How Much Does H&R Charge To Do Taxes? Unpacking The Cost For Your Return

Thinking about getting your taxes done by a professional, and H&R Block comes to mind? You're certainly not alone. Many folks wonder, just how much does H&R charge to do taxes, and is that a large amount for what you get? It's a very common question, especially as tax season approaches and people start to gather their documents. You want to make sure you're making a smart choice for your money.

Trying to figure out tax preparation fees can feel a bit like looking for a needle in a haystack, so to speak. Prices can vary quite a bit, depending on what you need and how complicated your financial picture is. It's not always a simple, one-size-fits-all number, which can be a little frustrating for some. You might have a straightforward return, or perhaps your situation involves a bit more detail, and that really changes things.

This article aims to help you get a clearer idea of what you might expect to pay when H&R Block handles your tax return. We'll look at the different things that can influence the final price, from the type of service you pick to the specific forms you need. Understanding these elements can really help you budget and decide if their services are the right fit for your needs this year, and that's pretty important.

Table of Contents

- Understanding H&R Block Pricing: What Influences the Cost?

- Breaking Down the Different Service Options

- How to Get an Estimate and Save Money

- When Is Paying H&R Block Worth It?

- People Also Ask About H&R Block Costs

Understanding H&R Block Pricing: What Influences the Cost?

When you ask, "how much does H&R charge to do taxes," it's a bit like asking how much a car costs. The answer really depends on a few key things, so it's not a single fixed price. You see, the cost is tied to the level of service you need and the details of your own money situation. It’s not just a flat fee, which is a bit of a surprise to some.

For instance, a very simple return with just one W-2 form will naturally cost a lot less than a return for someone who runs a small business, has investments, or owns rental properties. The more forms and calculations needed, the more time and specialized knowledge it takes, and that usually means a higher price tag. This seems pretty clear, actually.

Service Type Matters: Online, Software, or In-Person?

One of the biggest factors that changes how much you might pay is the way you choose to get your taxes done. H&R Block offers several ways to file, and each one has a different price point. For example, doing it yourself online is usually the least expensive option, as you might expect.

If you use their downloadable software, that's often a step up in price from the basic online versions, but it still allows you to prepare your return at home. The most expensive option, generally speaking, is having a tax professional at one of their offices prepare your return for you. This makes sense, as you're paying for their time and direct advice, which is a very different kind of service.

Your Tax Situation Plays a Big Part

The complexity of your personal tax situation is a huge influence on the final cost. A basic return, which typically involves just W-2 income and maybe the standard deduction, will cost the least. That's usually the starting point for their pricing, you know.

However, if you have things like itemized deductions, capital gains or losses from investments, self-employment income (like from a side gig or a full-time business), rental property income, or even certain tax credits, the price will go up. Each additional form or schedule needed adds to the overall fee because it requires more work and specific expertise from the tax preparer. It's a bit like adding more ingredients to a recipe; the cost just naturally goes up.

State Tax Returns Add to the Bill

Most of the time, the quoted price for tax preparation covers only your federal tax return. If you live in a state that requires you to file a state income tax return, that will be an additional charge. This is a common practice across almost all tax preparation services, so it's not unique to H&R Block. You should definitely factor this into your total cost, as it can make a noticeable difference.

Some states have very simple tax forms, while others are more involved. The cost for your state return might also depend on how complex your state's tax laws are for your specific situation. So, it's something to ask about upfront, just to be sure.

Extra Services and Add-Ons

Beyond the core tax preparation, H&R Block offers various additional services that can add to your bill. These might include things like audit assistance, where they help you if the IRS questions your return, or help with past-due returns. You might also find options for identity theft protection or specific financial planning advice. These are usually optional, but they can be very helpful for some people.

Sometimes, too, there are fees for certain payment options, like if you choose to have your preparation fees deducted directly from your tax refund. While convenient, this often comes with a processing fee. So, it's worth checking all the little details to avoid surprises, you know?

Breaking Down the Different Service Options

H&R Block provides a range of services to fit different needs and budgets. Understanding each option helps you decide which one might be best for you and, crucially, how much you'll end up paying. It's a good idea to consider your own comfort level with taxes when picking a service, as that really matters.

Online Do-It-Yourself Options

For those who feel comfortable doing their own taxes but want some guidance from a reputable name, H&R Block's online software is a popular choice. They offer different tiers of online products, typically starting with a free option for very simple returns. This free option usually covers basic W-2 income and the standard deduction, which is great for many.

