the property's appraised value. If a property is valued at $1 million and you ask for an $800,000 loan, your LTV is 80%. Lenders usually have limits on LTV, meaning you'll need a certain amount for a down payment. The DCR measures the property's net operating income against its debt service (mortgage payments). A DCR of 1.25, for instance, means the property generates 1.25 times the income needed to cover its debt payments, which is a good sign for lenders.

The CRE Mortgage Application Steps

Getting a CRE mortgage involves several steps, and knowing what to expect can make the process smoother.

First, you'll need to gather all your financial documents. This includes personal and business tax returns, financial statements, and a detailed business plan if you're an owner-occupant. For investment properties, you'll need income and expense statements for the property itself, and any existing lease agreements.

Next, you'll submit your application to various lenders. It's a good idea to shop around and compare offers from different banks, credit unions, and private lenders, as terms can differ quite a bit. Once a lender pre-approves you, they will likely order an appraisal of the property to determine its fair market value, and also conduct environmental and property condition assessments.

After all the due diligence is complete and the lender is satisfied, they will issue a loan commitment letter outlining the terms and conditions. Once you agree to these terms, the closing process begins, where all the legal documents are signed, and the funds are disbursed. It can take some time, so patience is key.

Things That Can Make Getting a CRE Mortgage Tricky

Securing a CRE mortgage isn't always a straight line; there can be some bumps along the way.

One common challenge is market shifts. Interest rates can change, or the overall economic outlook might become uncertain, which can make lenders more cautious or change their lending criteria. A property's value might also fluctuate with market demand, affecting the loan amount you can get.

Another hurdle can be property valuation. Sometimes, the appraised value of a property might come in lower than expected, which means you might need a larger down payment or a smaller loan. Also, unexpected issues with the property itself, like environmental concerns or structural problems found during inspections, can delay or even derail a loan approval.

Finally, the sheer amount of paperwork and the detailed financial scrutiny can be a bit overwhelming for some borrowers. Having all your ducks in a row from the start can really help to reduce these challenges, though.

Tips for Getting Your CRE Mortgage

To give yourself the best chance at securing a CRE mortgage, there are some smart steps you can take.

First, prepare your financials meticulously. This means having clear, organized business and personal financial statements, tax returns, and a solid business plan ready. Lenders appreciate a well-prepared borrower, so this is very important.

Second, consider working with an experienced commercial real estate broker or a financial advisor who specializes in commercial financing. These professionals can help you understand the various loan products, connect you with suitable lenders, and assist with preparing your application. They often have insights into current market trends and what different lenders are looking for, which can be a huge advantage.

Third, build a strong relationship with a commercial bank. Even if you don't get your first loan from them, having a banking relationship can be beneficial for future needs. Showing a consistent, positive financial history with a bank can open doors. Also, make sure the property you are interested in has strong income potential and is well-maintained, as this will make it more attractive to lenders. Learn more about real estate financial models on our site.

A Look at the CRE Mortgage Market Right Now

The commercial real estate market is always changing, and so is the availability and terms of CRE mortgages. Right now, in 2024, we are seeing a mix of conditions. Interest rates have been a big topic, and their movements certainly affect borrowing costs. Lenders are often looking for stable properties with strong tenants and good cash flow, which is always a pretty safe bet.

Some property sectors, like industrial and multifamily, have shown consistent strength, while others might be facing different challenges. Staying informed on national, regional, and property sector news that matters to your investment is a good idea. This includes keeping an eye on economic forecasts and local market reports. The market can shift, so being aware helps you make timely decisions about your CRE mortgage.

For instance, there's a growing interest in how artificial intelligence might affect real estate valuations and market analysis, which could influence future lending practices. So, keeping up with these broader trends is quite helpful.

Why Think About CRE Investment?

Investing in commercial real estate, often with the help of a CRE mortgage, can offer several attractive benefits.

One big draw is the potential for steady income. Commercial properties, especially those with long-term leases, can provide a reliable stream of rental income. This can be a great way to build wealth over time.

Another advantage is the potential for property value appreciation. Over the long term, well-located and well-managed commercial properties often increase in value, giving you a significant return on your investment when you decide to sell. There are also potential tax advantages that can come with owning commercial property, which can improve your overall financial picture.

Plus, owning commercial property gives you a tangible asset, something you can see and manage. This can provide a sense of security and control that other investments might not offer. It's a pretty solid way to diversify your investment portfolio, too.

Frequently Asked Questions About CRE Mortgages

What's the typical down payment for a CRE mortgage?

The down payment for a CRE mortgage can vary quite a bit, but it's generally higher than for a residential home loan. You can often expect to put down anywhere from 20% to 35% of the property's value, sometimes even more, depending on the lender, the property type, and your financial situation. For instance, SBA loans might have lower down payment requirements, but conventional loans often ask for more.

How long does it take to get a CRE mortgage approved?

The approval timeline for a CRE mortgage is usually longer than for a residential loan, you know. It can take anywhere from 45 days to 90 days, or even longer for more complex deals. This is because there's a lot of due diligence involved, including property appraisals, environmental assessments, and a thorough review of your financial records. Being well-prepared with all your documents can certainly help speed things up.

Can I get a CRE mortgage with bad credit?

Getting a traditional CRE mortgage with a low credit score can be challenging, as a matter of fact. Lenders typically prefer borrowers with strong credit histories. However, it's not impossible. You might need to explore alternative options like hard money loans, which focus more on the property's value than your credit. Or, you could look into SBA loans, which can be more forgiving for small businesses. Improving your credit score before applying is always a good idea, though.

