How Much Do H&R Block Charge To Do Taxes? Finding Your Price Tag

Figuring out your taxes can feel like a big puzzle, and a common question many folks have is, "how much do H&R Block charge to do taxes?" It's a very good question, as knowing the cost upfront really helps with planning your money. You want to make sure you get a fair deal, and that you understand what you are paying for, you know.

H&R Block offers quite a few ways to get your taxes done, so the cost can change a lot depending on what you pick. They have options for filing online by yourself, using their software, or sitting down with a tax pro in person. Each choice has its own set of fees, and what your tax situation looks like also plays a part, so.

This article will help you sort through the different H&R Block services and their typical costs. We'll look at what makes prices go up or down, and how you can find the best fit for your own tax needs. You'll get a clearer idea of what to expect, and that's pretty helpful, too it's almost.

Table of Contents

- Understanding H&R Block's Pricing

- Online Tax Filing Options

- In-Person Tax Preparation

- H&R Block Tax Software

- Extra Services and Other Fees

- Tips for Finding Your Best Price

- Current Trends in Tax Preparation

- People Also Ask

- Making Your Tax Decision

Understanding H&R Block's Pricing

When you ask how much H&R Block charges, you're looking for a clear answer, but it's not always just one number. The price you pay really depends on a few things. It's like asking how much a car costs; it changes based on the model and what features it has, you know. H&R Block has different service levels, and each one comes with its own price tag, so.

Why Costs Vary

The main reason for different prices comes down to how complicated your tax situation is. A simple tax return, maybe just a W-2 form, will cost less than a return with many different income sources or lots of deductions. This is pretty obvious, right? If you have investments, rental properties, or run your own business, your tax forms get more involved, and that usually means a higher fee, in a way.