As your tax situation gets a bit more involved, you'll need to upgrade to a paid online version. These paid versions might include support for itemized deductions, investments, or self-employment income. The price for these online products is generally a fixed fee, which is nice because you know the cost upfront. However, it's still up to you to enter all your information accurately.

Tax Software at Home

Similar to the online versions, H&R Block also sells downloadable tax software that you install on your computer. This option is often chosen by people who prefer to work offline or who like to keep a local copy of their tax files. The pricing structure for the software is also tiered, meaning different versions are available for different levels of tax complexity. You buy the software once, and it lets you prepare and file your return. This can be a pretty good value if you have a moderately complex return.

The software usually guides you through the process with questions, much like the online versions. It's a good middle ground if you want to handle things yourself but need more features than the basic online offerings. You still need to be careful with your entries, of course.

In-Person Tax Pro Assistance

This is where the cost can vary the most, as it involves a tax professional directly preparing your return. When you visit an H&R Block office, a tax preparer will sit down with you, gather your documents, and complete your return. The fee for this service is usually based on the forms required and the time it takes. So, the more complex your return, the higher the fee will be.

Many people find the peace of mind that comes with having a professional handle their taxes to be well worth the cost. They can ask questions, get advice, and feel confident that their return is accurate. This service is particularly popular for those with complex financial situations or those who simply dislike dealing with taxes themselves. It's a very hands-on approach, you know.

Drop-Off and Virtual Assistance

H&R Block also offers options where you can drop off your documents at an office, and a tax pro will prepare your return without you needing to sit there. They will then contact you to review everything. There are also virtual services where you can connect with a tax professional online, sharing documents securely and communicating via video or phone. These services often fall into a similar price range as the in-person option, as you're still getting the benefit of a professional's expertise. They offer a lot of flexibility, which is pretty convenient for many busy people.

These methods can be a good compromise if you want professional help but prefer not to spend time in an office. They still provide that expert touch, which is what many people are looking for when they ask how much H&R charges to do taxes.

How to Get an Estimate and Save Money

Since the cost can vary, getting an estimate is a smart move before committing to H&R Block. There are ways to get a general idea of the cost, and also some things you can do to potentially lower your bill. It's all about being prepared, actually.

Ask for a Quote Up Front

If you plan to use an in-person tax professional, don't hesitate to ask for a price quote before they start working on your return. You can describe your tax situation and the types of forms you expect to need, and they should be able to give you an estimate. Some offices might even offer a free initial consultation, which is a great way to get a feel for the cost without any commitment. It's always good to know what you're getting into financially, you know?

Be clear about all your income sources, deductions, and credits. The more information you provide, the more accurate their estimate will be. This can help prevent any surprises when it comes time to pay.

Prepare Your Documents Ahead of Time

One way to potentially save money, especially with in-person services, is to have all your tax documents organized and ready to go. This includes your W-2s, 1099s, receipts for deductions, and any other relevant statements. When a tax preparer doesn't have to spend extra time sorting through disorganized papers, it can sometimes reduce the overall time spent, and thus, the fee. It just makes things smoother for everyone involved.

A well-prepared client makes the process much more efficient. So, taking a little time to gather everything neatly beforehand can really make a difference, actually.

Look for Discounts and Promotions

H&R Block, like many businesses, often runs promotions, especially early in the tax season. Keep an eye out for coupons, special offers, or discounts for new clients. Sometimes they offer specific deals for students, seniors, or military personnel. Checking their website or local advertisements can help you find these savings. You might find a pretty good deal, you know?

These promotions can sometimes take a bit off the total cost, which is always a welcome thing. It's worth a quick search before you head in or start your online filing process.

When Is Paying H&R Block Worth It?

Deciding if paying H&R Block is worth it really comes down to your individual situation and what you value. For some people, the cost is a small price to pay for peace of mind and to avoid the stress of doing taxes themselves. If your tax situation is complicated, with multiple income streams, investments, or a small business, a professional can often identify deductions or credits you might miss, potentially saving you more money than the fee itself. That's a pretty big deal, actually.

Consider, too, if you have had significant life changes in the past year, like getting married, buying a home, or having a child. These events can change your tax situation quite a bit, and a professional can help you understand how to handle them correctly. For instance, a professional might help you figure out how much a certain deduction is worth to you, ensuring you claim everything you're allowed. You might find that the expertise is worth every penny.