Understanding CRE mortgages is a very important step for anyone looking to invest in commercial property or secure a business location. By knowing the different loan types, what lenders look for, and how to prepare, you can approach the process with greater confidence. Keep learning about commercial real estate transactions and trends to stay informed. Thinking about your next commercial property move? Start by getting your financial picture in order and exploring your options.

Agriculture Machinery, Equipment, Technology in India - Shop It

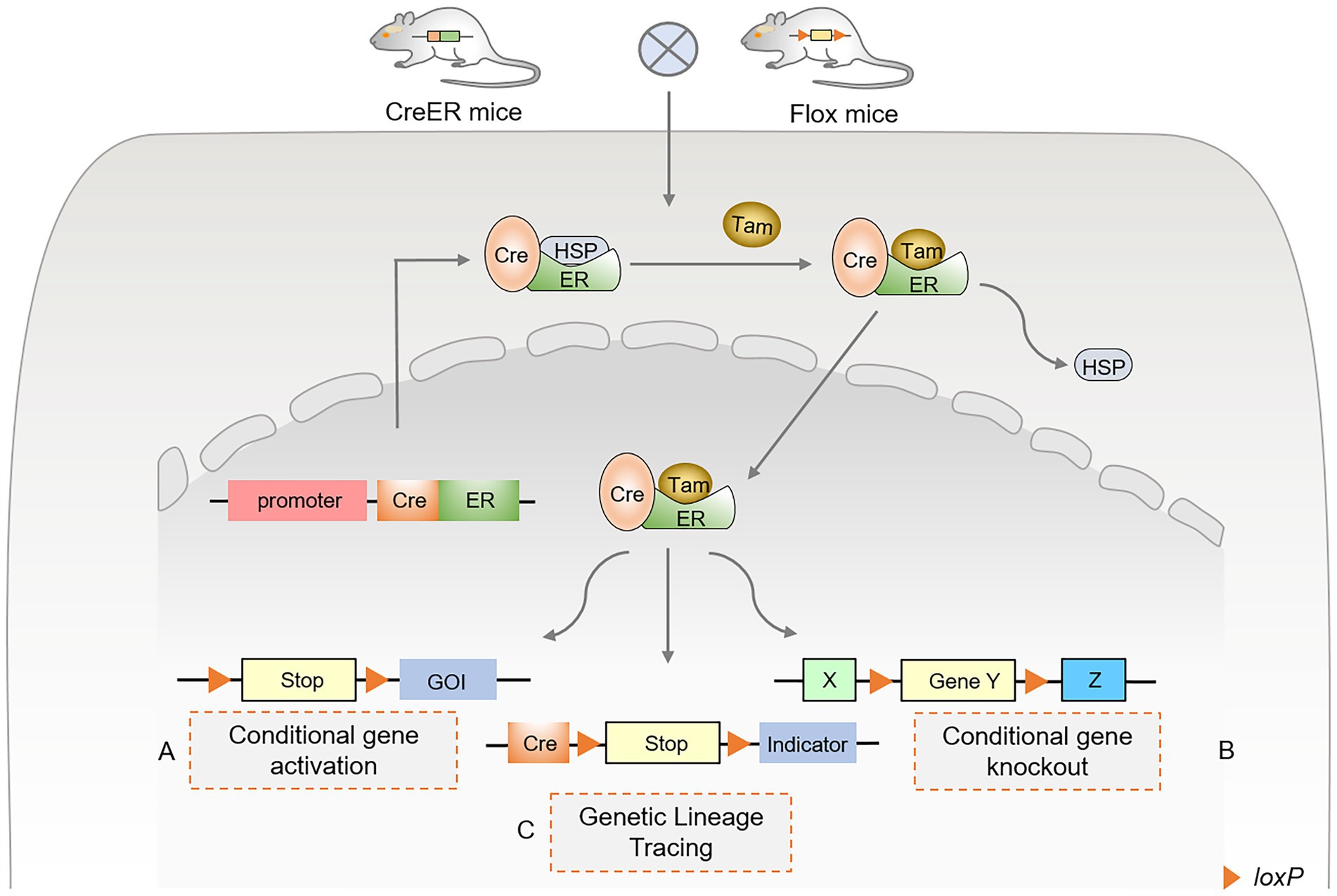

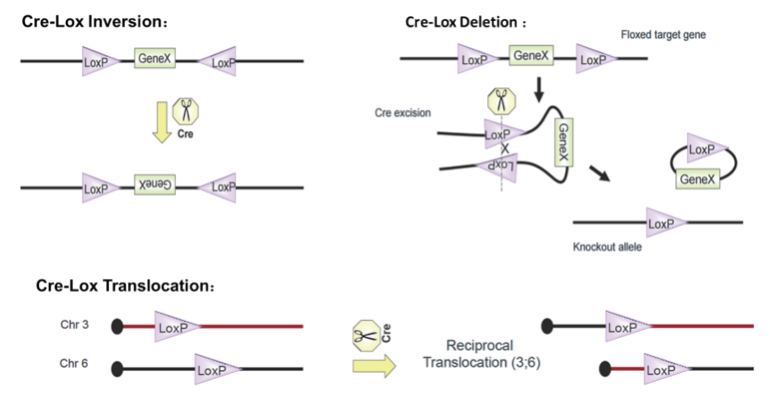

Cre重组酶

Cre Bacteria Effect