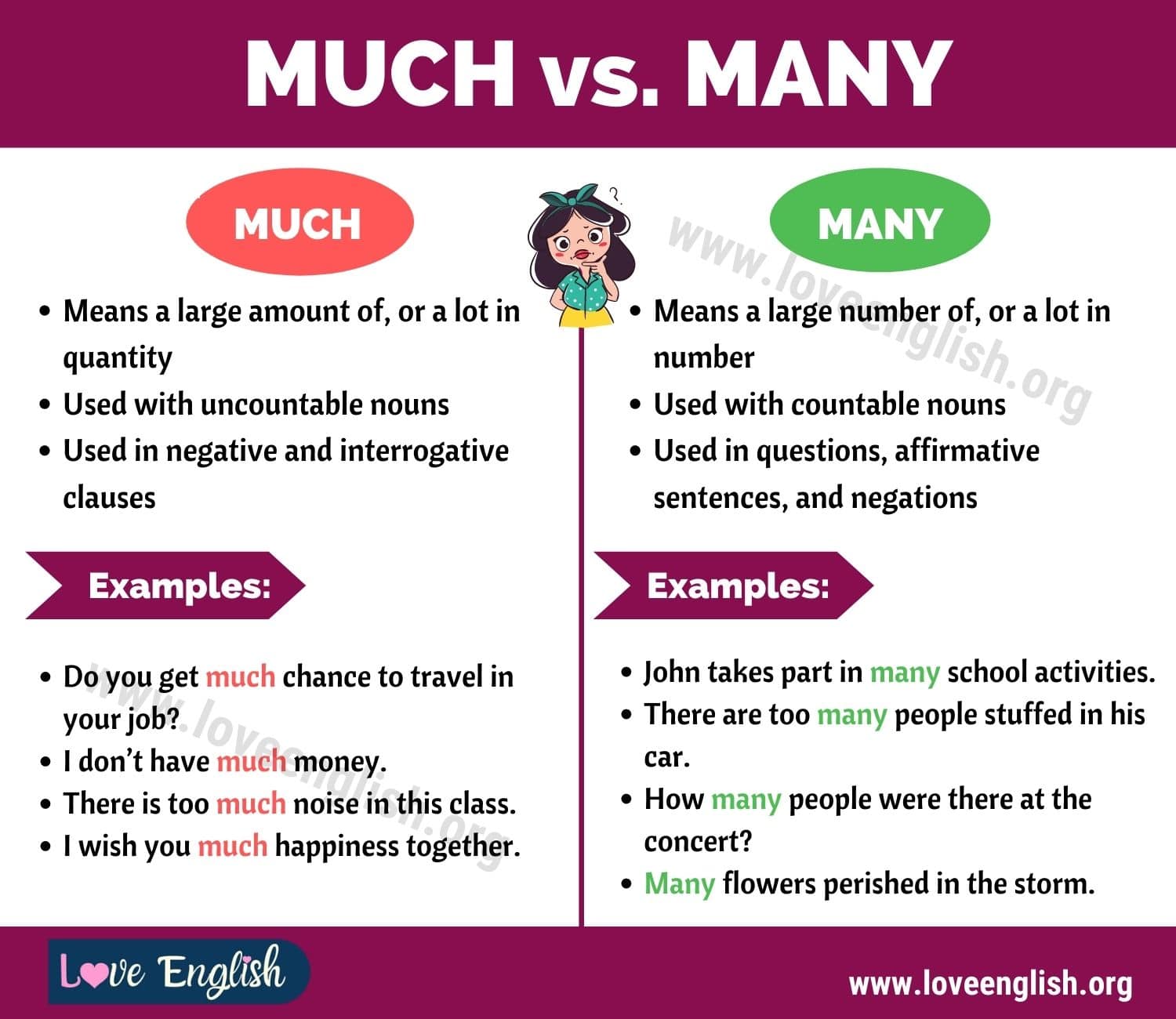

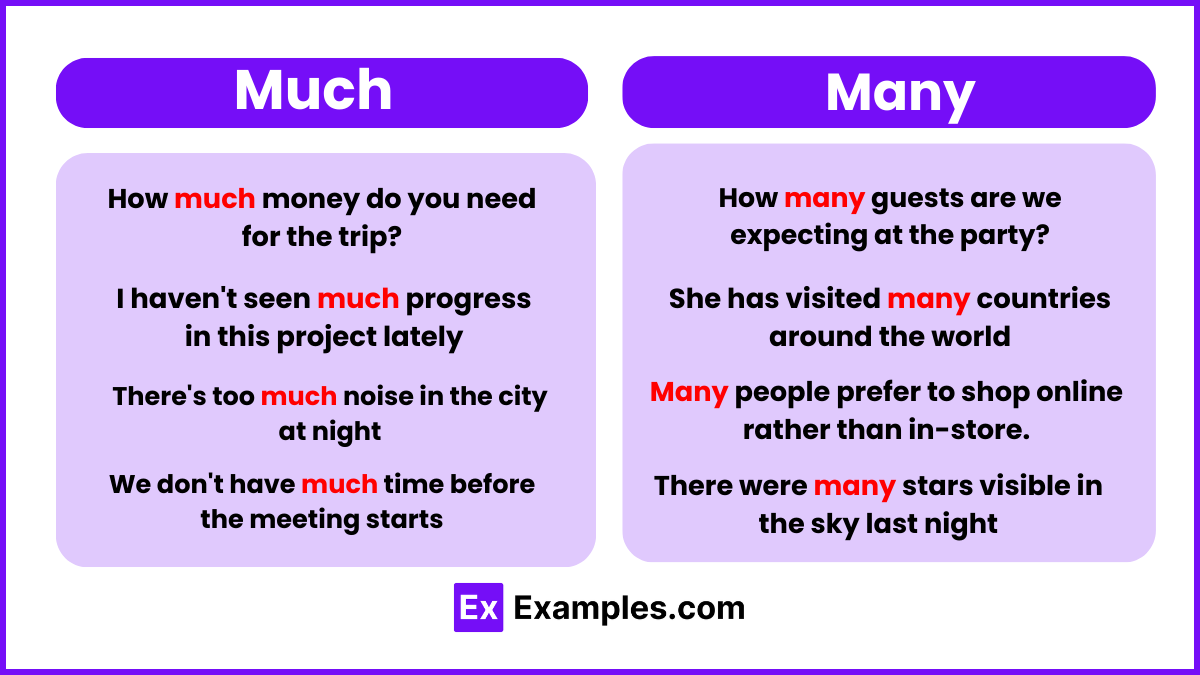

Another thing that changes the cost is the type of service you pick. Do you want to do it yourself online? Or do you want someone else to prepare everything for you? These choices have very different price points. As My text explains, "much" can mean a large quantity or amount, and for tax services, how much you pay often relates to the quantity of work needed, you see.

The time of year you file can also play a small part. Sometimes, H&R Block offers deals early in the tax season. Waiting until the last minute might mean fewer special offers. So, planning ahead could save you a little money, which is good, anyway.

Different Service Levels

H&R Block generally offers three main ways to do your taxes. There's their online do-it-yourself option, which is pretty popular. Then there's their tax software you can download or use online. Finally, you can go to one of their offices and have a tax professional do it all for you. Each level provides a different amount of help and comes with a different price. We will look at each one, as a matter of fact.

Online Tax Filing Options

Many people like to file their taxes online because it's often the cheapest way. H&R Block has several online products, from free to more involved paid versions. It's a good choice for those who feel comfortable doing their own paperwork. You just follow the steps on the screen, basically.

Free Online

Yes, H&R Block does offer a free online filing option. This is for very simple tax situations. If you only have W-2 income, take the standard deduction, and don't have many other forms, this free version could be for you. It's a pretty straightforward way to get your taxes done without paying a cent, you know.