If you're worried about making mistakes that could lead to an IRS audit, having a professional prepare your return can also offer a layer of security. They are trained to stay up-to-date on the latest tax laws and can help ensure your return is accurate and compliant. This can save you a lot of headaches later on, which is pretty valuable. Learn more about tax preparation services on our site, and link to this page here for more insights.

Ultimately, the "worth" of H&R Block's services is a personal calculation. It involves weighing the fee against the time saved, the potential for maximizing your refund or minimizing your tax liability, and the assurance that your taxes are done right. It's about deciding if the amount they charge is a fair trade for the benefit you receive. You might find it's a great value, or perhaps you prefer to handle it yourself.

People Also Ask About H&R Block Costs

How much does H&R Block charge for basic taxes?

For very basic tax situations, H&R Block often has a free online filing option. This typically covers simple W-2 income and the standard deduction. If you need a tax professional to prepare a basic return in person, the cost will be higher than the free online option. The exact price can vary by location and the specific forms needed, but it will be at the lower end of their professional service fees. It's usually the starting point for their in-person charges, you know.

Is it worth paying H&R Block to do your taxes?

Whether it's worth paying H&R Block really depends on your tax situation and how comfortable you feel doing your own taxes. If your taxes are complex, or if you want the peace of mind that comes with professional help, paying for their service can be a good idea. They might find deductions or credits you missed, or simply save you a lot of time and stress. For some, the value of that expertise and time saved makes the cost completely worthwhile. It's a personal decision, actually.

How much does H&R Block charge for self-employed?

For self-employed individuals, H&R Block's charges will be higher than for basic returns because self-employment taxes involve more complex forms and calculations. This applies to both their online software versions and their in-person professional services. The cost will depend on the amount of business income and expenses, and any other specific forms required for your business. It's generally one of their higher-tier services due to the added complexity and specialized knowledge needed. You can often find specific pricing tiers for self-employed filers on their website or by asking for a quote at an office. For more general information about tax preparation, you can visit a reliable source like the IRS website.