This free option usually covers federal and state returns for basic filers. It's a great choice for students or people with very simple jobs. You just enter your information, and the system guides you through it. It's a good starting point for many, naturally.

Paid Online Tiers

Beyond the free option, H&R Block has several paid online versions. These are for people with more complex tax situations. The names often include "Deluxe," "Premium," and "Self-Employed." Each one adds more features and support for different types of income or deductions, so.

The "Deluxe" option is usually for those with itemized deductions, like mortgage interest or charitable donations. It also helps with health savings accounts. This version costs more than the free one, but it covers more tax situations. It's a step up for many homeowners, for instance.

The "Premium" tier is often for people with investment income, like stocks or bonds, or rental property income. It handles more advanced tax forms. If you have K-1 forms or sell investments, this level might be a good fit. It offers more specialized help, you see.

The "Self-Employed" option is, as the name says, for independent contractors, freelancers, or small business owners. It helps with business income and expenses, and things like Schedule C. This is typically the most expensive online option because it handles a lot of business-related tax issues. It's pretty comprehensive for those working for themselves, you know.

In-Person Tax Preparation

For those who prefer to have someone else handle their taxes, H&R Block offers in-person service. You go to one of their offices and meet with a tax professional. This can be a good choice if you feel unsure about doing your own taxes, or if your tax situation is quite involved, that is.

How In-Person Works

When you choose in-person tax preparation, you set up an appointment at a local H&R Block office. You bring all your tax documents with you. The tax pro will ask you questions about your income, expenses, and any other relevant details. They then prepare your return for you, apparently.

They also review your return with you before filing. This service provides a lot of direct support and a chance to ask questions face-to-face. It gives many people peace of mind, which is very valuable, you know. They handle the filing process for you, too, basically.

Factors Affecting In-Person Fees

The cost for in-person tax preparation varies quite a bit. It depends on the complexity of your tax return, just like with the online options. A simple W-2 return will cost less than a return with business income, multiple investments, or foreign income. The more forms and calculations needed, the higher the fee, usually.

H&R Block's fees for in-person services are generally higher than their online or software options. This is because you are paying for the time and expertise of a human tax professional. They provide personalized advice and help, and that service has a price. It's a premium service, in a way.

The fees can also vary by location. A busy office in a big city might have slightly different pricing than a smaller office in a rural area. It's always a good idea to ask for an estimate upfront if you can. They should be able to give you a rough idea once they see your documents, or.

H&R Block Tax Software

H&R Block also sells tax software that you can install on your computer or use through a web application. This is different from their online filing service, which is purely web-based and often simpler. The software usually offers more features and flexibility for those who want to do their own taxes but need more guidance than the basic online tools, you know.

Software Editions

Just like with the online versions, the H&R Block tax software comes in different editions. These typically include "Basic," "Deluxe," "Premium," and "Self-Employed." Each edition is designed to handle different levels of tax complexity, so. The "Basic" edition is for simple returns, similar to the free online version, but you buy the software.

The "Deluxe" software often helps with itemized deductions and things like student loan interest. "Premium" adds support for investments and rental properties. The "Self-Employed" software is for business owners and freelancers, covering Schedule C and other business forms. They are quite comprehensive, in fact.

Software Pricing

The cost of H&R Block tax software is usually a one-time purchase fee. You buy the software, and it typically allows you to file a certain number of federal returns and often one state return. Additional state returns usually cost extra. This is a common model for tax software, you see.

Software prices can change throughout the tax season. Early bird deals are common, and prices might go up closer to the tax deadline. It's worth checking their website for current pricing. Sometimes, you can find bundles that include multiple state filings, which can save you a little money, too.

Extra Services and Other Fees

Beyond the core tax preparation, H&R Block offers several additional services that can add to your total cost. It's good to know about these so you aren't surprised by extra charges. These services are optional, but many people find them useful, apparently.

Audit Protection

One common extra service is audit protection. This service means H&R Block will help you if your tax return gets reviewed by the IRS. They will communicate with the tax authorities on your behalf and provide support. This can give you peace of mind, especially if you worry about audits, you know.

The cost for audit protection is usually an add-on fee. It's not included in the basic tax preparation price. You need to decide if the peace of mind is worth the extra cost for your situation. Some people feel it's a good investment, so.

Refund Advance Loans

H&R Block also offers refund advance loans. This is a short-term loan based on your expected tax refund. If you need your refund money quickly, you can get a portion of it as a loan, often within a day of filing. The actual refund then goes to pay off the loan. This can be helpful for immediate needs, in a way.

While the loan itself might not have interest charges, there can be other fees associated with this service. It's important to read all the terms and conditions very carefully. You want to understand exactly what you are agreeing to before taking out such a loan, naturally.

State Filing Fees

For many online and software options, federal tax filing might be free or included in the base price, but state filing often costs extra. Each state has its own tax rules and forms, so filing a state return means more work. This is a common extra charge across most tax preparation services, you see.

If you live in a state with income tax, you will likely pay a separate fee for your state return. This fee can vary from state to state. It's important to factor this into your total cost when figuring out how much H&R Block charges. Don't forget this part, basically.

Tips for Finding Your Best Price

To get the best value from H&R Block, or any tax service, a little preparation goes a long way. You can often save money by being organized and knowing what you need. It's pretty simple steps that can make a difference, you know.

Gather Your Documents

Before you start, collect all your tax documents. This includes W-2s, 1099s, receipts for deductions, and any other income or expense statements. Having everything ready means you can quickly figure out which service level you need. It also makes the process faster, so.

If you use an in-person preparer, having all your documents organized saves them time, which could save you money. For online filing, it helps you enter information correctly and avoid mistakes. Being prepared helps you get through it more smoothly, in fact.

Compare Options

Don't just pick the first option you see. Take a moment to compare H&R Block's different services. Think about your tax situation. Is it simple, moderate, or complex? Then look at the free online, paid online, software, and in-person options. Which one truly fits your needs and budget? That's the real question, you see.

Sometimes, paying a little more for a higher tier might save you money in the long run by finding more deductions. Other times, a simple free option is all you need. Do a quick check on their website to see the current prices for each level. This comparison can really help, you know.

Look for Discounts

H&R Block often has discounts, especially early in the tax season or for returning customers. Keep an eye out for special offers or coupons. Sometimes, they offer deals for students or military members. A quick search online for "H&R Block coupons" might turn up something useful, apparently.

These discounts can reduce how much H&R Block charges. It's always worth checking before you commit to a service. Every little bit of savings helps, after all. So, take a moment to look for these deals, basically.

Current Trends in Tax Preparation

The world of tax preparation is always changing, and H&R Block, like other services, adapts to these shifts. Knowing about current trends can help you understand the pricing and service landscape. It's pretty interesting how things move, you know.

Digitalization

More and more people are choosing to file their taxes online or use software. This trend means tax services are putting more effort into their digital offerings. Online tools are becoming easier to use and more powerful. This can sometimes lead to more competitive pricing for online options, so.

The convenience of filing from home is a big draw for many. H&R Block's online platforms reflect this shift, providing guided experiences that make self-preparation more accessible. This means you have more choices than ever for how you do your taxes, in a way.

Inflation's Impact

Like many other services, tax preparation fees can be affected by economic factors such as inflation. The cost of running a business, including paying staff and maintaining offices, can go up. This might mean slight increases in fees over time. It's something to keep in mind when looking at prices from year to year, you know.

However, competition among tax preparers also helps keep prices in check. H&R Block aims to offer competitive pricing to attract customers. So, while costs might adjust, they usually try to stay in line with the market. This is just how business works, naturally.

People Also Ask

Here are some common questions people have about H&R Block's charges:

1. Is H&R Block free for simple taxes?

Yes, H&R Block does offer a free online filing option for very simple tax returns. This usually applies if you only have W-2 income and take the standard deduction. It's a good way to file your federal and state taxes without paying anything. You can check their website for the most current details on what their free version covers, so.

2. How much does H&R Block charge to do taxes if I have a small business?

If you have a small business, your tax situation is more involved, and the cost will be higher. H&R Block has specific paid online tiers or software editions for self-employed individuals, like their "Self-Employed" option. For in-person service, the fee will depend on the complexity of your business income and expenses. It's best to get a quote, as a matter of fact.

3. Can I get a refund advance with H&R Block?

Yes, H&R Block offers refund advance loans. This lets you get a portion of your expected refund money quickly, often on the same day you file. The actual refund then pays off the loan. There might be specific requirements and fees, so you should read the terms very carefully before you choose this option, you know.

Making Your Tax Decision

Understanding how much H&R Block charges to do taxes means looking at your own tax situation and the different service options available. From free online filing to personalized in-person help, there's a range of choices. Each option comes with its own price tag, and the right one for you depends on how complicated your taxes are and how much help you want, you see.

Taking the time to compare these options and gather your documents beforehand can help you find the most cost-effective way to get your taxes done. Remember that things like state filing fees or audit protection can add to the total cost. Knowing this upfront helps you avoid surprises, you know.

For more general information on tax preparation services, you can visit the IRS website. To learn more about tax filing options on our site, and to explore other financial planning tools, you can find more details here, basically. Consider what fits your budget and your comfort level, and then make your choice. It's all about finding what works best for you, so.

Much (canal de televisión) - Wikipedia, la enciclopedia libre

Much vs. Many: How to Use Many vs Much in Sentences - Love English

Much vs Many - Examples, Difference, Tricks, How to use