Much (canal de televisión) - Wikipedia, la enciclopedia libre

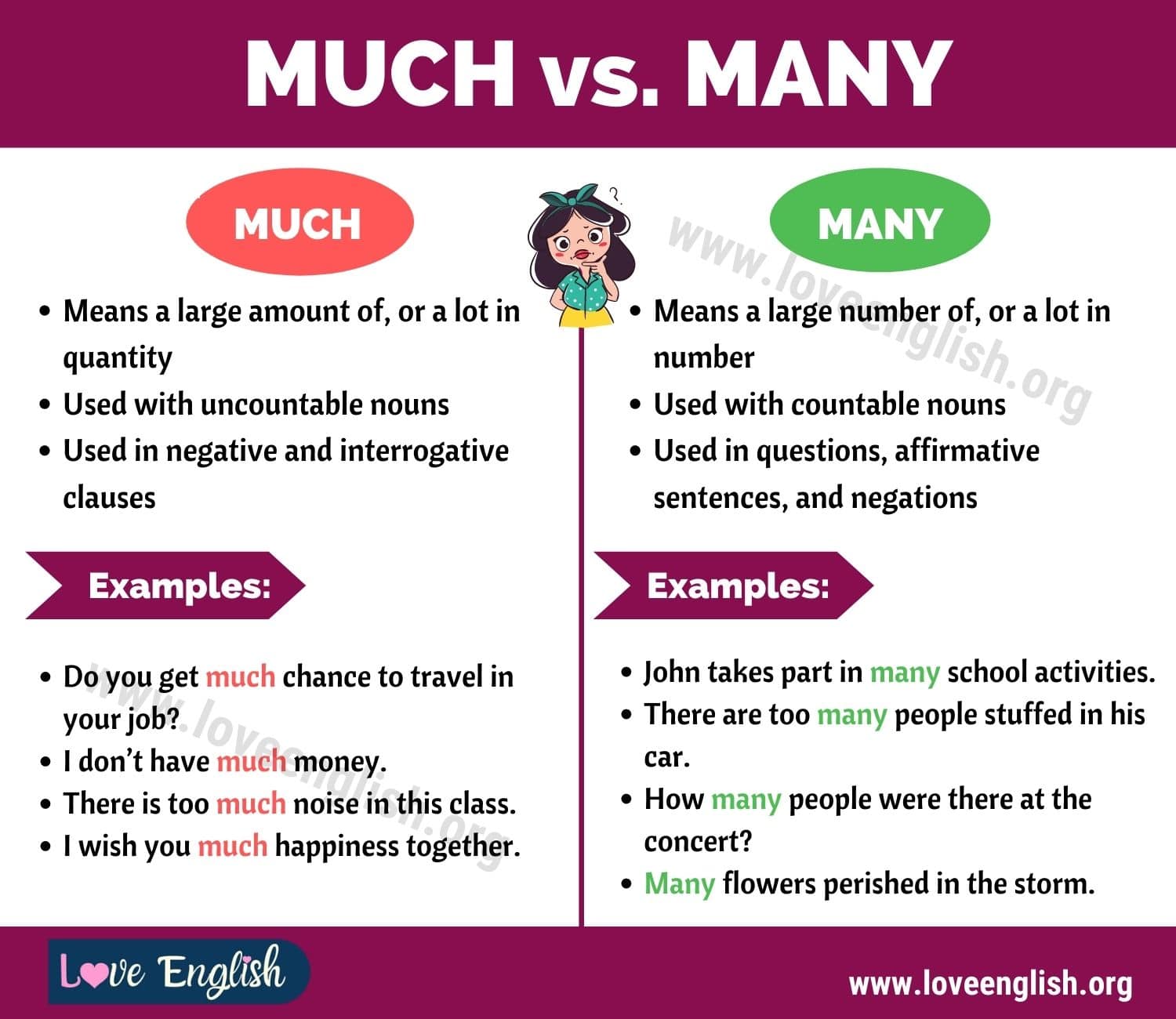

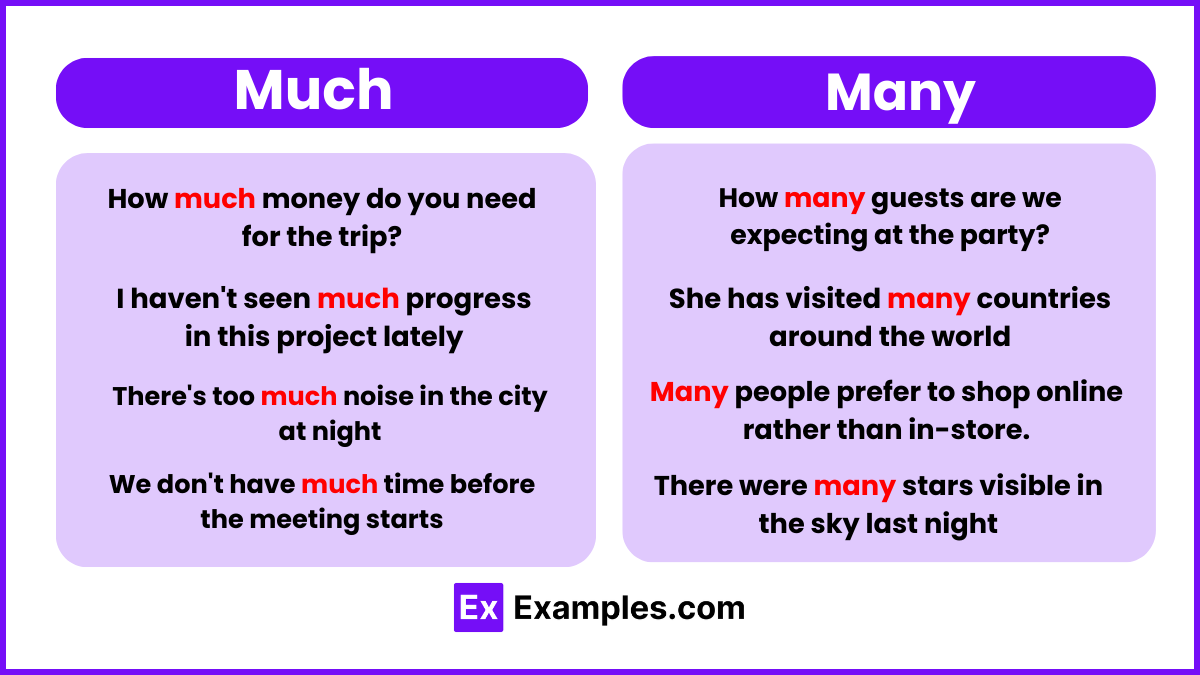

Much vs. Many: How to Use Many vs Much in Sentences - Love English

Much vs Many - Examples, Difference, Tricks, How to use